White-Collar War Crimes and For-Profit Famines

What should be called ‘white-collar crimes’ could kill more people than combat itself in the Russia-Ukraine war.

In war, noncombat deaths often outnumber violent killings. For instance, in the extended World War years, from 1915 to 1950, around 40 million people died from hunger, more than the number that died from “direct violence,” according to Alex de Waal’s book Mass Starvation: The History and Future of Famine. Starvation has often been a direct tactic of war. In World War II, the Nazi Hunger Plan sought 30 million deaths, and the American mining of Japanese harbors was called Operation Starvation. In World War I, up to 750,000 Germans starved, “many of them after the 1918 Armistice as the British maintained [their naval] blockade for 6 months to force” acceptance of harsher peace agreement conditions. We could recite further stories from history’s cornucopia of such cruelties against civilians. But sadly, civilian-harming hunger isn’t only historic. In April 2022, a Kremlin bigwig called food Russia’s “quiet but ominous” weapon. And a German diplomat believes that “Putin is hoping that disruption of grain supplies will lead to … starving people fleeing to Europe.”

Nowadays, noncombatants face an additional menace: volatility in global commodity markets results in food supply disruptions and dramatic price hikes far beyond battle zones. Shockwaves from the Ukraine conflict have so worsened world hunger that aid workers report children starving to death “before our eyes.” The U.N. World Food Programme’s chief David Beasley estimates that 49 million people are at “immediate risk of death” and 323 million face “acute food insecurity” (up from 276 million before the war). As the world food price index hit an all-time peak in April, the Programme had to halve rations in several countries (it feeds 125 million people a day). By July, 1.8 billion people in 62 poor nations faced food import cost increases.

As the Washington Post reported: “In Lebanon, food prices rocketed by 332 percent, while Iranian food bills jumped by 87 percent and Turkish grocery costs rose by 95 percent.” Jacobin notes that soaring prices “triggered protests in Argentina, Chile, Cyprus, Greece, Guinea, Ghana, Ecuador, Indonesia, Iran, Kenya, Lebanon, Palestine, Peru, Sudan, and Tunisia.” Although food prices nominally returned to pre-war levels by August (due to traders’ concerns about economic headwinds, as well as the recently negotiated resumption of grain shipments from blockaded ports), and since poor-nation currencies like those of “Zimbabwe, South Sudan, Turkey, Sri Lanka, Laos and Malawi have lost at least 25 percent of their value against the greenback,” local prices continue to be brutally burdensome.

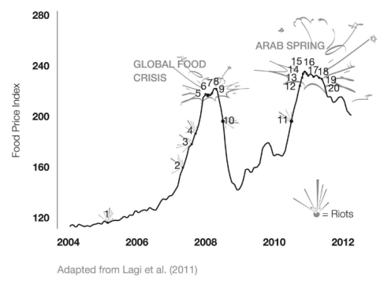

The greed-driven gambling behind this staggering systemic cruelty is explained in Price War$: How the Commodities Markets Made Our Chaotic World by anthropologist, filmmaker, and author Rupert Russell (reviewed recently in Current Affairs). His extensive investigation concludes that commodity trading has caused a “global tsunami of suffering through skyrocketing food prices.” Russell set out to solve the puzzle of why food prices spiked in 2007, triggering the Arab Spring, even though global production had been growing steadily. Likewise, wheat prices doubled in just 7 months preceding what the U.N. called the Global Food Crisis of 2010. How could prices defy the physical reality that there had been no shortfalls in aggregate production? Russell quotes a Goldman Sachs analysis which found that “without question increased funds flowing into commodities has boosted prices” (even in a time of global abundance). As these charts show, global food supply was steady and rising while vast swings occurred in prices:

Source: Our World in Data.

Source: Time dependence of UN Food and Agriculture Organization Price Index from January 2004 to May 2011. The Food Crises and Political Instability in North Africa and the Middle East. Lagi et al. (2011)

Like so much else, commodity trading had become caught in the currents of the veritable Niagara of neoliberal greed. As Russell notes, in the wake of the 2008 financial crisis, a “bubble migrated” as a tidal wave of capital sought higher returns, like those touted by the then new trendy commodity-index funds. Analyzing the aftermath, Joseph Stiglitz, Nobel Prize winning economist, told Russell that widespread societal harms were “just collateral damage in the struggle to make more money for the financial sector.” Wealthy warriors in this financial war of naked greed paid no heed to the harms their day job heaps on the world’s poorest people. Stiglitz is a vocal critic of free-market dogma, quipping, “the invisible hand is invisible because it does not exist.” Surely, only the invisible-hearted could condone the collateral carnage of these intra-wealthy wars? “Losing” for hedge funders means fewer luxuries. But for far flung poor folks? Starvation, through no fault of their own.

Russell singles out commodity-index trend-following algorithms as an extra-wicked weapon in the war to fatten the wealthy. They’re “engineered to exacerbate the human costs” of volatility by mindlessly amplifying market swings. Commodity markets once served real-economy purposes—futures contracts meant farmers could lock in prices in a mutually beneficial arrangement enabling investors to earn a risk premium. But now most trading is algorithmic and has little to do with real-world issues like producers hedging their crop prices. Russell quotes one hedge funder’s estimate that these markets are 80 percent software-driven speculation, including loony computerized trades triggered by the presence of keywords in headlines. The crude rule is to buy if the sentiment of the article seems positive, sell if negative. Russell provides an amusing and absurd example: Berkshire Hathaway’s stock price is correlated with Anne Hathaway’s film career (a 2 percent bump when she hosted the Oscars).

But collateral kinetic impacts are far from funny. These digital weapons exploit and amplify chaos, carpet-bombing suffering onto the world’s most precarious people. In this algorithmic combat, rich players win while the planet’s poor bear the deadly costs. Why do we allow poor babies and kids to be starved or stunted so that the world’s wealthiest people and institutions can gain by gambling?

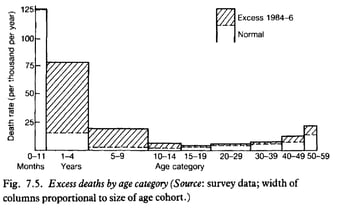

Among those of us fortunate enough never to have experienced a famine, few know the brutal fact that babies and kids bear the brunt of famine. Here’s de Waal’s chart of excess deaths by age (in Darfur) showing the largest impact among the young.

As Claire Sanford of Save the Children reports, conditions in Somalia this year are “even worse” than in 2011’s famine when 250,000 “mostly children” died. She “met mothers who had already buried multiple children in the last year, and whose surviving children were now suffering severe malnutrition.” It’s important to be clear here: “malnutrition” and “severe malnutrition” are medical terms for horrific conditions. As the World Food Programme notes, “most malnourished children will have an impaired ability to learn for the rest of their lives.” And “many of the health impacts from severe malnourishment can be prevented, but they cannot be reversed.” Steve Collins, director at NGO Valid Nutrition, explained in 2017 that “severe acute malnutrition” dismantles “a lot of your metabolic processes: liver, heart, kidney function are all compromised. Your immune system also breaks down. Ultimately you lose appetite and at that late stage, treatment is really hard. Even in hospitals, mortality used to be 20-30 percent.”

Surely, we should do all we can to prevent such suffering no matter what excuses economic theorists give.

Abstract economic theorizing typically asserts that prices coordinate the best rational resource allocations and that prices reflect the best information available while the market bets of the smartest people with skin in the game ensure efficiency. But Russell exposes this as flawed fig-leaf logic. He quotes one market participant (an insider “traitor”) confessing the “irrationality of commodity prices.” Algorithmic trades are shots fired between swanky skyscrapers as “hedge funds raid each other’s coffers,” collaterally taking calories out of the mouths of poor kids.

Besides, only the absurdly blinkered could imagine that global food is used rationally or efficiently—never mind ethically. Grain used for biofuels “eats up enough food to feed 1.9 billion people annually.” Rich-world pets are less food insecure than the 2.4 billion people (1 in 3 humans) classified by the U.N. as lacking “access to adequate food.” Seventy-seven percent of global farming land is used for livestock which mostly the rich consume (or waste). Indeed, 30-40 percent of all food grown is wasted.

Market forces aren’t in the business of fixing this sort of massive and malicious malarkey. For instance, analysis of market-oriented African Green Revolution projects, which aimed to “catalyze a farming revolution in Africa” by helping farmers in 13 countries over a period of 15 years switch from traditional subsistence-and-barter methods to raising monocrops for commercial export, concluded that they led to 31 percent higher undernourishment. As Timothy A. Wise reports in Mongabay News, this large-scale effort was led by the Bill & Melinda Gates Foundation and the U.S., U.K., and German governments, with the goal of doubling “yields and incomes for 30 million small-scale farming families while halving food insecurity.” As much as $1 billion per year went into the effort. But integration of small farmers into international markets put these small farmers under the same pressures that for-profit farmers face the world over (but without rich-nation safety nets). They’re at the mercy of volatile global pricing but have high fixed costs of inputs like commercial seeds and fertilizers. The net result was that even when yields rose, they often “failed to translate into rising incomes.” Many of these small farmers could now neither barter traditional crops with neighbors, nor did they have sufficient income to buy local food, a punishing recipe for food insecurity (further details are available in Wise’s coverage). The bottom line is that markets only feed you if you can pay (to match the bets of invisible-hearted hedge-funders or manufacturers of rich-world pet food).

Much more ethical and effective means of allocating the world’s food abundance are needed. Mark Bittman, in Animal, Vegetable, Junk: A History of Food, from Sustainable to Suicidal, his book on the history of the global food system, describes and decries a long-standing pattern whereby “the myth of the free market justifies mass casualties.” He finds our food system to be “immoral and cruel.” Pushing the world’s poor into global markets makes them vulnerable to price volatility (e.g., events like a climate-impacted drought can depress local wages while food prices increase). Bittman rightly worries about the world’s 500 million peasant small farmers who are being pressured into greater dependence on global markets.

It isn’t exactly a secret that inadequately regulated commodity trading has become a faminogenic threat multiplier. For instance, a 2009 U.S. Senate investigation into “Excessive Speculation in the Wheat Market” found that the “total value of the speculative investments in commodity indexes has increased an estimated tenfold in five years, from an estimated $15 billion in 2003, to around $200 billion by mid-2008. They concluded that “unwarranted changes in wheat prices resulting from the large amount of index trading in the Chicago wheat futures market created an undue burden on … farmers, grain elevators, grain merchants, grain processors, and others.”

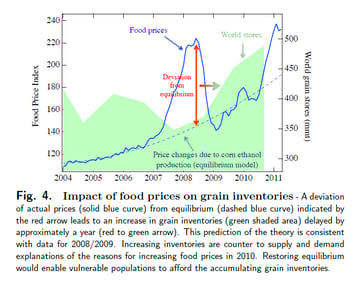

Those “others” include the far-flung poor who are at the mercy of global markets, where an “undue burden” can be deadly. As research by Yaneer Bar-Yam of the New England Complex Systems Institute has shown, world grain inventories increased by 140 million metric tons from September 2007 to September 2010. That’s enough to feed 440 million people for a year, but Bar-Yam concludes, the main reason that grain was not purchased and eaten was “due to speculation” (the rightmost green peak shows storage was increased as prices were rising, i.e., hoarding).

Facing a future of heightened risks (climate, etc.), we need to decide whether we are going to continue to let greed-driven market logic decide who lives and dies. De Waal’s book calls for intervention in food markets to prevent “speculative spirals” in wartime. He advocates for criminalizing war famines and laments that an “irrevocable right of people to be free of threat of starvation” is not adequately codified in international law.

Couldn’t an equal case be made that well-heeled fat cats gambling in commodity markets should be made to adhere to these not-moral-rocket-science don’t-murder-people rules at all times, war or peace? Instead those gold-plated ghouls are gloriously rewarded for amplifying and spreading deadly suffering among the poor. For instance, bonus percentages at the commodities houses can be double what Wall Street banks pay. And remuneration at Vitol Broking in London was a total of 329 million pounds (average of $6.5 million per employee). We have policy tools to curtail these cruelties, including “position limits,” which prevent traders from holding too many simultaneous contracts. Or we could impose excess profits taxes on commodity traders (and indeed on any ill-gotten greed-o-rama gains) such that plundering plutocrats know in advance that loot that shocks our collective moral conscience will simply be taxed away, thus creating a disincentive for that kind of behavior.

There are many things that we must figure out how to do, regardless of whether they are profitable for the rich. Sadly, the global economy, that gigantic Rube-Goldberg enactment of our collective ethics, often makes appallingly bad allocations (for instance, despite the billionaire-beloved claims to the contrary, there has been paltry progress on global poverty-alleviation). And as the monstrous food mess described above and the horrific fiasco over COVID-19 vaccine patents show, too many of our higher-ups and members of the thinkerati are OK with putting profits ahead of saving the lives of the poor. We must stop allowing global markets to enact distributional priorities that are a gruesome parody of decency.

Russell notes in passing that in the escalating bread riot eventually called the French Revolution, speculators were lynched. Perhaps putting yourself into the shoes of those who likely watched their loved ones, including their own children, die of avoidable hunger can add psychological context to this violence against the wealthy? We don’t condone extra-judicial killings, so why do we stand by idly watching lethal but legal murder perpetrated by greedocrats in grain markets? These are white-collar war crimes committed for no purpose other than to fatten already well-stuffed wallets. (For more on related ghastly history see: Forgotten For-Profit Famines.)

The current Russia-Ukraine war death toll is in the tens of thousands (so far). Horrifyingly, if just 0.2 percent, or 2 in a thousand, of those the World Food Programme says are at starvation risk do perish, then food price gambling will mean there are a greater number of noncombat deaths than combat deaths.1 Daily trading at one commodities index fund “increased up to 100-fold from January to early March” this year as well-heeled war profiteers sought to cash in by increasing the already abhorrent burdens on the poor.

That anyone suffers even temporary hunger, never mind dies from starvation, is a greedocratic white-collar crime. There is more than enough food, more than there has ever been, for all humans to be “free of the threat of starvation.”

It is projected that we will need an extra 7,000 trillion calories per year (to reach a projected total need of 20,000 trillion) to feed the world by 2050. History, data, and basic decency suggest it’s unwise to leave that task to what Bittman calls “corporate immoralism” (which has created corporate-warlord loot enough to mint 62 new food billionaires while poor nation food insecurity has doubled). We must resist greedocracy, which puts greed above need and assumes that the poor only have a right to life insofar as their existence is profitable and convenient for the wealthy.

Based on the 49 million at “immediate risk of starvation,” 0.2 percent of 49,000,000 is 98,000. So far Ukraine War deaths haven’t reached the upper tens of thousands. ↩