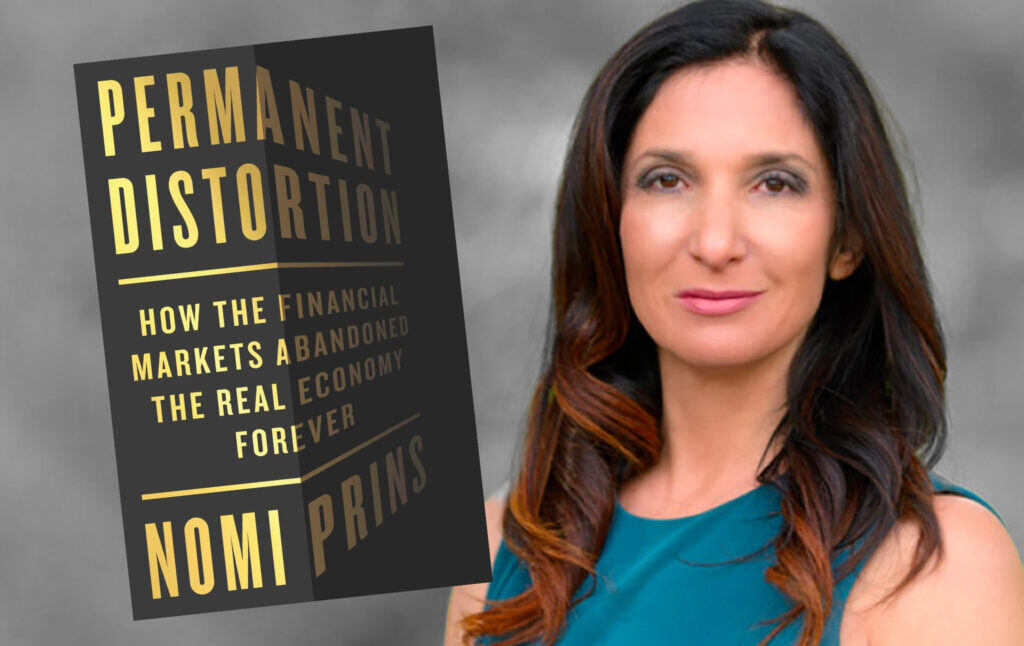

Nomi Prins Explains the Difference Between the Market and the Economy

The financial expert and author of “Permanent Distortion” gives insight into the real ways that money moves.

Nomi Prins is one of the country’s leading financial journalists, who has gone from working on Wall Street to exposing the inner workings of the economy and how it is rigged in favor of the powerful. Her books include Other People’s Money: The Corporate Mugging of America, Collusion: How Central Bankers Rigged the World, and most recently Permanent Distortion: How Financial Markets Abandoned the Real Economy Forever. Nomi joined Current Affairs editor-in-chief Nathan J. Robinson to explain how the financial markets and the “real economy” became so disconnected and why the actions of central banks make such a difference to our lives.

Robinson

The distinction that you draw between the markets and the economy is really central to the book; the book is about the departure of the markets from the economy. Could help us understand what the distinction between those two things are?

Prins

Sure, absolutely. I think that when people live in the real world, as we all do, we think of our personal economies first and foremost: we care about the bills we pay, what things cost, and what our futures are going to look like—our present kind of stack up, and just the general nature of what’s going on around us. To a large extent, that is our economy. And so, you extrapolate that from individuals out through the main economy—the real economy, the broad economy—and add all that up along the way. Then we have the markets. Mostly what we hear about the markets is the stock market, though financial markets include stocks, bonds, housing markets, and other types of asset markets where money flows liberally when it’s available and can pump them up when there’s a lot of money that inflates.

And so, the stock market is one main metric—for example, after the financial crisis of 2008, which was devastating to the markets and the real economy, and then fast-forward through the pandemic of 2020—but in each case, what happened was the Federal Reserve, which is the central bank of our country and the most powerful central bank in the world—and by central bank, I mean the thing that sets interest rates, bails out banks, helps the market, and says it’s doing all of this for of the real economy—that Federal Reserve has the unlimited, uncapped, unregulated, unelected ability to create as much money as it is deemed necessary to meet the crises of the day. It did, to the tune of $4.5 trillion dollars— a really big number—in the wake of the 2008 financial crisis. It did it again by doubling that amount to the tune of $9 trillion in the wake of the pandemic. The difference was it took a few years after 2008 to get the $4.5 trillion and only a few months, in the spring of 2020, to get to $9 trillion.

What that money does is it basically goes straight through the banking system in different ways to different private investment companies and so forth. It goes into the markets first and foremost because that’s the easiest place. It’s like water: water is going to go to the path in which it’s going to have the least obstructions in its way. It’s going to just keep going. If there’s more water, it will gush. And if there’s a tsunami, it’s going to gush great—add wind and everything else, and you have a situation where for the markets, this money caused them to inflate. The real economy didn’t have quite that access to that money, and as a result, it has not just lagged behind, it lags behind whether or not those markets are inflating and even when those markets stumble, waiting for the next sort of jolts of money to come to them.

That’s what I call the permanent distortion between the two, and it’s very much created because of how money has come to be available to a certain portion of, not just the economy, but institutions of the entire banking and finance structure that we live under, with the Fed being able to create it. The government’s leaning on that to happen for different reasons we can get into, and the real economy just not getting that benefit even though it is the thing that’s held up as the reason for the need for that money.

Robinson

Could help us better understand how the markets can do well, and the real economy not? Obviously, there is a simple story that is told about the market being the thing that directs capital towards investment, helps fuel the real economy, and the real economy is dependent on financial markets. So, how could it be that there is this bifurcation?

Prins

It has to do with the speed and the availability. So, you think of it like this, and you go back to water, or to any kind of natural event that has water because it comes up a lot in financial terminology. We consider banks being liquid or not liquid, and that just means that it’s available to do things with, or they’ve dried up—that means credit has dried out and they don’t have the availability. There are a lot of water terms.

Robinson

And blood. You compare it to blood in the book too, which I like.

Prins

I do. There are myriads of liquid things that are used to describe how markets and banks operate. The reason that money, when it’s created out of nowhere, is like a spontaneous combustion—like a big bang of money—because that is what central banks are capable of doing for the financial system. It happens really fast. So, where does it go? It goes really fast through the financial system because banks have access to them. You and I can’t go and say, we want a couple trillion dollars to do something. It goes through the financial system, and there are mechanisms for it, but that’s the way that we’re set up. And the Wall Street companies that buy back their own shares, and thereby lift them—whenever you buy something, the price goes up. If they all of a sudden have globs of money to use to buy their own shares, and they go ahead and do that, it lifts them up. It doesn’t mean their companies are more valuable, like at their core intrinsically, it just means that money floated in through different ways and sort of pushed those values up, and it did very aggressively and quickly, particularly in the wake of the pandemic, which is when that distortion between markets and the real economy really became permanent. But also, that happened to a large extent in the wake of the financial crisis of 2008. As a result, the markets effectively appreciated and went up by six times as quickly as the economy. I have pictures of that in the book if those words are wonky, but the reality is that the money flows to where it can go most easily, and it reproduces itself like a virus as quickly as it possibly can, and the place that can do that the most effectively and easily is through the stock market. The stock market is supposed to be a representation of the shares in public companies that we know that we use: car companies, food companies, technology companies, and so forth. But when money sloshes in really quickly, it has the ability to elevate values that shouldn’t be elevated, and it can basically put a fog over the real value of what those companies might be. Now, the reason that’s not going into the real economy is because if it’s going into the markets, and if it’s inflating them and these relationships are, at best, six-to-one in terms of the amount of upward movement and markets versus the economy at any given time (and in certain moments it’s far more than that), that creates this permanent gap and distortion between the money that ultimately goes into the real economy. That money takes a long time—you got to work, pay taxes, and hope that the company you work for also pays taxes, which, of course, many don’t. You have a situation where you have a government that’s amassing that money and considering what to do with it in terms of, say, public projects, and has to decide what those projects are, and then it has to decide whether our infrastructure is shoddy, which it is, and where to put it. That’s conversation, debate, waiting and seeing where the money is, and that’s years and years of strategies. It doesn’t take that long for it to just go straight into the markets, and that’s why this effect has been happening.

Robinson

I mentioned that you compare money to blood at one point, and it was helpful to me because it made me think of the economy as a kind of body. The Fed is putting blood into the body, and then where does the blood go? Is some part of the body getting engorged with blood and some other parts and not receiving enough blood? It helped me think of how money moves and where it goes.

Prins

Right, if we think of the markets and the economy as part of one body, then it would be like you’re stifling blood or oxygen to a certain component of that body, cut off from where the blood is actually flowing. Think of a situation where there’s a wound or something like that, and blood can’t flow to a certain area, hand to foot or whatever, and the sort of remedy for that is chopping it off. So now, if that has happened, why does this matter? Take away the explanations and the hard thinking about what money is and where it goes. The reality is that it’s going into one place very quickly and created from nowhere, and it doesn’t go to every other part of the body—every other part of the economy—in the same accelerated fashion. I’m not saying no money goes into the economy. But we do know a couple of things. We know the government’s had to borrow three times as much money in the last 14 years since the financial crisis, and has tripled the size of its debt, just to basically function.

The US government borrowed about $9 trillion worth of public money in 2007, so before the financial crisis of 2008. Fast-forward to now, and they’re sitting on, or borrowing, an amount of debt of $31 trillion. So, what’s happened during this entire period has been like money’s gone from one place to another, and as a result, all these other things occur. Housing prices go crazy, so real people can’t afford real housing. Rents go up because there’s more of a corner on some of those house prices, and so landlords can afford to charge more because more people aren’t diffusing that cost because they can’t afford to buy those houses.

We have a situation where banks can, for example, charge more interest on loans they give out to people, whether it is for houses, cars, home loans, credit cards, or whatever it is. But they’re getting that money incredibly cheaply. So, they’re making money on the fact they’re getting money cheap, and then charging us a lot more. These are things that have been going on for quite some time. But the way in which it’s all accelerated, and why the money has been sucked out of the real economy relative to the markets most recently, is because the Fed is creating it, putting it out at the top. It’s not being created at the bottom of the economy and the sort of foundation of the economy. And as a result, the economy is up or down by bits over these years, whereas the markets can literally double, even because the COVID, in no time, because of that injection of money from a place that creates it from nowhere. The Fed doesn’t go to work, do a job, make money, pay taxes, accumulate money—it’s not like that.

The function of it is to be able, at this point, to create as much as they want to. And by doing this, it creates more and more of this distortion between the two, and that’s unhealthy. That means the economy is being basically choked from money that’s available to elements of that economy, like Wall Street banks, private equity funds, hedge funds, and all the financial players who have so much access.

Robinson

One of the things you do in this book is trace so many things back to central banks. What comes across more strongly than almost any other point in this book, and if people want to understand the mysterious forces that govern their lives: one of the most powerful institutions hidden from public discussion or understanding is the Fed and the central banks of various countries. You even say that central bank policies in recent years have triggered social unrest: the Brexit vote and the Yellow Vests. You attribute how a lot of the social disruption and people’s anxiety can be traced back to the choices made by central banks. Could explain that link a little more clearly?

Prins

Yes. So, just think about what central banks have the power to do. Central banks leaders are not elected officials. We can’t get rid of them. If they do anything to hurt the economy, even help it around the edges, there’s nothing we can do to connect into them. They are, therefore, a sort of dark force. And I say dark because we don’t have the ability, like we do, for example, even with our governments, to have an opinion as to what they do, how they do it, and who’s doing it. So that’s number one. As a result, they also don’t have any laws, caps, or limits to the amount of money they can create when they want to. Now, it sounds all good. We got this body that can magically create money, and it goes into the system. Well, supposedly banks should have this money blended out to businesses, people, etc., and that should be good debt, and should help to grow the economy. That should create a situation where the government, for example, of the United States, doesn’t have $31 trillion of debt on its books or a deficit every year. So, that’s one thing that central banks create, by having this mechanism where they can filter money into the markets, into Wall Street, but there’s no component that’s responsive or responsible to the real economy. You got that in the Bank of Japan and the European Central Bank, which can also decide which bonds to buy—not Greece today; yes, Germany today. They make choices as to where money goes as well, by virtue of creating that money and deciding which bonds, which governments, which debt they feel like buying back or holding in return for giving that money out into the financial systems of those countries. So, there are choices that the central banks are making that we have absolutely no control over, and that creates more instability and inequality. There are central banks that have no ability to create money in areas, for example, that do have tremendous problems. A recent example is the Russia Ukraine situation. Ukraine’s central bank isn’t powerful enough to create enough money to pay for more military. It’s got relationships, it’s got geopolitics, there are other things going on. But the reality is that the bigger central banks can create money, decide where it goes by not being responsible for where it goes, and potentially also choosing winners and losers, which makes people feel disenfranchised. I do write about Brexit, a vote by the UK populace to decide to detach the UK from Europe. Why? Because the UK felt, or at least the vote felt, that by being connected to Europe, with Europe having all of these problems, not which least of these were caused by where money went and where it specifically did not go, and all the turmoil that cost to the economy in between, that they didn’t want to be bothered with that. And so that was one of the reasons that vote happened. Now, as a result, they have less trade with Europe, an economy that’s stumbling significantly, and so is Europe’s right now. But the reality is that then has other ramifications and creates more infighting among people in the country: Should we or should we not? Is this helpful or is it not?

And all of those sorts of little things are heightened by just general economic anxiety. If anybody is stressed, or stretched by the economics of their own personal situation, it causes them to act out. And one of the things we saw, for example, in 2019, is the most civil unrest we’ve seen on the planet, in developed and developing countries across the board. These are not just my stats. This is from economists, the UN, and major international bodies, and what they cite was a result of economic instability. Is there political instability associated with that? Yes, but generally, when economies don’t do well, people get upset with their governments. It doesn’t matter if the government is sitting there as left or right. It doesn’t matter. They vote them out, they switch around because they are just not getting from their governments what they believe they deserve to be getting for electing these people to have this kind of power. So it all ties down to if we had none of this extra money in the system, all these things might still be happening.

But the fact is, we have the central banks that can create so much more instability by producing so much more money out of nowhere that goes to the top of markets of the economic elite throughout the entire world. That creates more and more fractures relative to everybody else, and that, again, creates more dissent. I write about all these things in more detail in the book, and it sounds all very ominous, this idea that there’s somebody out there that sort of controls everything. I’m not saying that. What I’m saying is they do control the ability to produce money out of nowhere, and that money does not have a responsibility to economies, and also doesn’t go into real economies throughout the world, in the manner in which it goes to the most elite financial players and markets on the planet.

Robinson

Could you discuss the change that has occurred over time? As I understand your argument about permanent distortion, you’re talking about some things that have happened since the financial crisis. There was a lot of public controversy over bailing out banks following the financial crisis, but not so much over what you draw attention to a lot, which is quantitative easing, which I think most people still don’t understand. And you suggest that over the course of the last 15 years, the markets have become addicted to cheap money. Could you explain what that means and how the situation has come about?

Prins

I go through the timeline of what happened since the financial crisis and through the pandemic, every time the Fed created a bunch of money or even implied that it would continue to be doing that over time. And again, other big central banks around the world were doing similar things. The financial markets reacted by shooting up, and every time there was any kind of conversation about dialing it back a bit—we won’t create as much, we might raise rates—anytime it got a little bit off the topic of easy money—easy meaning that it has very low or zero interest rates, and creating money out of nowhere as well to buy debt—then those markets behaved in a very sort of euphoric manner, just like how you would imagine of someone who’s addicted to a particular kind of drug, particularly an amphetamine or a coke type of drug. And when markets are coming down off that high and given other sorts of jolts, then the high sort of reinstates itself. That, for every single moment during this time period, is what happened with the markets. And on the flip side, if an addict doesn’t get that supply of whatever that drug is, they tend to become sort of more negative, and things kind of collapse. What we’ve seen recently is that even though the Fed still has almost $9 trillion on offer, and other central banks around the world have trillions and trillions of dollars on offer as a cushion for markets and big finance, even when the Fed started raising rates, as it has done since March, the markets have been really upset by this. What we’ve seen is markets going down substantially, not because values came down and because of inflation. Inflation doesn’t have the same impact as quickly on markets as money externally flowing in or flowing out does. And if the expectation is money flowing out because interest rates are getting higher, then markets get upset, and they send a message to the Fed. That’s what’s happening now. But the problem is that real people feel the impact of interest rates going much higher so quickly in their pockets. Their bills and rents go up. For mortgage payments, if you want to buy a new house, the interest is double what it was six months ago. All of these things hurt the person and the people and most of the economy that doesn’t have a lot of money sloshing around to draw from, much more viscerally than it does the people who have a substantial cushion or the companies that have tremendous wealth—they just sort of ride it out.

Robinson

The conclusion that you come to is somewhat disturbing or worrying for those who might hope that the period of political and economic instability would come to an end soon. You call it permanent distortion. I just want to quote the end of your introduction here. You write, “the saga of permanent distortion follows the money more than that exposes why the rise of populism social unrest, and technology driven financial alternatives driven by economic fragility will increase. Without a dramatic course correction, each new 21st century crisis will build upon the last creating an ever greater pile of debt, asset bubbles, and central bank aid, the disconnect between the markets and the real economy will widen this will spark a massive alteration in the global power paradigm.” Could you expand on that?

Prins

That’s tough, isn’t it? It’s true, though. This is based on what we’re seeing. This is based on looking at the numbers, at the events unfolding, at elections, at central bank interventions, and at what happens when they don’t intervene for a minute and jump right back in, which we’ve just seen happen in the UK, for example, with the Bank of England and the pension system there. And I’m saying, we’re not really buying bonds, but we’ve got to because otherwise, the pension system will collapse. Every time there’s a thing, this is what’s going to happen. So, we’re in the middle of this period, and it’s not like just because the Fed is raising rates. All of what you just read, all of what I wrote, is actually destined to happen. Now, on the positive side, as a result of what’s happening with this sort of disconnect between where money’s going, how it’s produced, is it can also cause more individuals, small businesses, etc., to step outside that main central bank connected system, and work among themselves. More p2p lending, more decentralized finance, and more cooperatives of companies working together and trading expertise, for building, for innovating, for creating. I think, having seen through Covid, that we can do things differently from the standpoint of just going into the regular job as it used to be, but we can actually connect across the world and move things forward among ourselves organically. I think that’s really the positive flip side of everything that is going to happen.

Robinson

You do preface that everything’s going to continue on this path by saying “without a dramatic course correction.” What would a dramatic course correction look like?

Prins

Again, one course correction is a lot of people in small companies, and so forth, abandoning the system and finding a way to work together. But within the system itself, I think the Fed needs to be held accountable or be effectively removed. What that would indicate is that they become elected officials instead of appointed or selected officials, and this becomes a global thing, so at least people have some connection and hearing from them about the policies and how they’re going to impact them when they get into those positions. Money needs to have responsibility. The course correction means that we—i.e. the government, central bank establishment, Wall Street, etc.—have to be more accountable to how money is created and where it goes, and there has to be more of a tie into going into the real economy versus the markets. And if that course doesn’t happen, if that money doesn’t get diverted and isn’t responsive in that way to the real economy, we’re just going to keep on going with the permanent distortion, gaining spread.

Transcript edited by Patrick Farnsworth.