The Entirely Predictable Collapse of FTX Exposes the Failures of Regulators and Journalists

The most ‘respectable’ of the crypto billionaires was just another fraudster. When will journalists stop hyping this industry? When will regulators protect consumers from getting ripped off by the next Ponzi scheme?

One of the world’s largest cryptocurrency exchanges, FTX, recently imploded spectacularly. Its CEO, Sam Bankman-Fried, had been called “the next Warren Buffett” and was a Democratic mega-donor as well as a major funder of the “Effective Altruism” movement. Overnight, Bankman-Fried saw his fortune and his company wiped out, and he is now under criminal investigation. An excerpt from the Financial Times from May of this year gives a sense of the aura that surrounded Bankman-Fried and his firm before their sudden collapse:

“[Bankman-Fried] defies expectations. In just three years, the success of FTX has catapulted him to fame and a roughly $24bn personal paper fortune. His company is backed by blue-chip investors including BlackRock and government pension funds. In March, Goldman Sachs chief executive David Solomon met with him on Bankman-Fried’s Caribbean home turf. And the week before our lunch, he hosted a conference where he interviewed Bill Clinton and Tony Blair, dined with Katy Perry and Tom Brady, and was pursued for selfies by admiring fans. … Although Bankman-Fried has a knack for winning converts, crypto is still assailed by critics who see the sector as a financial perpetual motion machine, something close to a Ponzi scheme, that survives by sucking in new money. … Bankman-Fried offers an alternative narrative, focused on how crypto can do good and give ordinary people control of their money. He plans to give away at least 99 per cent of what he earns as fast as he can.”

To explain what happened, and why we keep seeing spectacular frauds in the crypto industry, editor-in-chief Nathan J. Robinson recently spoke on the Current Affairs podcast to Stephen Diehl, a longtime critic of crypto who has been warning for years that crypto assets can suddenly implode and that unregulated crypto exchanges like FTX are a terrible place to keep your money. Diehl is the co-author of the new book Popping the Crypto Bubble, an accessible explanation of how cryptocurrency works and why it’s a terrible idea. He and his co-authors show how the history of financial bubbles and manias helps us understand crypto-hype today. In this episode, Stephen discusses the credulity that allows con artists like Bankman-Fried to flourish in the crypto industry, and that dupes supposedly savvy investors into believing in the digital equivalent of magic beans. We also discuss the complicity of financial journalists in promoting con artists as altruistic geniuses who can be entrusted with one’s retirement savings. This interview has been edited for grammar and clarity.

Nathan Robinson

You’ve been writing about cryptocurrency for a while. And I want to just read the pretty emphatic opening sentence to your book Popping the Crypto Bubble:

Cryptocurrency is a giant scam, although a complicated scam that uses technobabble, heterodox economics and populist anger to obfuscate its functioning. A pitch perfect scam for the post-truth era of social media where trust in institutions and experts is at an all-time low.

So what is it that led you to that pretty strong conclusion, that cryptocurrency as a whole is a giant scam?

Stephen Diehl

Well, it’s the conclusion I’ve come to over the last couple of years, when I’ve looked at the space and the impact it’s having on everyday people, on the tech industry, and on the world at large. This is a technology that has an overwhelmingly malign influence on the world, all for a set of theoretical upsides which never seem to match reality or bear any fruit. So crypto really is a solution in search of a problem. And we’ve seen that in the last year with the collapse of most of these tokens, a lot of them are revealed to be outright scams. A lot of people in the public have gotten hurt. And unfortunately, a lot of it was very preventable. So I tried to lay out in the book the case for why the crypto industry is selling the public a lot of lies, because none of the things that they say make a lot of sense.

Nathan Robinson

Maybe you could elaborate on what you think the biggest of those lies or misconceptions is. What are some of the things that the industry tries to convince people of that they should not, in fact, believe?

Stephen Diehl

Well, the problem with the crypto industry is that it changes its story every six months. This all goes back to maybe 10-13 years ago, when the conception of Bitcoin came around. Bitcoin originally started as a so-called “peer-to-peer electronic payment system,” which aim to be a way to send value between different parties without the need for an intermediary like a bank or payment processor. Unfortunately, it turns out that the design of Bitcoin was informed by some very strange sort of Austrian economics and heterodox views about money that were baked into this design of this fixed supply. So there’s only 21 million Bitcoin. So that’s a really poor design for a currency. Currencies have to be dynamic. They have to adjust with the market effects and the broader economy as a whole. And money derives its value from the requirement for you to extinguish your obligations to the state in the form of taxation.

Crypto has none of that. So crypto as a whole is an asset which has absolutely zero intrinsic value. The only value it’s derived from is people’s faith in the fact that there’ll be another sucker who will buy it off of them for more than what they paid for it. That’s not a sustainable thing. So crypto as money failed. It doesn’t work. Ever since then, every six months, the industry has to come up with some sort of new story. It’s a “new version of the internet.” It’s a speculative investment that’s uncorrelated with the broader market. It’s a hedge against inflation. And all of these are wrong. None of them pass any kind of intellectual scrutiny. And they just keep coming up with new stories and new lies all over again, with the aim to bring more suckers from the public in to buy this stuff because they want to make money off of them. And that’s the big scam.

Nathan Robinson

You do say in the book that the word “currency” really is a misnomer here, because the things that are touted as the features of it as “currency,” the things that distinguish it from the dollar, the things that make it special, are actually bugs that make it unworkable as currency.

Stephen Diehl

There’s a joke in software engineering, “that’s not a bug, that’s a feature.” So the crypto people look at fiat money, like the dollar and the euro, and they see the dynamic supply and they think that’s a bug. But actually that’s a feature of money that actually makes it all work. So they’ve engineered a really heterodox currency that has this very strange fixed supply property, which doesn’t work at all.

Nathan Robinson

It’s money, but without central banks! Actually, those do something. You know, you mentioned Austrian economics there. And one of the interesting conclusions that you come to in the book is that, “cryptocurrency is a technology built on and inseparable from right-wing philosophy.” That’s also the conclusion that the guy who created Dogecoin came to. He said that cryptocurrency was an inherently “right-wing” technology. I wonder if you could explain what you and he mean by that.

Stephen Diehl

So if you look at the design of it, and you look at the original Satoshi white paper and the forums that used to talk about it, they have a very particular view about the state and its role in our daily life. They are for the most part what people in Silicon Valley are. They’re called “techno libertarians.” They believe that software and the internet as a whole is a means to dismantle democratic institutions and replace them with software. It is a very heterodox view that’s not very widely held outside of Silicon Valley. But it’s a very popular view in that particular domain. And you see that embedded everywhere in the crypto space. These people really don’t want to have institutions. They don’t want to have regulation. They don’t want to have laws. They don’t want to have the same kind of normal safeguards that we have around regulated financial products. They believe that the market and complete laissez-faire capitalism should dominate all of our economic life. And that the market is the ultimate arbiter of anything that actually matters. And that happens to resonate with a certain branch of right-wing philosophy, especially in American politics. And it’s hard to separate the desire for the minimization of the state, a belief in complete laissez-faire capitalism, and a belief that there should be no regulation from right-wing politics.

Nathan Robinson

Cryptocurrency is the privatization of money. And so it’s right wing in the same way that the privatization of the roads and the schools and the police would be inherently linked to “right-wing” philosophy, i.e., moving these things from being in public, democratically accountable institutions into the hands of oligarchs who have mastered the markets. There is something “right wing” about moving anything from the public sector to the private sector.

Stephen Diehl

That’s exactly right. They want to take the issuance of money, which has traditionally been the role of the state, and they want privatize it. They want to have corporations issue their own private forms of money. And in the United States, we’ve actually tried, back in the 1800s. It was called the “wildcat banking” era. And, spoiler, it didn’t end very well. We ended up nationalizing currency for a very, very good reason. Because having 5,000 different types of private issuances of money is really bad for commerce. And it’s really bad for the average layperson, because they just want to buy bread and buy their socks. You don’t have to want to have to exchange all this money and become an FX trader just to go to the grocery store.

Nathan Robinson

Sure. Actually, one of the real values of your book is that you have this great section on the history of market manias, where you go through lots of different examples. Each of these historical examples can tell us a little something about cryptocurrency. And what made me laugh as I was reading this is that I had just read an interview with Sam Bankman-Friedman—who we will talk about—where he said he “didn’t read books.” He said “you could just put it in a blog post. I don’t read books.” And I thought, “Well, this is a really good reason to read books.” Because what you’ve done, Stephen Diehl, is you have read books. On history. And so you have understood how a lot of the things that we see now have precedents and predecessors. And so perhaps you could introduce us to a couple of the examples that you bring up to try and help us understand what we see now.

Stephen Diehl

The joke about history is that it repeats itself first as tragedy, then as farce.

Nathan Robinson

But what comes after farce?

Stephen Diehl

Absurdism, I guess. That’s where it is right now. I mean, there’s nothing new under the sun. And the biggest lie in finance is that “this time, it’s different.” There have been dozens of these financial manias throughout history all going all the way back to the tulip mania in the 1600s, to the South Sea bubble in the 1700s. And you start to see a pattern if you look at the cycles of history. There are these irrational moments in markets where people become enamored with the narrative about a specific type of financial asset or a specific commodity. And suddenly, the price of these assets become untethered to the base reality. And people basically pile in expecting to make money on top of this bubble—not because of any kind of intrinsic value or any kind of cash flows, but because they can offload it on another fool. Back in the 1600s, people sold tulips for the price of a small house. And this was a market mania that lasted about six months. Everybody was speculating on tulips, and they developed this whole economy where they’re trading like derivative products on top of tulips.

And probably one of the more representative bubbles is what’s called the “South Sea bubble,” which was a famous mania in 1720 in England, where people created a empty shell company called the South Sea Company, which would originally have rights to do trade in the South Sea in the Americas, which had recently been discovered at the time. Except they forgot to do the actual business part of it. So they were selling shares in this company that wasn’t actually doing anything. And the public thought, “Well, this is just a great way to make money. Why don’t we just go buy up the shares because the price just seems to be going up and up and up?” And let’s not ask too many questions about what’s going on here. And at a certain point, this consumed an enormous amount of the GDP of the entire nation state of England. The Crown was in on it; the Bank of England was piling into this thing. It had an arrangement with the government itself to buy government sovereign debt. It had gotten this massive bubble. Sir Isaac Newton, one of the greatest geniuses of all time, lost a large chunk of his savings in the South Sea bubble. And so this was in 1720.

Nathan Robinson

No one’s a genius about everything.

Stephen Diehl

Of course. So there’s a favorite famous book called Extraordinary Popular Delusions and The Madness of Crowds. It was written in 1841. And it’s the best book ever written about Bitcoin. Nothing has changed since then. These things have always happened. They always will happen. They’re just part of markets. They’re part of human madness.

Nathan Robinson

I want to read a great paragraph you have on the era of wildcat banking. You say:

“[T]he lessons of wildcat banking are still a stark reminder today about the failures of experiments in private money. When the public allows private accountable entities access to a money printer, they usually use it as a ‘machine of fraud’ just as much today as they did back in 1839. The wildcat era marked an era of unnecessary friction in commerce, rampant fraud, and a breakdown of trust in the financial system. The history lesson from the wildcat banking era is that bank deposits cannot reliably act as money without bank regulation and supervision and some form of government insurance. Bank runs and defaults are not only common with private money—they are inevitable and financial markets are subject to undue and completely unnecessary shocks when large blocks of assets and contracts denominated in those assets suddenly become valueless. This phenomenon, in turn, puts more pressure on the courts to clean up the financial messes, which they are most often unable to do adequately. Finally, this turns into a vicious cycle that erodes more trust in public institutions. A developed economy needs a sovereign currency backed by the full faith and reserve of a single issuer, of which the state is the most qualified and natural entity. Putting faith in a free market for thousands of types of private money is always doomed to failure. The wildcat banking era is an important lesson to learn from the past, given the recent fringe efforts to return to a digital variant of private money with stablecoins and cryptoassets.”

So by looking at what happened in, as you say, 1839, we will be on our guard, and we don’t we don’t miss or misunderstand things when they come around again, as they inevitably do.

Stephen Diehl

Exactly the same kind of fraud that they were running back in the wildcat banks in the Midwest at the time, is happening today with stablecoins. Turns out when you give people an infinite money machine, what do they use it for? To enrich themselves. It’s very indicative of human nature that if there are no safeguards on what you can do with other people’s money, chances are you’re going to run away with it.

Nathan Robinson

You also say that we can even learn from looking at the Enron scandal, looking at Beanie Babies, looking at the 2007-2008 financial crisis. You enumerate how each one of these teaches us something about cryptocurrency.

Stephen Diehl

Crypto synthesizes different facets of all these manias from the past, into this sort of mega-frothy bubble, which draws on a lot of different scandals. We can learn from the Enron scandal about how creative accounting can be used to obscure all sorts of problems, just like we saw with the latest FTX collapse. We can learn from Beanie Babies about how commodities can become untethered from fundamental value and how even clever people can get swept away in the mania. We can learn from the savings and loan crisis and the market crash of 1929. There’s a lot of lessons that history has tell us about these things. And it’s not even that far back. I mean, we’re talking about a few hundred years.

And there’s a lot of wisdom baked into our current regulation in markets that was paid for by a lot of our ancestors, by our grandparents. And they put these things in for a very good reason. And the securities framework that was put in place back in the 1920s after the Great Depression is the very thing that the crypto industry is fighting with at the moment. There are many parallels between the speculative mania that led to the Great Depression, and what’s happening in securities evasion in the crypto market today.

Nathan Robinson

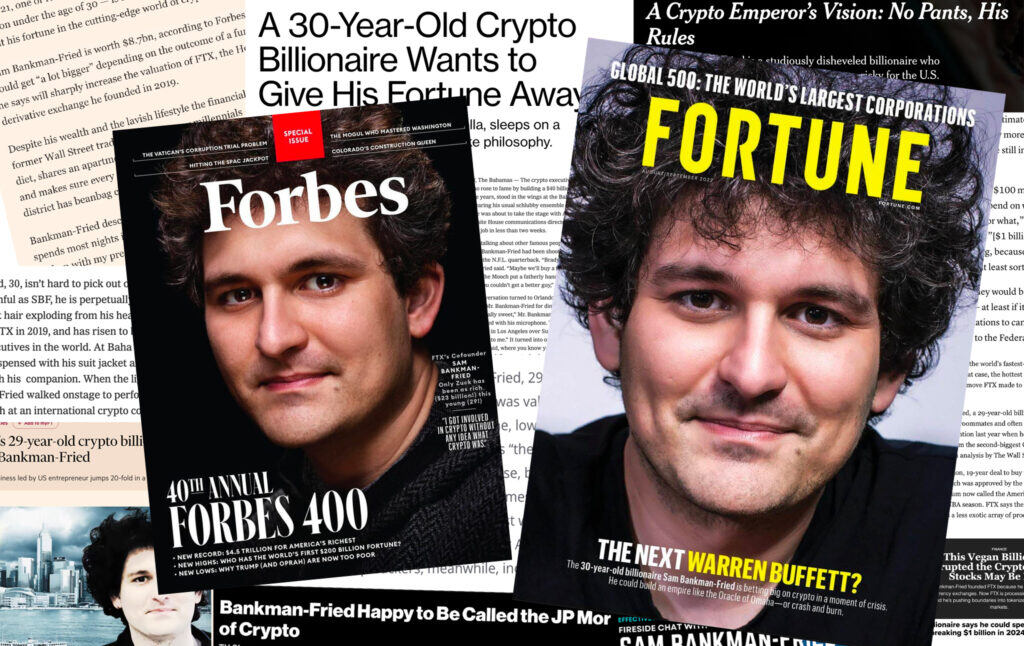

The reason that I have brought you on today, in particular, is that the things that you have been writing for a long time have become super-relevant in the last couple of weeks because there has been perhaps the largest, or most sudden, collapse in the crypto industry in the history of, well, a long series of sudden catastrophic collapses. This is the demise of the cryptocurrency exchange FTX. Sam Bankman-Fried, the CEO, was profiled in many major outlets—in the New York Times, Fortune Magazine, Forbes, Bloomberg, and was kind of the ambassador for cryptocurrency in Washington. He was a major proponent of the Effective Altruism movement, this big do-gooder who was putting up this respectable face for cryptocurrency. Well, within I think a couple of days, the entire enterprise collapsed. His $16 billion fortune fell apart. And it seems as if the company was built on— surprise, surprise—a big fraud. So first perhaps you could tell us a little bit first about crypto exchanges like FTX. Because you have a whole chapter in the book about these about “crypto exchanges” and what they do.

Stephen Diehl

So crypto exchanges are the entry points by which people take their actual money, and they use it to buy crypto tokens. So at least on face value, these are businesses which you can connect to through a web portal, and they offer you the capacity to connect your credit card or your bank account and purchase these crypto assets. That’s how it works in principle. What actually happens is that they’re set up in very dodgy ways: typically offshore from the United States, outside of financial regulation. They will go shop around for a jurisdiction that is very lax about financial regulation. Oftentimes, these things are set up in tax shelters where wealthy people hide their money and where they can basically buy off the regulators to let them to do whatever they want.

And the thing to understand is that the entire world’s banking system is already connected. So people in the United States in Europe and Britain, they can wire money to these entities abroad. And then their money is basically held by a corporation that exists in this offshore tax haven, which can do whatever they want. And allegedly, some of them actually offer services for their customers. But they don’t act like a normal exchange, like a Fidelity or a Charles Schwab, that actually takes your money and allows you to buy actual stocks. What they do is they take your money, and then you have an unsecured creditor arrangement with this offshore entity, in which they have absolutely no requirement to deliver you anything. And they basically let you buy crypto assets. They basically operate like a casino or what would traditionally be called a “bucket shop.” And these businesses can get away with a lot of really, really shady things. And because a lot of the crypto assets are illegal to sell in the United States, people are forced to go abroad to what are essentially these offshore casino boats, operating these tax shelters, to buy these assets that they want to gamble on.

And the latest one was this company called FTX, which is run by this American chap named Sam Bankman-Fried, which was allegedly one of the more respectable of the—that should tell you enough right there actually—exchanges. FTX was doing this massive marketing campaign in the U.S., trying to get all these customers and trying to lobby Congress to get regulation. And it turns out the entire thing was basically operating, to first approximation, like a giant Ponzi scheme. And what always happens with Ponzi schemes is that Ponzi schemes are insolvent from the start. And when it’s at the point when outflows exceed inflows, they collapse. There’s a lot of sound and fury about what went on inside of that collapse. But at the base level, there was just not enough money to go around. Because they were basically siphoning it off to this other entity, which is basically operating as a hedge fund and using it to gamble on even riskier things. And that means everybody that was putting their money on this exchange is now an unsecured creditor of some Bahamian shell company which is now insolvent. And that’s really bad. A lot of people got hurt.

Nathan Robinson

Yeah, they had ads in the Super Bowl. This was the Larry David ad. They bought naming rights to some stadium. You know, I tweeted recently that I think this is just as much a story about the failure of financial journalism as it is the failure of this company. Because to the extent that people trusted this institution—in the Super Bowl ad, they had said, “it’s a safe way to get into crypto—and to the extent that people did not realize that giving your money to a 28 year old in the Bahamas to put money into magic beans, and to the extent they thought “this guy’s good for it,” it is in part because there are all these newspaper stories touting him as a brilliant genius and altruist who is the future of finance and may soon buy Goldman Sachs or JP Morgan.

Stephen Diehl

You’re exactly right on that. It is baffling to me that we have all of these seemingly respectable institutions, the credulity of them is staggering. They’re treating this thing, which to anybody who does due diligence on any kind of company, this thing is papered in red flags. It is a Bahamian shell company set up in the least regulated environment on the planet, with no board of directors, no governance, completely opaque financials, set up by a 28 year old and apparently staffed by 17 kids all living in a frat house in the Bahamas. You couldn’t make this stuff up. But the investors in this thing are in some of the most sophisticated funds on the planet. These are nobody’s fools. These are the biggest Sand Hill Road investors in Silicon Valley. SoftBank, Tiger Global. And apparently none of them did any due diligence. And the story just gets more and more strange. And it just speaks to what happens in this super low interest rate environment where there’s so much money sloshing around the United States, chasing too few things. People are just so desperate to get into deals that they’re willing to say, “Well, I like this chap, Sam. He seems respectable and there’s nothing else to put my money in.” So let’s just let it ride. That’s really what this is.

Nathan Robinson

I don’t know if you read the interview that Mr. Bankman-Fried did with Matt Levine of Bloomberg a while back. Levine is a pretty sharp guy who writes Bloomberg‘s “Money Stuff” newsletter. And he asked Bankman-Fried to describe this thing that I don’t quite understand called “yield farming.” And Bankman-Fried describes it and he begins basically, Well imagine you have kind of a worthless thing but everyone starts believing in it. And Matt Levine of Bloomberg reacts by saying “Well, it sounds like you’re saying I’m in the Ponzi business and that business is good” And Bankman-Fried replies, “Well, there’s some validity to that.” Now, Levine interestingly—because I subscribe to his newsletter—still says today that when he heard that, his trust in Bankman-Fried increased rather than decreased because he thought, “Well, this guy at least kind of knows what he’s doing.” He’s not like a religious believer—you describe how a lot of these people have this kind of mystical view of how cryptocurrency will save us all. No, Bankman-Fried is a real cynic. But it was shocking to me that the guy could acknowledge in a public forum that the word “Ponzi” was not inapplicable to his line of work. And it didn’t seem to register with anyone, including the sophisticated financial journalist who was interviewing him.

Stephen Diehl

That interview—it’s on the Odd Lots podcast on Bloomberg—was surreal. So Matt Levine is a very clever chap, and he writes this column every week in Bloomberg. And he’s one of the wittiest and most brilliant minds in journalism. And he interviewed Sam Bankman-Fried and asked him to describe what his line of business was. And the description that he gave was like, “Okay, imagine a box, we put money in the box, we all believe really hard, and then more money comes out of the box than we put in.” And that was the essence of what was going on. And Matt Levine turns to him and says, “What you’re describing is that you’re in the Ponzi business and it’s pretty good.” And Sam confesses, “Yes, yes, I’m in the Ponzi business, and it’s great.” And he basically confessed to running a Ponzi scheme on Bloomberg. And everybody was like, “Well, that’s just the norm now.” And then basically, six months later the entire thing exploded.

I’m not quite sure what to make of this phenomenon. These journalists do their best to expose what’s going on here. It’s just that the public doesn’t seem to care. They want to invest in the Ponzi scheme. The fact that it’s a Ponzi is actually a feature to them. What do you do as a financial journalist in those kind of circumstances where people are going into this with somewhat clear eyes, and they’re choosing to invest in these things that they know are financially unstable? How do you cover this thing? I’ve talked with many financial journalists. Many have basically taken this “I just report the facts and figures on this stuff, I don’t have an opinion” attitude. And it’s sort of taboo to even talk about. A lot of financial journalists prefer not to talk about this stuff. Its like, “I went to Yale to study journalism for eight years, and now I’m forced to cover assets whose only intrinsic value is a meme of a talking dog.” It’s kind of an affront. And that’s really where we’re at. I mean, the public doesn’t care what the journalists write, and the journalists don’t know how to cover it. And then the public is left with this very imperfect information. It’s very much a symptom this kind of post-truth era, though. People just don’t care anymore.

Nathan Robinson

And it would be amusing if not for headlines like the teachers’ pension fund that was invested in FTX. That’s real people. It’s not dumb crypto bros who buy cartoon apes.

Stephen Diehl

Yeah, there’s all the schadenfreude we might have about some of these really wealthy hedge funds getting wiped out. That’s always funny. Watching wealthy people destroy themselves is good fun. But at the end of the day most of the money that’s flowing into crypto is not coming from these hedge funds. It’s coming from everyday moms and dads. These are just normal, salt-of-the-earth people. Imagine your canonical crypto investor is just some some mom in the NHS, who said her grandson convinced her, “Oh, you should put $200 in crypto.” Then she lost it all. That can mean a lot of money to her. Those are the people that are being suckered into this stuff. So this isn’t just some abstract financial game played by hedge funds. This is real people losing real money that they can’t afford to lose, because they’re being told by celebrities or being told by influencers, they’re being told by some financial journalists, that this is the future and you have to get in now. Unfortunately, none of that story makes any sense and that’s the big problem with crypto. It hurts real people.

Nathan Robinson

Is it the case that the story of FTX is a story of the inherent unsolvable problems with the crypto space? Or is it the case that this is one fraudster who nobody knew was a fraudster? When I said “a lot of us have been saying all crypto is a scam” someone came back and said, “Well, how could we possibly have known that this guy was not doing what he said he was doing?” He was actually taking his customers’ assets and placing risky bets with them. He told us he wasn’t doing that. One of the arguments that you make in the book is that there is no way to make crypto non-Ponzi-like. But I think even what Matt Levine still says is that Bankman-Fried wasn’t saying that he runs a Ponzi scheme. He was saying that he facilitates a lot of other people’s Ponzi schemes. So his business didn’t have to be a fraud. It didn’t have to come tumbling down. Now, it did come tumbling down. But we can imagine a world with a more honest broker. For example, there’s another crypto exchange, Binance. The big one that killed FTX. Are they inevitably going to collapse? Or maybe if they’re run by a more honest broker could they have stable functioning without these terrible collapses?

Stephen Diehl

So Binance has all of the red flags that FTX was and then some. It’s even more opaque than FTX. It has no adherence to any regulation. In fact, they’re actually illegal in my country, in Britain. They’ve been completely banned. This is the same with several other countries. They cannot operate in the United States. This is a company which makes FTX look like the Easter Bunny. This is a company opposed to regulation in any form, set up in the most shadowy parts of the financial system, with absolutely no oversight. And a CEO who is the most unapologetic nihilist that will just do whatever it takes to achieve his end goal. He is very Machiavellian. So I would not hold up Binance to be the shining example that will save us.

But to go back to your question, people often push back and say, “Oh, you can’t say that crypto is all a scam. You have to take a more moderate position. Maybe it’s just a tool.” Well, you have to ask, “What is the tool being used for?” And we could ask from an intellectual perspective, what is crypto useful for? Well, okay, it’s not money. It’s not building a new financial system, because it doesn’t actually function as money, you can’t build anything on top of it that can be used for commerce. It’s not building a new internet. And it’s not a hedge against inflation. It’s not an uncorrelated asset.

So what is it? The only comparable thing you can kind of compare it to is art. So art is a thing, which has some sort of conceptual or aesthetic value that people can sell, basically, to another fool. So imagine a piece of artwork chopped up into 21 million pieces that people just trade. And if it was just that, actually it wouldn’t have a whole lot of problems with. If it was just basically a piece of libertarian performance art, kind of like that Banksy, chopped up into different pieces at auction. If crypto was basically just the financial version of Banksy, I wouldn’t care. Except it happens to be this performance art that has all of this negative externality, which is screwing so many people over. It has all of these climate implications, geopolitical implications, it’s used for sanctions evasion, for dark markets, for human trafficking, for terrorism financing. So it’s not a harmless thing that we have going on here. It’s not just high net worth individuals fighting over a Picasso.

And so when you deconstruct all of the narratives, none of them actually makes sense. When you treat it as a speculative digital commodity, you have to look at: what’s the actual outcome? And from a pure consequentialist perspective, most people are gonna get hurt by this. And so I think it’s extremely fair to call it a scam. Because it just doesn’t work. And it has all these horrible things associated with it.

Nathan Robinson

One of the things that you argue is that there is never going to be stability, The Ponzi-ish nature of cryptocurrency is here to stay, because it’s built on nothing, because it depends so heavily on faith. I will quote you here. You say:

“In the rational bubble model, the value paid by increasingly greater fools must increase exponentially as a function of the discount rate and the probability of failure. If the asset does not sustain this growth or stabilize, then the sales to the infinite chain of fools cannot overcome the cash outflows, and the yield of the entire scheme must become negative. Bubbles need to be fed, and bubbles cannot sustain themselves with stable inflows. Under the rational bubble model, a crypto asset can only be an ‘economic black hole’ investment on long time scales requiring increasing capital to be fed to sustain its ultimately unstable and transient existence.“

Could you explain what you mean by an economic black hole?

Stephen Diehl

So if you want to treat crypto as an investment, you have to ask the question: where’s the money gonna come from? So everybody knows at least one person that became a crypto millionaire, right? And you have this question like, “Where did that money come from?” Well, it came from 10,000 other suckers. And the only reason people are investing in these things is because they want to get more dollars. They want to flip their crypto tokens around to a greater fool. There is no other source of income associated with a crypto asset. A Bitcoin doesn’t produce anything. It’s not like a house which can generate rent. Or it’s not like a stock where there’s actually a company that sells something.

Nathan Robinson

It produces CO2 emissions.

Stephen Diehl

Okay, so it has externalities that are negative as well. But there’s no cash that flows into a Bitcoin. It’s a pure what’s called a “greater fool” asset, which means that if you’re trying to treat this as an investment, the only money that comes to pay out people who sell ultimately comes from new investors paying out old investors, which is exactly the same economics as a Ponzi scheme. And if you just look at the base economics of this thing, it’ll never function as money. Because there’s a fixed supply. And there’s variable demand, because people are treating it as a speculative investment. Well, okay, price is the equilibrium between supply and demand from economics 101, and if you have variable demand and fixed supply, what are you going to have? Variable price. And so basically, crypto exists and will always function as this random oscillator that will bubble up and down based on wild sentiment in the market. And that looks like a casino rather than an actual market. Because there’s no goods or services actually being exchanged in this process. It’s basically just the equivalent of a roulette wheel.

Nathan Robinson

I previously interviewed Molly White and Nicholas Weaver, who co-signed a letter with you that was written to Congress about cryptocurrency regulation. And one of the things that came up in those interviews was: when you see all of the ads for crypto, and the kind of culture that has developed around crypto where those who ask questions are treated as idiots who just don’t understand the magic of crypto, you need to remember that in the case of an asset where people are depending on the “greater fool” theory, someone is trying to suck you in. Because they need to keep finding new suckers. And so when you look at that ad, remember that the sucker might be you. We didn’t get flying cars, but the future does have the democratization of the Ponzi.

Stephen Diehl

That is exactly right. The reason they’re taking out Super Bowl ads, the reason they’re putting their names on stadiums, the reason every time I ride the Tube in London, there’s an advertisement for “buy my dog coin today” is because they just need more inflows of money to pay out old investors. And that’s exactly how Ponzi schemes work. It’s just a very strange one. Nicholas Weaver is actually a brilliant chap. He calls it a “self-assembled” Ponzi scheme, because it differs from the classical Ponzi scheme in some very strange ways. Because there’s no central operator on it. It’s basically run on a kind of decentralized marketplace online, where people construct the Ponzis themselves, which is very bizarre. But if there is any actual innovation in crypto it’s the fact that any teenager can create a self-assembled Ponzi scheme overnight.

Nathan Robinson

One of the things you do in the you talk about how religions and cults work and and how we can we can spot irrationalism in in crypto culture.

Stephen Diehl

There’s a whole chapter in the book called “the Cult of Crypto,” which is my best attempt at describing kind of the sociology of people who are in deep inside the crypto space. And it’s important to caveat this by saying that not everybody in crypto is in this cult, but the cult definitely exist. And people have some very, very strange beliefs that border on what I would call a secular religion. They really believe that this technology is going to usher in some new golden era for mankind. And it’s gonna lead to the dissolution of the nation-state and the overthrow of the dollar. The entire international order is going to collapse and give rise to this techno-anarchist utopia in which they’re going to be basically God-kings. They believe this sincerely. They literally write entire diatribes about how they’re going to have citadels full of their anarchist friends, and they’re all going to be living in this crypto-utopia. And they always lack details of how that society would ever work. But, alas, they really do believe it. And unfortunately, there’s a lot of lost young people who are economically disenfranchised, and this narrative is speaking to something deep inside of them that they’re not finding elsewhere in our society.

Nathan Robinson

In your intro, you say that this is an era when trust in institutions and experts is at an all-time low. It’s also a time of great inequality—everyone grasping at hope, people looking for meaning in their lives. It certainly appeals to that.

I suppose we should just finish here by asking: in the wake of the FTX collapse and the discrediting of the most respectable ambassador for crypto, Effective Altruist billionaire Sam Bankman-Fried, what would your advice to Congress be on what should be done next? Some people would say, “Well, don’t throw the baby out with the bathwater.” But you say in the book, it’s all bathwater. There is no baby. Or perhaps if there is a baby, it’s a demon baby that shouldn’t survive. If a legislator sat down with you and said: “Stephen Diehl, tell me what we ought to do? What is the optimum response here, post-FTX?” What would you tell them?

Stephen Diehl

So last year, I drafted a letter and got 1,500 people in my industry to sign what was called the concerned tech letter. The points that we made in that letter are very clear.

First, we don’t want Congress to carve out a specific bespoke regulatory regime for crypto assets. These are products which are deeply predatory. They have no clear economic use case, other than pure naked speculation. They come attached with all of these climate externalities, all of these investor protection externalities. And after 13 years, they’re still a solution in search of a problem. Crypto is the same age as the iPhone. And imagine if with the iPhone we were still scratching our heads like “what’s the phone for?” We’re still asking these fundamental existential questions after 14 years. That’s a big red flag.

And so for Congress, what they really need to do is just enforce the laws on the books. There’s this piece of legislation that our grandparents put into place in the 1920s called the Securities Act, which outlines how joint stock companies can be made, and what kind of disclosures and investor protections have to be put around the sale of things that look like what are called securities. Securities are abstract financial instruments that people can trade that represent some ownership in something. And so crypto assets are securities. Full stop. The U.S. has more or less declared this to be the case in the courts, which means they fall under the remit of the Securities and Exchange Commission.

Unfortunately, the Securities and Exchange Commission in the United States is tiptoeing around this issue, and not enforcing the law as it’s written. A lot of these exchanges are basically operating as illegal securities marketplaces. And the SEC apparently doesn’t have anything to say about that. But if they did, that would curtail a lot of the harm. So really, Congress doesn’t need to do anything other than get the SEC to do their jobs. If you just enforce the laws as they’re written and declare crypto assets to be securities, a lot of the negative externalities and harms to the American public would basically go away. And that’s really what I want to see. I just want to see the laws, as written, enforced. People should be protected so they don’t get screwed like they did in FTX. Because all of this was very preventable. FTX could have been shut down years ago, and we’ve just collectively as a society allowed it to exist. It doesn’t have to be that way.