The ACA Marketplace Is a Scam Covered With the Veneer of “Choice”

Purchasing health insurance on the marketplace is so confusing that it is impossible for consumers to make rational choices.

Until now, I was fortunate enough not to need the HealthCare.gov insurance marketplace. My university paid for my health insurance, and the coverage was excellent, and I didn’t realize how good I had it. But then I graduated and had to find insurance on my own. Having now tried to navigate my options on the website that infamously cost $2 billion to make, I have some fresh perspective on why the American health insurance system is utterly dysfunctional and unacceptable.

The first thing you realize when you try to choose a plan on the marketplace is that it is extremely difficult to figure out which health insurance plans will be best for you. For instance, I was presented with 41 different plans. There were bronze, silver, and gold plans (bronze mostly being plans with low monthly payments and high costs for treatment, gold tending to be the opposite). Some plans had “star ratings” supposedly indicating the quality of the user experience, but most didn’t. While the most obvious variables among plans are the monthly premiums and the annual deductibles (for non-American readers, that’s the amount you have to pay each year out of pocket before the insurance actually pays for your care, in addition to the monthly costs), it’s not really clear whether it’s a better deal to pay more per month and have less to pay for treatment, or to pay less per month and have more to pay for treatment. After all, that depends on whether I think I’m likely to get sick in the next year, and the thing about illness is that it’s very hard to anticipate. Will I get into an accident in the next year that requires me to go to the hospital? Well, I don’t really know, do I?

Having to figure out whether to gamble on a low-premium, high-deductible plan or a high-premium, low-deductible plan would be difficult enough on its own. But when you start to look closely at your options on the marketplace, the whole thing gets much, much more confusing. If you’re trying to figure out what care will cost under different plans, and select one rationally, what you will quickly realize is that this is literally impossible.

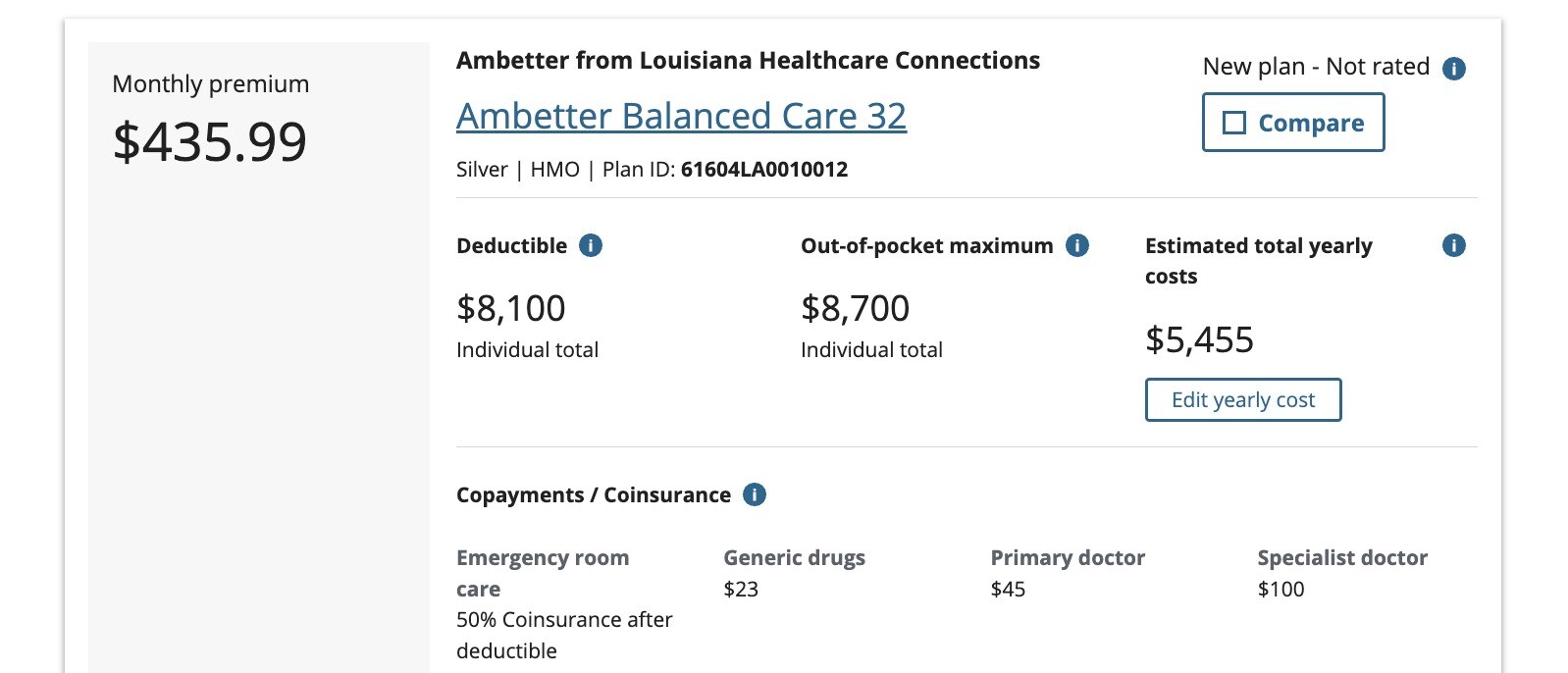

Let us consider some aspects of the user experience. Here is one of the plans in the list available to me:

Now, looking at this, what would you think it would cost to visit your primary doctor if you had this insurance plan? $45, right?

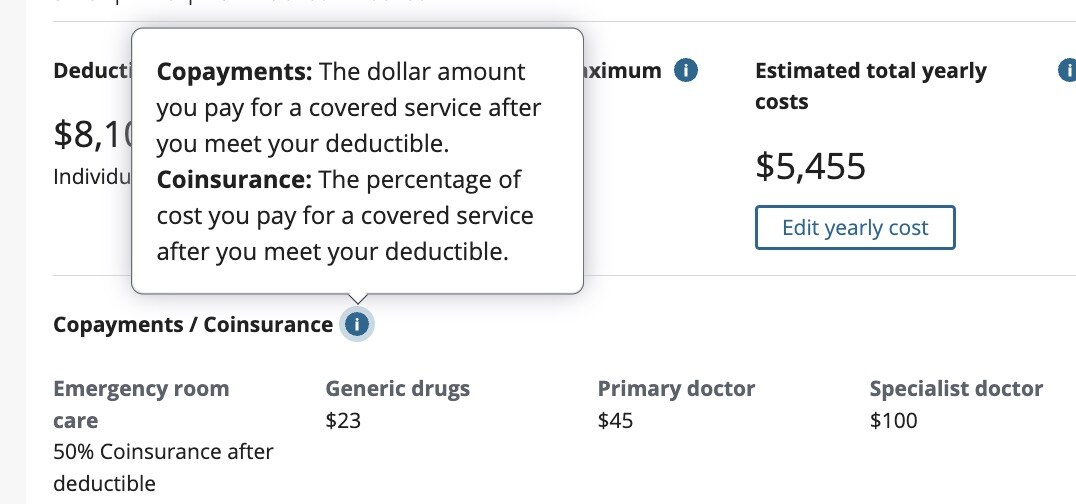

Well, maybe. That’s what it says the “copayment” is. But if you scroll over the little “info” button you will be told that the listed copayments are “the dollar amount you pay for a covered service after you meet your deductible.”

But what about before you meet your deductible? Does it still cost $45? And if it does, why does it say that the listed payments are the payments you pay after you meet your deductible, rather than just saying they’re the amount you pay? (And which payments actually “count” toward the deductible? As one web site puts it, “Your copay may count toward your deductible, but it doesn’t always. And you may owe copays for some services after you meet your deductible.” As another explains, “On some plans, certain services are covered with a copay before you’ve met the deductible, while other plans have copays only after you’ve met your deductible. And the pre-deductible versus post-deductible copay rules often vary based on the type of service you’re receiving.” Note that these definitions of “copay” both directly contradict the one on the HealthCare.gov site, which defines copays as dollar amounts paid after deductibles are met.)

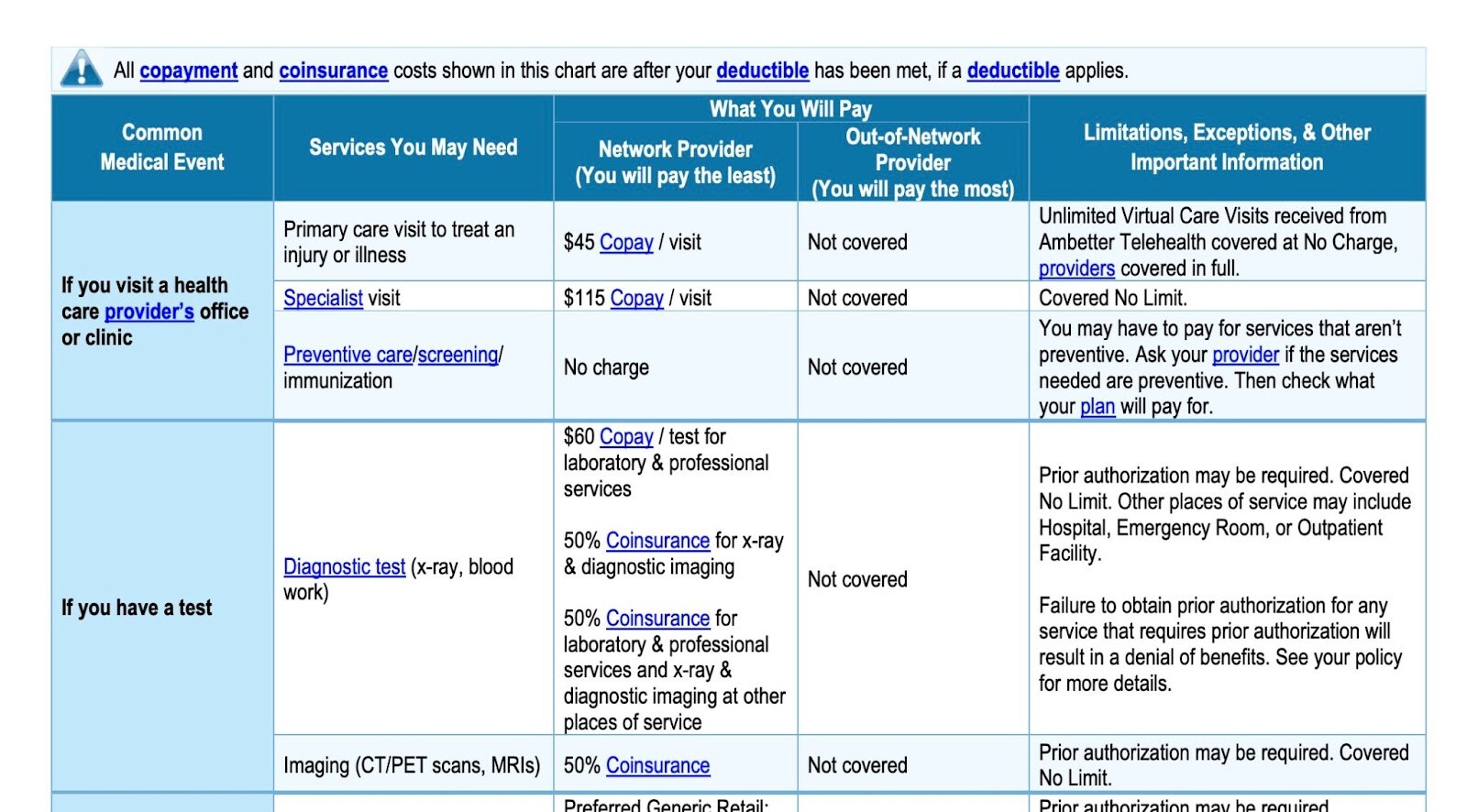

Fortunately, each plan comes with a giant PDF explaining all of your benefits in much more detail. And so when we click on it, we can see much more on the costs we pay:

This has a “What You Will Pay” section, which should in theory be helpful. But note the warning at the top: all the listed rates are the rates you pay after you’ve met your deductible. It’s very clear on that. (And note: the provider had better be in the network, otherwise all bets are off. Travel much? You’ll most certainly be out of network on a vacation, another worry you’ll have to plan for should anything untoward happen on your trip.) So, again, what are the rates before you meet your deductible? Why is it telling us that these are the after-deductible rates, unless they’re different? Elsewhere, the Healthcare.gov explanation of costs also says that primary care visits cost $45, without mentioning whether this is before or after the deductible is met:

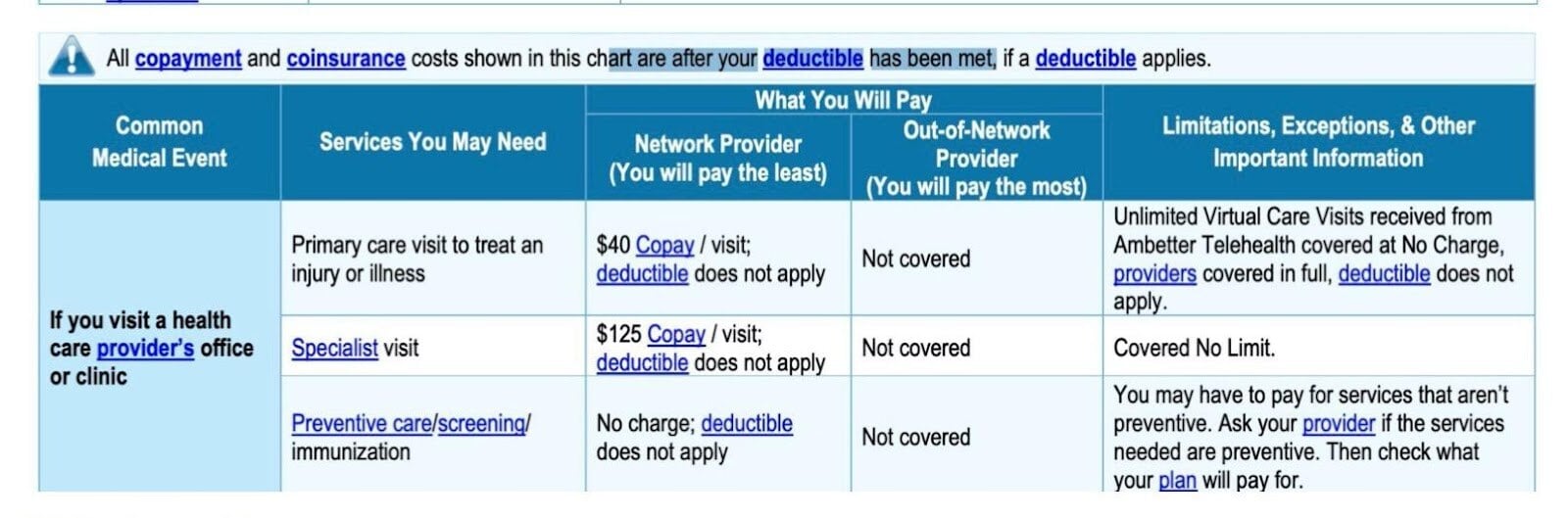

How about this chart, from a different plan, which says both that “all copayments in this chart are after deductible has been met” and “$40 copay, deductible does not apply”:

I think already we can conclude that HealthCare.gov has put out information that is indefensibly confusing. People are quite likely to assume that the rates they see listed on the plans are the costs that they will pay under those plans, i.e., if I buy this plan, it will cost me $100 to see a specialist. But that appears to be what you pay after paying both your premiums and the $8,000 deductible. What do you pay before that, though? It’s not easy to find out, and I’m certain that many users are totally unaware of how exactly the deductible affects the costs of visits.

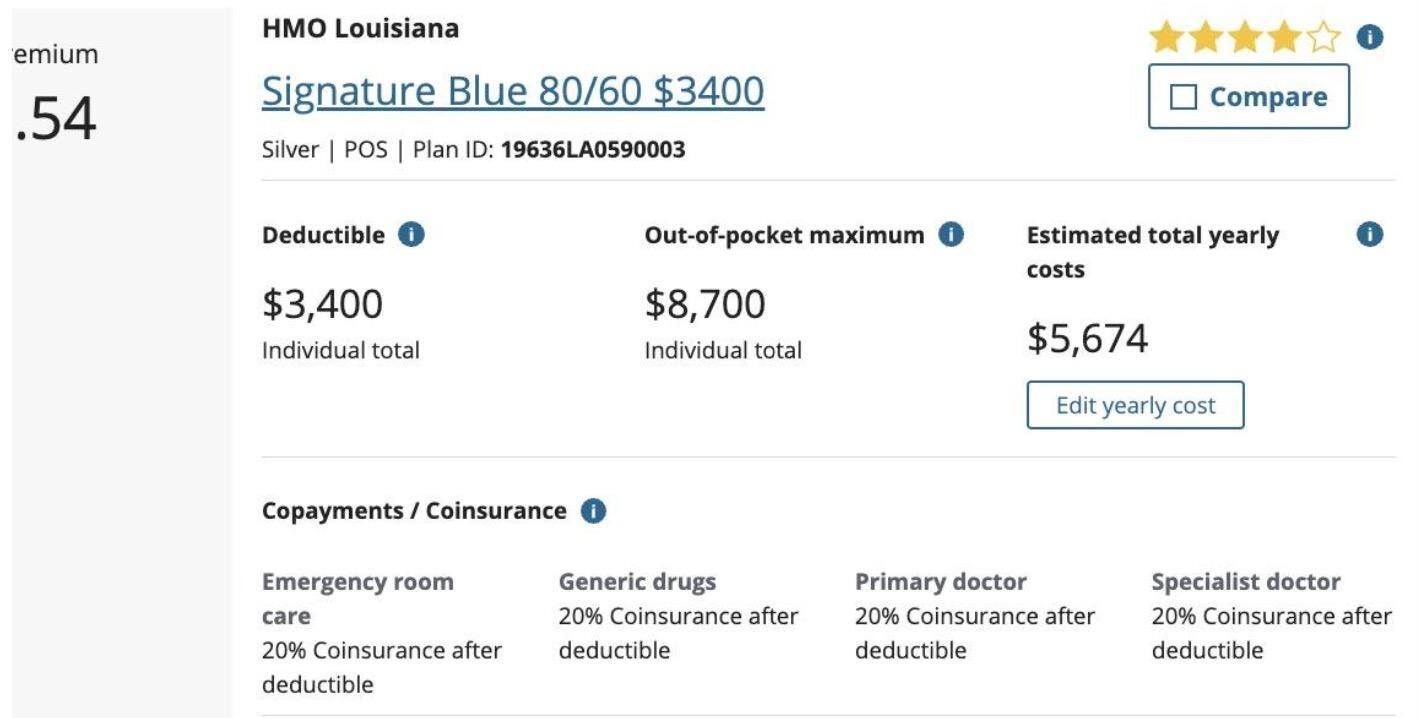

Consider two other plans:

Notice that in the copayments/coinsurance section on the first, we are told a percentage rather than a fixed cost. (Coinsurance is measured in percentages, as one can learn from the two huge glossaries provided by HealthCare.gov to help you translate everything.) And it’s clear that that percentage applies only after the deductible is paid, meaning presumably that up until then, the amount you pay is 100% of the cost. The second plan says there is no charge after the deductible for visiting your primary doctor. But we are still left with the question: what would I pay before reaching the deductible?

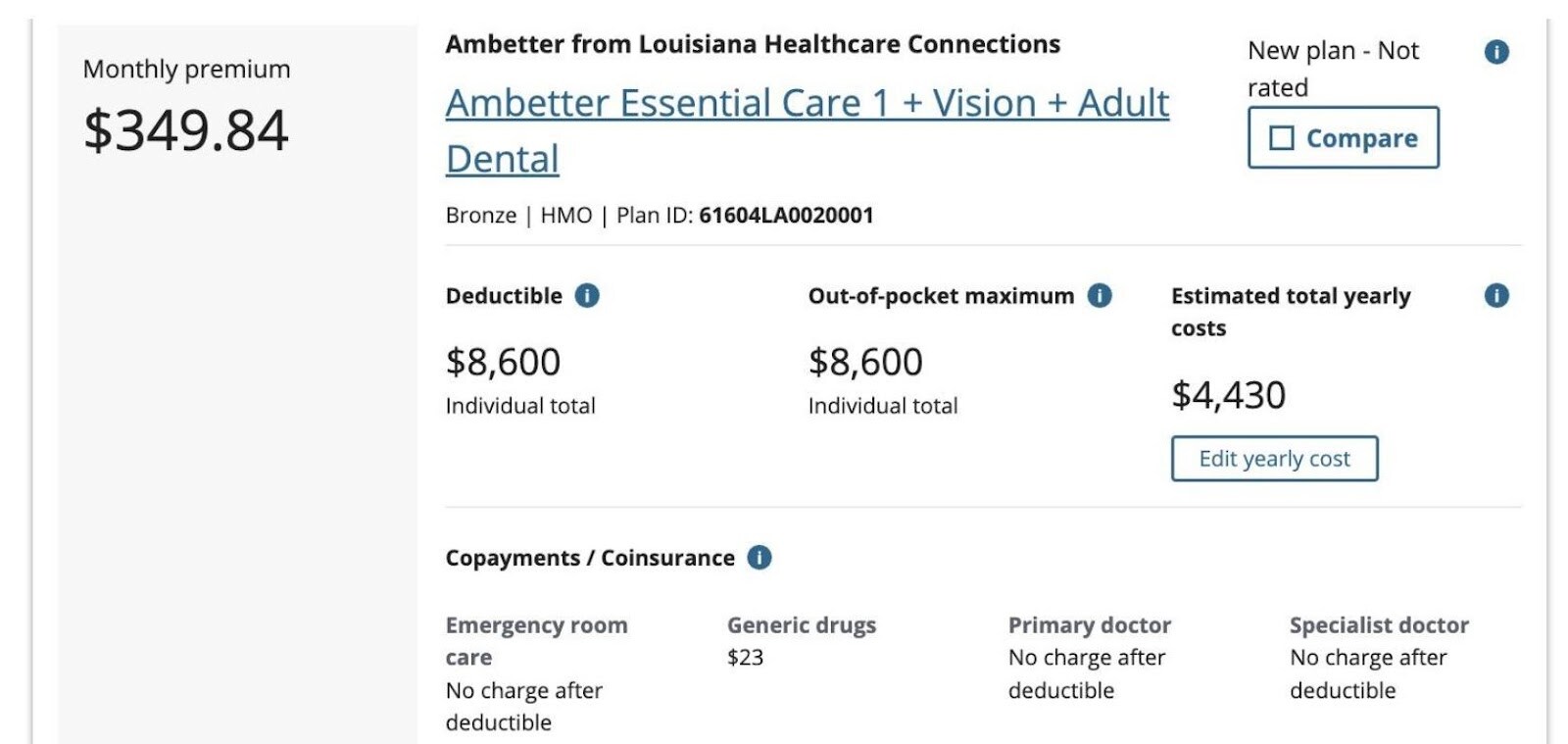

As you try to figure this out, you may turn to the examples that HealthCare.gov has provided showing what various kinds of possible medical care might look like under the different plans. Here is one:

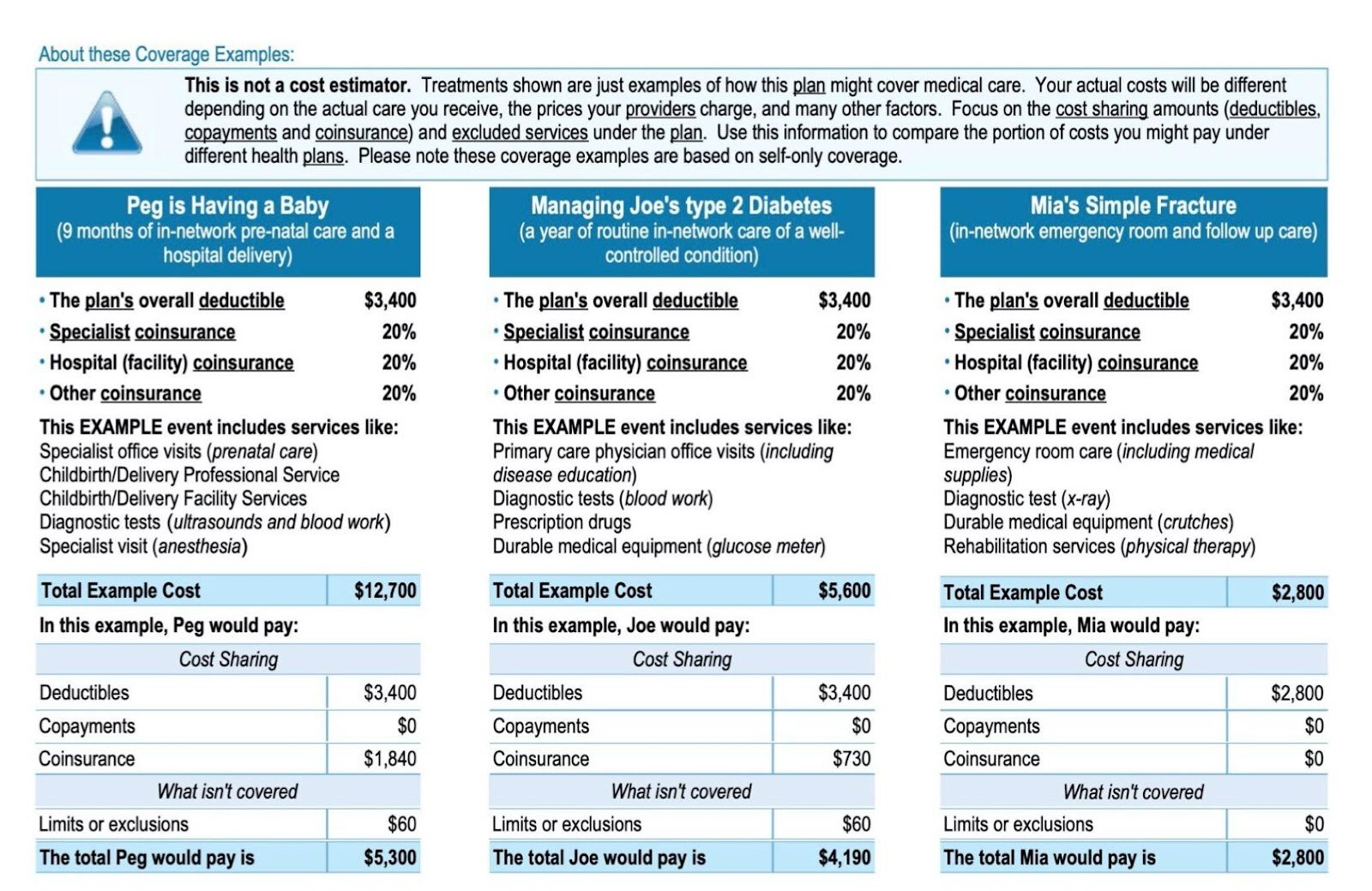

We can see here how the costs would work out for one particular plan in a hypothetical scenario. Here’s one from another plan that has a lower deductible:

On the second plan, note that even though the insurance plan has a deductible of $0, poor Joe in the middle actually has both a deductible of $0 and a deductible of $3,500, because if you click the asterisk you can discover that the deductible on your health insurance as a whole may be different from the deductible for certain types of care. Also both Peg and Mia have deductibles of $0 but also for some reason $10. Let’s not try to figure that one out.

You might, after scrutinizing this for a few minutes, sort of grasp where most of the numbers are coming from. But I want to draw your attention to the warning at the top: “This is not a cost estimator.” In other words, all of the numbers plugged in have been made up. They are not actually what you will pay. This is showing how, given certain costs, your insurance would calculate the percentages that you owed. But you have no way to know what the actual costs are going to be, because of course in this country the costs for the same thing can vary wildly from facility to facility. To actually have any approximate estimate of what you could expect to pay, you would need the actual costs of everything rather than numbers HealthCare.gov made up. So all of this is virtually meaningless in helping you estimate what you can actually expect to pay for healthcare.

The point here is that consumers trying to select a plan rationally lack enough information to make a rational decision. Knowing that the insurance company pays a certain percentage under certain conditions is only useful if you know what they’re paying a percentage of. If you don’t know what a hospital visit will cost, how can you know whether it’s better to have an insurance plan that charges you $200 or one that charges you 20%?

There’s a great deal that’s misleading on the HealthCare.gov marketplace that I think is the direct fault of the government. The “gold, silver, bronze” categorizations are deceptive, because a “gold” plan is actually not necessarily better than a bronze plan, because it could be a huge rip-off for someone. Different plans just distribute costs differently. It’s understandable that insurance companies want to sell people on the plans that have the highest premiums, but the companies shouldn’t be allowed to get away with branding these plans better, because they might actually be much worse for the individual consumer.

People navigating the marketplace are almost certainly going to be confused about how much they’re actually going to pay to visit the doctor, because it’s not at all obvious.1 And if you can’t figure out the expected costs, how can you choose a plan? Consumers are being asked to perform sophisticated calculations of the expected benefits of certain plans, which would be hard enough for the average person even if they did have sufficient information to make an informed comparison. But the task people have been set here is not actually possible.

There are some plans that are obviously worse than others. But for me, there are still about 30 plans that I do not know how to choose between, and I don’t think anyone could choose between them. The New York Times reported on an economist who tried to put the various plans into a spreadsheet to compare them, and then gave up, deeming the task too complicated. Nobel Laureate Paul Krugman similarly concluded his options were “incomprehensible.” The Times also noted that “study after study has shown that people routinely pick bad plans, even choosing options that leave them worse off financially in every possible scenario. And, because people are so bad at choosing good plans, the market often sends weird signals to insurance companies, encouraging them to offer more of the wrong plans instead of the right ones.”

One of the problems with the whole system is that healthcare, an essential good for all, has been commodified into “health insurance.” As a result, we get 42 varieties of health insurance that we don’t really need. The sole purpose of the 42 differing plans is to shuffle money slightly differently, which underscores how health insurance is treated more like a financial product than a legitimate way to get health care. Insurance companies are not designing different ways of delivering care tailored to personal need, they are designing different kinds of revenue streams to themselves, and are incentivized to trick consumers into the worst plans, so that we become maximally lucrative never-ending streams of money. (The very idea of for-profit health insurance is silly, because it introduces a needless parasitic middleman who creates no value into the provider-patient relationship.)

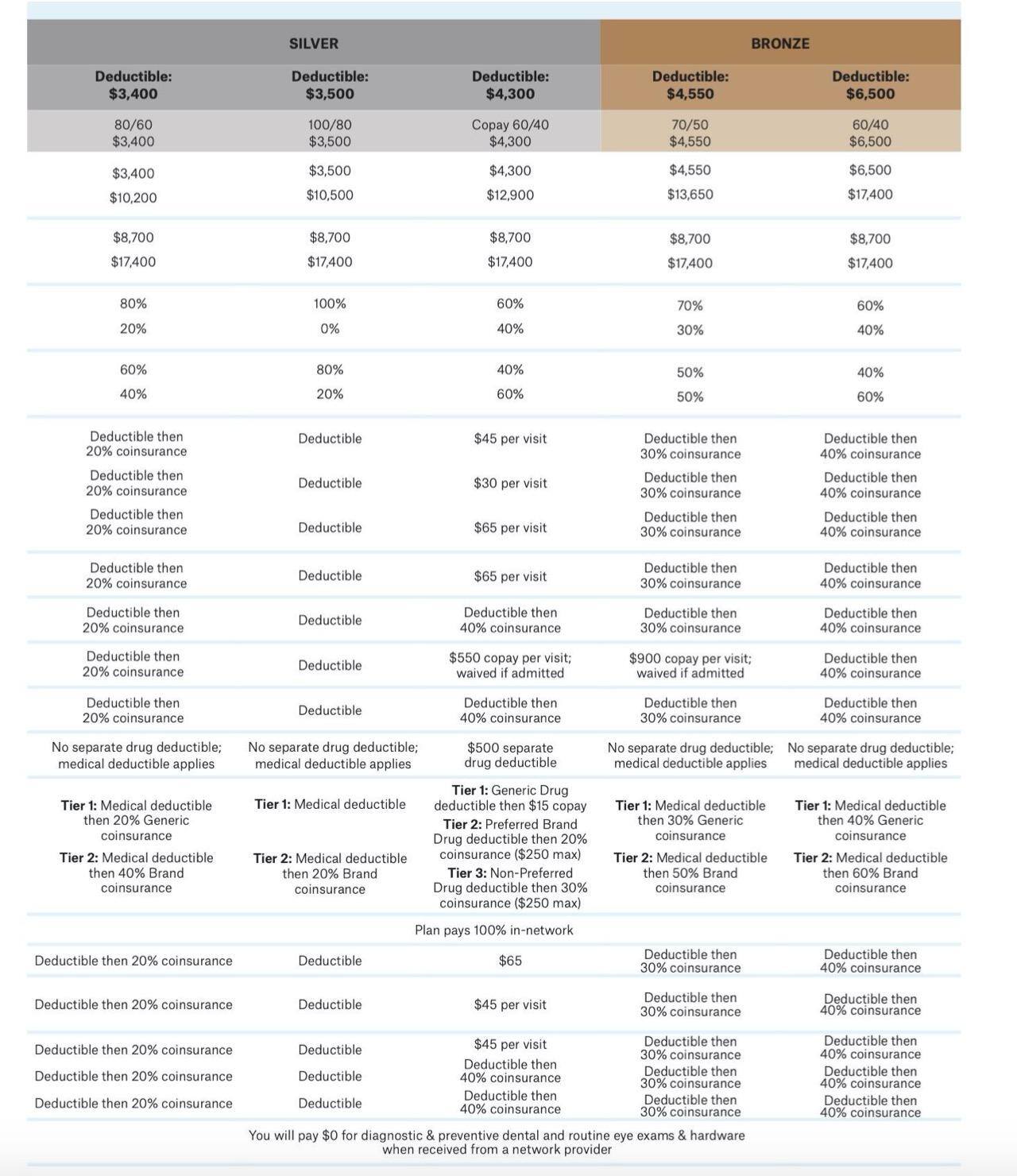

We’re used to shopping around when buying things, and this familiarity of trying to get a good deal is what the designers of the marketplace are clearly tapping into. If I’m buying a set of speakers, I might be deciding between a set that is stylish with good audio quality and a set that is less stylish with stellar audio quality, and I might decide whether I want something that looks great or sounds great. And I might compare prices, too: perhaps there is a set cheaper than both that has some of the qualities of each. In this kind of case, I might find it difficult to make a decision, and there’s not one right answer, but it’s clear what sorts of things I’m weighing against each other. In the case of health insurance, I’m being asked questions like: “Would you like to pay $500 monthly, then up to $5,000, and 20% of all costs over $5,000 or $400 monthly, then up to $6,000, and 10% of all costs over $6,000?” That’s a much simplified version of the kind of information we’re talking about, actually. Have a look at some of the permutations offered by BlueCross:

Now that’s just the BlueCross plans. Add dozens more from different companies and you’ll get the real experience of trying to choose health insurance in the marketplace. It’s a total clusterfuck. (Indeed, two Current Affairs editors between us have a PhD and an MD, and we couldn’t figure out how I was supposed to make a sound choice.)

There are plenty of Americans who love the ideas of “choice,” “competition,” and “free markets.” For them, the more options you have, the better off you are as a consumer. But I think we can clearly see that in the case of health insurance, the marketplace gives us the illusion of being better off with all this indecipherable information at our fingertips. We might be tempted to consider consumers picking among these options as performing an act of “rationally maximizing” their preferences. But that’s not what they’re going to be doing, because they can’t do that. They are just going to get confused and pick something that seems not bad and hope for the best. (This is all assuming they make it to HealthCare.gov in the first place and are not taken in by any of the many scam websites that purport to offer you ObamaCare. Unfortunately, the government does not provide much assistance in navigating the chaos. As the New York Times article pointed out, there’s always the option of paying a professional broker to help you, but they don’t make any better choices, either, it turns out—which suggests that the whole thing is a giant scam.)

Alexandria Ocasio-Cortez, when she became a member of Congress in 2018, wrote on Twitter about her experience in open enrollment: “Also, pretty sure one Dante’s Circles of Hell includes scrolling through a mirror-hall of agonizingly similar healthcare plans like ‘UHG Choice Master HMO 1800’ vs ‘RedGo Option Plus EPO 2000.’ I don’t know one normal person in this country that actually enjoys open enrollment.” The following year, she tweeted about it again, noting that choosing among 66 approved healthcare plans was “absurd” and “no one should go through this.” In response, many right-wing Twitter users mocked her, suggesting it was ridiculous and privileged to complain about an abundance of choice. A sample:

- “You’re actually mad that you have 66 different healthcare options that U.S taxpayers funded? I knew you were dumb, but this is a whole new level.”

- “Shorter AOC: I’m either too stupid or too lazy to sort through the various options for me. I’d rather let bureaucrats do it for me.”

- “It’s called choice and it’s emblematic of a free market economy.”

- “Yeah. Having lots of choices sucks. ROFLMAO!”

- “boo hoo I have too many options”

- “You have got to be kidding me AOC in this country we have the freedom to choose what we want and need”

- “Communist wants only one insurance plan, society has to be uniformed, that’s the way this girl thinks. We can’t allow people like this reach the power, if this happens, we’re gonna have all the bad thing communist brings with it: deaths,famine,diseases,inflation,less jobs…”

But these people do not know what they are talking about. Giving someone sixty choices does not mean maximizing their freedom if all of their choices are confusing, many are bad, and there is no way for them to distinguish the good ones from the bad ones. (What do you do if the one that seems financially optimal has a bad “star rating”?) It is far better to have three choices that have been vetted by someone who knows what they’re doing than to have a million choices that could be full of scams and deception. When someone wants to put out a fire, they do not have to choose among forty different fire departments each of whom offer different financing plans. They just call the damn fire department. It is absurd that we make consumers make these meaningless choices, when everyone is really trying to choose the same thing: good care at low cost, something the government could simply provide but chooses not to.

My experience with the ObamaCare exchange has confirmed for me that a “market” for health insurance is senseless and inefficient and just plain cruel. We are putting people through needless torment and wasting their precious time. People are being gaslit into thinking that they’re just too stupid to work out the answer to the puzzle of which insurance is best, when in fact they couldn’t choose correctly no matter how smart they were. The government is failing to choose the best plans or give people real indications as to what they are going to pay. The web site is so maddening as an example of “bad government” that it’s not hard to see why average people could get behind overturning ObamaCare or eliminating the government’s role in health care, as the right wants to do by essentially eliminating government. Of course, the solution to a bad government health insurance website is not to get rid of the government but to abolish the terrible ACA marketplace and to provide a real solution to people’s health care needs. As AOC put it:

“People don’t want overly complicated choice between pricey, low-quality plans. We want an affordable solution that covers our needs, like the rest of the modern world. Medicare for All:

– Single-payer system

– Covers physical, mental, & dental care

– 0 due *at point of service*

Every moment I have spent on the ACA marketplace site, a voice in the back of my head has just kept wailing on repeat: “Why, oh why, can’t we just have Medicare For All?” It is possible to have a system with zero copays, zero coinsurance, zero deductible, zero all of it. Do you know what happens in Britain when you want to go to the doctor? You look up a doctor, book an appointment, and go to the doctor. We could have that. All of this is unnecessary.

The Wall Street Journal reports that as of this week, insurers have “begun publicly posting the prices they pay for healthcare services,” but the “long-secret” information is “in the form of massive, machine-readable digital files, typically in formats not easily accessible to consumers.” Insurers promise this will “eventually allow consumers to make more comprehensive decisions.” ↩