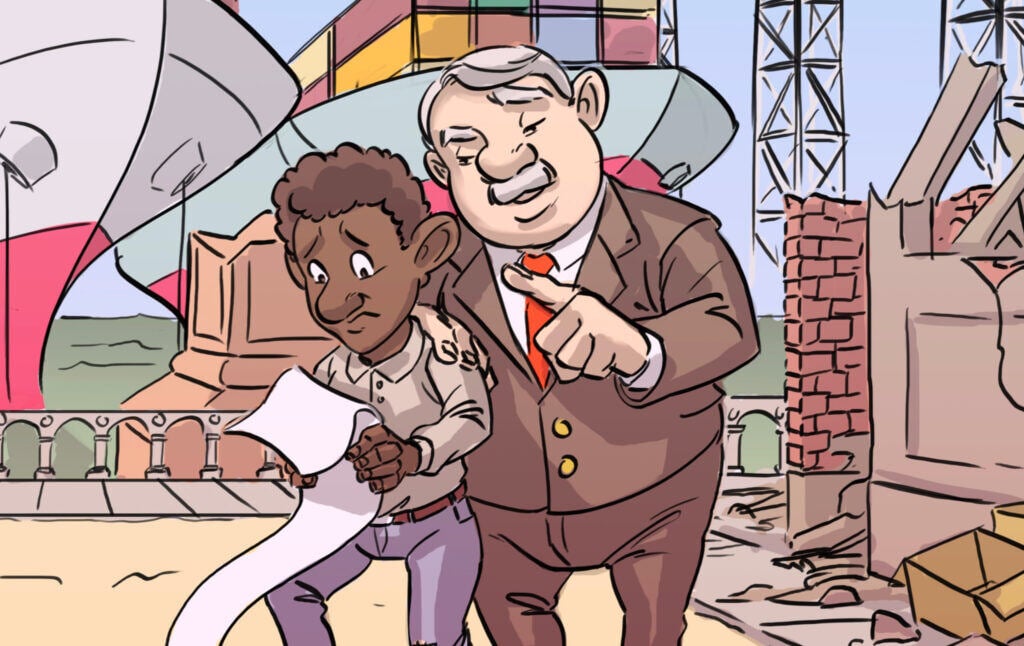

The IMF’s Bottomless Bottom-Line Cruelty

How the IMF & the World Bank—in the name of progress—succeed in keeping poor countries poor.

Everyone knows there are many extremely poor countries in the world, but people rarely talk about why. These nations are sometimes collectively called the Third World (being neither the Western First World or the Soviet-aligned Second World); the more recent euphemism is usually the “developing world.” Whatever the name, these states are imagined by most Westerners to be scary, struggling places, and they tend to take the blame for global woes like terrorism and unsanctioned migration. Some of our greatest billionaires polish their public personas by donating to charities that supposedly aid the people trapped in grinding poverty across parts of Africa, southern Asia, and Latin America.

These countries have been The Poor Countries for quite some time now. At the end of World War II, the great states of the developing world—like Brazil, Indonesia, India, and the Congo—were dramatically poorer than the developed world. Today, 75 years later, and after decades of “investment” and “development,” they’re still very poor. In fact, huge numbers of people in these large, resource-rich countries are much poorer than their ancestors. What the hell is going on here? Colonialism ended years ago—didn’t it? Or did it just change shape?

Bad Pennies

For centuries, most of what is now called the developing world was part of the colonial systems of the European powers—Britain controlled India and Egypt, the French owned West Africa and Vietnam, the Netherlands possessed Indonesia, the Portuguese ran Brazil, the Belgians brutalized the Congo, the Portuguese ran Brazil, and so on. These imperial “possessions” of nations and peoples were sometimes held directly by the crown, sometimes run by European militaries, and sometimes owned by monopolistic trading corporations like the East India Company, but all were used in a common pattern.

Colonies were sources of vital materials, from precious Eastern spices to rescue bland European cooking, to desperately needed petroleum for the West’s industrial revolution. The colonies were also often barred from importing products from other European powers, making them important “captive markets” of their mother country. And in addition to these economic incentives, the colonies’ territories were treated like chess pieces in the endless rivalries of the great powers. Even countries that were never fully incorporated into a particular European colonial empire, like China, were subjected to years of partition into spheres of influence and forced to import European-manufactured products, keeping domestic industry from developing. The West fought large wars to prevent China from barring the import of opium, causing tremendous damage to Chinese society in one of the Western world’s all-time ugliest episodes (which, given Western history, is saying something).

After the imperial powers were beaten, exhausted, and/or occupied during World War II, the developing world strove for independence—and the Europeans fought like mad to avoid giving it to them. From French Algeria to British India, the colonial powers used ungodly violence and torture on a huge scale against dissidents, keeping cruel pro-Western dictators in office as long as possible. As the developing countries of the Global South gradually won independence through long, bloody struggles, their traumatized societies came under what leftists often call “neocolonialism”—a system in which rich capitalist states install and support local dictators and strongmen, allowing Western companies to continue owning many of the same old crucial resources and selling products to profitable, effectively captive markets. This pattern widened after the Cold War, when the “fall of the Soviet bloc… [created] a new imperial age,” as the conservative Financial Times of London related, with “a system of indirect rule that has involved the integration of leaders of developing countries into the network of the new ruling class.”

From Regular Slavery to Debt Slavery

One of the most valuable tools used to keep developing countries from developing some real independence has been debt. The battle-scarred governments arising from the wars of independence—some authoritarian and some managing to remain partially republican—often wanted compensation from the former imperial powers, which they’re mostly still hoping for. This was in recognition of the scale of imperial crimes against the developing world, from the enormous violence unleashed against them to the massive wealth that was stripped to build up Western economies, plus the fact that choice resources like oil deposits and rich farmland often remained in the hands of citizens of the colonial powers. Europe and the United States refused, though they frequently indicated they were prepared to lend developing countries the money instead.

Despite requests for capital grants as reparations rather than lines of credit, many developing countries ended up borrowing money, ostensibly for development—investing in education, health, and domestic infrastructure to begin the journey to something more like the developed world’s standard of living. Often funds were needed to pay the developed powers “compensation” for nationalizing their assets, like the Suez Canal. Frequently these loans were organized by the World Bank, created by the Western powers after World War II to help provide development credit to the Third World. These loans for roads, bridges, schools and hospitals were supposed to be paid for by the countries’ great future economic growth, although notably the World Bank and Western investors favored projects that built on poor countries’ existing comparative trade advantages. This meant exporting basic commodities like bulk crops, or raw materials like oil and copper—largely leaving the higher valued-added processing and manufacturing to the developed world.

But the numerous right-wing authoritarians installed by the U.S. in the Cold War environment were extremely corrupt, including the Shah of Iran, the fascist Brazilian military government, and the string of U.S.-backed dictators in Pakistan. So the countries borrowed giant amounts from international banks located in Western countries in the name of their penniless citizens, but much of the money went straight up their noses. Meanwhile, the debts stayed on the books despite being clearly “odious”—debt that should be canceled due to illegitimacy, in economics lingo. Since the populations of the former colonies didn’t borrow the money and often didn’t even benefit from it in the form of improved public services or broader economic development, why should the people have to pay these loans to fabulously wealthy banks and investors? It’s not a small question: according to the World Bank, by 2010 the “external debt” owed by poor Third World states had reached an outrageous, towering $4 trillion.

John Perkins, a former participant in the debt traps sprung on poor countries, wrote in his 2004 Confessions of an Economic Hit Man that the debt in these poor, neocolonialism-ridden states had reached monumental proportions. As he explains:

“[T]he cost of servicing [this debt]—over $375 billion per year as of 2004—is more than all third world spending on health and education, and twenty times what developing countries receive annually in foreign aid … Ecuador is typical … For every $100 of crude taken out of the Ecuadorian rainforests, the oil companies receive $75. Of the remaining $25, three-quarters must go to paying off the foreign debt. Most of the remainder covers military and other government expenses—which leaves about $2.50 for health, education, and programs aimed at helping the poor.”

It’s not just Ecuador. Many poor states, like Malawi and Paraguay, spend much more on their overseas debt servicing than they can on schools and health.

And it’s even more offensive when you consider where these giant sums from poor countries—and their poor citizens—end up going. More often than not, it’s straight into the pockets of the global rich. The developing world’s debt is held widely, including by pension funds and governments in the developed world. But as with most financial assets, public debt from the developing world is mostly held by private, rapacious financial institutions and wealthy investors in the developed world. The atrocity of this really needs to be considered—you have the most grindingly poor people on this entire godforsaken planet, forced to remit enormous sums of cash to the richest people and institutions in the world. It’s taking from Malala to give to Donald Trump, Jr.

Mind the SAP

Why did the giant loans from the World Bank and private foreign investors so absolutely fail to jump-start economic growth in the developing world? It’s partly because of the inherently limited, primary commodity export-based development model, and also because much of the money has gone into corrupt dictators’ Swiss bank accounts. Additionally, according to Perkins, the system was a grift from the beginning; the enormous infrastructure products launched with the credit were mostly built by U.S. and European engineering contractors, thus meaning the benefits to local economies were likely overstated. And when the promised growth failed to materialize and countries were left unable to readily pay their debts, creditors called the IMF—the International Monetary Fund.

Originally created to help regulate capital flows, the IMF was constituted alongside the World Bank in the famous (okay, famous if you’re an economist) Bretton Woods global financial policy summit in 1944. But by the 1980s, the IMF had evolved into the credit community’s enforcer. Developing countries that fell behind on their debt payments would find that no lenders would extend them further credit—except for the IMF. So they were forced to borrow from the IMF to pay their previous lenders, with the IMF acting as a sort of hard money lender for nations.

Somewhat like a Victorian charity project, the IMF is itself funded by “subscriptions.” Member countries pay based on their share of the world economy, and voting power is based on their monetary contributions. Western countries and allies have dominated the world economy, paying the most in subscriptions, and thus have always held a large majority of the voting rights. According to the Fund, the U.S. has 16.7 percent of the vote total while the tiny island nation of Tuvalu has 0.03 percent.

For decades, the IMF was steered by the usual developed world suspects, above all the U.S. and Western Europe. But after many years of wrangling, the U.S. finally dropped its hold-out resistance and the IMF board was rebalanced in 2015, allowing large developing countries China, Russia, Brazil, and India to join Western countries in the top 10 most powerful countries in the IMF system—yet without much change in its cruel demands. Regardless of who’s seated at the table, the Fund has become infamous worldwide for the policy changes it requires before extending new loans, changes known as SAPs (structural adjustment programs). Allegedly these are meant to help countries stabilize their finances, giving lenders confidence that the countries can manage their debt and resume economic growth. However, the policies demand aggressive “austerity” programs, in which social safety nets are shredded to ribbons in order to satisfy wealthy foreign lenders.

For example, SAPs typically include fiscal austerity—fixing the government’s budget deficit by cutting social spending. The main targets usually include health and education spending, like when Greece was bailed out in 2010 by the IMF, and in return was forced to chop its health spending to below 6 percent of GDP (compared to other developed countries, where 10 percent or more is common). Another common target is public commodity subsidies—a.k.a. spending by the state to lower prices for basic food and fuel, like rice or heating oil. For the globe’s poorest people, these subsidies are often life-and-death issues, saving families from having to choose between eating and keeping the heat on, and so they’re often the most popular government policies. But, since huge numbers of desperate people rely on these programs, they are a fiscal drag on the poorest states, and they make an obvious target for IMF policy writers. SAPs additionally require new, highly-regressive taxes, usually on the poor or small middle classes.

SAPs also require monetary austerity—hiking interest rates to strengthen the local currency so that foreign investors don’t dump their holdings. Another frequent demand of the IMF is privatization, where public agencies and assets are sold to private investors. One of the most famous examples occured in Argentina in the 1990s, which was forced to sell most of its major infrastructure, like ports, telecommunications networks, and airlines. This helps the government budget but means citizens must pay for formerly free services, and comes with large layoffs as the newly-private agencies try to make money, damn the cost.

The IMF further insists on capital and trade liberalization. This often involves removing limits on the ability of foreign investors to buy domestic assets like land, which allows them to hollow out their home country’s manufacturing base and build giant industrial plants in the developing world for export. All these wide-ranging requirements have two things in common:

- They are “deflationary,” meaning they slow economic growth. The deflation occurs due to layoffs of public workers, reductions in subsidies that effectively cut mass buying power, and higher interest rates restraining economic activity. This is of course completely counterproductive, since the whole point of this model (in theory, anyway) is supposed to keep the developing world on the path of healthy capitalist economic growth.

- Liberalization ensures the debt-holding commercial banks in London and New York are paid off. And indeed these investors are free to buy formerly public infrastructure, often after a debt crisis at fire sale prices, even as it also swamps the impoverished countries in a flood of low-cost foreign imports.

The great Marxist writer Vijay Prashad uses the example of the small south African state of Malawi, which after a disastrous privatization of its agricultural development agency saw prices of basic grains shoot up 400 percent. Along with alternating floods and droughts, this brought full-on starvation. The IMF did not consider this adequate cause to amend the SAP, and today Malawi spends more annually on its debt service than on health, education, and agriculture put together. Hunger and famine are cruel tragedies in any conditions, but they’re especially ugly when they’re a result of policy decisions. That’s the special legacy of SAPs and other Western decisions like Winston Churchill’s policy of exporting rice from India during World War II, leading to a disastrous famine without a drought.

Public health expert David Stuckler and professor of medicine Sanjay Basu documented the social ramifications of this austerity, focusing on public health programs, in their phenomenally interesting book The Body Economic: Why Austerity Kills. Among their careful data analysis is a comparison of health outcomes in Iceland and Greece. When Iceland’s banks went bankrupt in the world financial crisis of 2008, the IMF stuck to the neoliberal script and was willing to extend emergency loans only on terms of extreme austerity. Iceland was supposed to pay its creditors an amount equal to half the country’s gross income, meaning their public spending had to be cut by a dramatic 15 percent of GDP. Almost unbelievably, the IMF designated healthcare a “luxury good” that would have to be cut, but Iceland’s government put it to a vote. In a 2010 referendum, the people of Iceland voted 93 percent against the IMF austerity program. (In the politics biz, we like to call that “a mandate.”)

Instead of bowing to the IMF, Iceland tried the opposite of economists’ demands. As Stuckler and Basu wrote, “By first rejecting the IMF’s plan for radical austerity, [Iceland] protected a modern-day equivalent of the New Deal … In 2007, Iceland’s government spending as a fraction of GDP was 42.3 percent. This increased to 57.7 percent in 2008,” which was financed by deficit spending that the IMF partially accepted as part of a much milder program than usual. Chastened by defeat, the Fund diplomatically stated that the rescue “safeguarded … the key elements of the Icelandic welfare state. This was achieved by designing the fiscal consolidation in a way that sought to protect vulnerable groups by having expenditure cuts that did not compromise welfare benefits and raising revenue by placing greater tax burden on higher income groups.” This was a pretty incredible reversal by the Fund, and Iceland has since convincingly moved on from the crisis.

Stuckler and Basu then contrast Iceland’s success with the tragedy of Greece at the same time, where an even more drastic IMF bailout was offered. But unlike in Iceland, the supposed birthplace of democracy canceled a planned public referendum on austerity. The cuts were heinous: the IMF demanded that public health spending drop to 6 percent of GDP to free up budget money to repay foreign banks and lenders, while governments supporting the IMF (like Germany) typically get to spend around 10 percent of GDP on health. In a horrifying plunge, Greece’s public health indicators went from those of a lower-rung developed country to levels more common in the developing world, with OECD data showing a 40 percent spike in infant mortality and an almost 50 percent jump in unmet healthcare needs. Indeed, Stuckler and Basu noted “[the] Health Ministry continued to avoid collecting and publicly disclosing many standard health statistics.” And, crucially, with Greece forced into austerity after passing on democracy, it did not start getting out of debt. In fact, as its economy slowed and tilted into recession under austerity, its debt-to-GDP ratio rose, supporting claims that the real purpose of the SAPs is actually just to keep poor countries in debt, claims made even by former insiders like Perkins.

Of course, the normally obscure subject of “public health in the developing world” recently broke into the headlines due to the coronavirus pandemic. Tucker Carlson viewers eager to blame China should realize the IMF, largely staffed by veterans of the U.S. Treasury Department, has been the major force fighting against health funding in the world’s poorest countries.

As the Wall Street Journal reports:

“[M]any join the epidemic already overwhelmed … The vulnerability most of these countries share is giant urban slums where hundreds of millions live with poor sanitation and no plumbing. Basic practices to prevent the virus’s spread, such as regular hand-washing, can be impossible given the scarcity of clean water… Nearby, people queued to use fetid public toilets and communal taps … In many poorer countries, the starvation threat could outweigh the coronavirus specter, conspiring against social distancing and other mitigating measures wealthier nations can afford to take.”

The New York Times adds that the panicky bidding for medical supplies has seen “Rich Countries Push Poor Aside,” as the U.S. and European Union nations lock up months worth of supplies for treatment and testing, leaving the strapped health budgets of the Third World “at the back of the queue.” The Times observes the developing world’s record of “health systems that are underfunded, fragile and often lacking in necessary equipment,” without putting any blame on the IMF for insisting upon this condition. The toiling residents of the jammed megaslums of the Global South have been subjected to crushing pressure by COVID-19 lockdowns, including from the collapse of remittances: a.k.a. money sent by immigrants working in the developed world, which is often a crucial lifeline for poor families. Private creditors to sovereign lenders in the developed world have publicly stated they will not grant even a moratorium on payments to the Third World during the crisis. This summer has seen the developed nations largely reopening, but the poor countries have had extremely limited vaccine access, due to the rich countries hoarding them, big manufacturers like India needing all they can make for themselves, and a basic lack of buying power.

So the IMF and their brutal SAPs, along with other Third World calamities, have kept the developing world in a perpetual state of “development” for many decades now, turning them into debt-servicing machines at the expense of public health and happiness. Don’t take my word for it—the late archconservative economist (and my personal archnemesis) Milton Friedman himself said, “IMF bailouts are hurting the countries they are lending to, and benefitting the foreigners who lent to them. The United States does give foreign aid. But this is a different kind of foreign aid. It only goes through countries like Thailand to Bankers Trust.”

And so as decades pass, large countries containing enormous wealth and resources of all kinds— like Brazil, Indonesia, and the Congo—somehow remain grindingly poor. This is neocolonialism—the component of neoliberalism that maintains the people of the Third World in debt traps—which looks not all that different from classic colonialism when those same countries were formal subjects of European empires. After so many decades of failed promises, even the IMF has been forced to recognize the real effects of its SAPs. In a truly incredible IMF paper titled “Neoliberalism: Oversold?” staff economists report: “Instead of delivering growth, some neoliberal policies have increased inequality, in turn jeopardizing durable expansion … Austerity policies … hurt demand—and thus worsen employment and unemployment. … episodes of fiscal consolidation have been followed, on average, by drops rather than by expansions in output.” Yet new IMF lending programs for states like Argentina and Pakistan are still based on austerity-heavy terms, just as with previous bailouts. It’s no longer possible to ignore that these “bailouts” are intended not for the countries themselves but for their creditors, past and future.

Meanwhile, the effect of neocolonial SAPs on the natural environment in developing countries, which often include tropical areas with extraordinary species biodiversity, is pretty heinous. Indonesia is an instructive case. In return for continued access to credit, the IMF required Indonesia to loosen investment rules, allowing foreign companies to buy giant amounts of land. At the same time, it forced Indonesia to defang trade rules like its ban on exporting palm oil. Foreign agricultural companies began aggressive land clearing for palm plantations to grow lucrative palm oil, used for many products like processed food. The Financial Times reported that “the appetite of foreign investors” dramatically escalated Indonesia’s long tradition of clearing forests, so “the arrival of logging and plantation firms have made the situation much worse in recent years.” The resulting constant burning of Borneo’s rainforests, gigantic acrid smoke clouds, and the horrible loss of habitat for critically-endangered species like the orangutan, are as much part of the IMF’s legacy as sick children in slums and downtrodden peasants in the countryside.

But the global poor majority isn’t taking all this lying down. In surprising numbers, they are rising up.

The Force Majeure of the Streets

It is a darkly hilarious fact that there’s an entire category of urban and rural uprisings known as “IMF riots,” which reliably erupt after some proud, poor country is racked with SAP austerity. Vijay Prashad wrote in Znet that

“[it] is reasonable to call the Arab Spring of 2011 an IMF riot because it was provoked by IMF austerity policies combined with rising food prices. The current unrest from Pakistan to Ecuador should be filed under IMF riot. In response to these riots, the IMF has used new language to describe the same old policies. We hear of ‘social compacts’ and of Structural Adjustment 2.0 and then the bizarre ‘expansionary austerity.’”

Often IMF SAPs require explicit repudiation of political programs that have won mass support. After the Asian financial crisis of 1997-8, the IMF had major leverage over Pacific states like South Korea and Taiwan. It forced its SAPs on them, with the Financial Times reporting on “the strikes, riots and mass job cuts that … orthodox reforms provoked.” When the Indonesian government was mandated by the IMF to cut back fuel subsidies in 1998, the measure led to nationwide riots that were repressed by what the neoliberal Economist magazine called “[the] familiar armory of riot police.”

Pakistan is another example, where new prime minister Imran Khan ran for office on a program of jobs and welfare—more health and education spending, and more employment to raise the quality of life for this fast-growing population. But finding the state close to defaulting on its debt, his government has been largely forced to “shred his political program,” as the Wall Street Journal reported, and instead “raise tax rates, curb government spending and increase gas and electricity prices in return for IMF support.” Openly calling his country’s condition a “debt trap,” Khan hopes the country can return to growth after the SAP, but the bailout isn’t even a sure thing since “the U.S. government, which holds sway over the IMF,” is concerned that Pakistan will use the bailout funds to repay large loans to China instead, making the Pakistani people pawns in a geopolitical struggle between the U.S. and China. Even as the new program continues to weaken the economy and “stifle demand,” this is Pakistan’s 22nd IMF program, as successive U.S.-backed military dictators come and go, from General Zia-ul-Haq to General Pervez Musharraf.

The “tumultuous Middle East” can credit much of its turmoil to the IMF as well. Tunisia, the symbol of the Arab Spring, is struggling with painful spending cuts that jeopardize the revolution’s gains in order to meet IMF demands. In Iraq, after decades of crippling sanctions, several destructive American wars, the long violent U.S. occupation and then the war with ISIS, huge demonstrations have broken out. Protestors have braved rubber bullets, tear gas, and even mysterious snipers on tall buildings to demand a share of the nation’s potentially stupendous oil wealth. The Western business press notes that “[under] IMF guidance, Iraq made tentative steps to prune the payroll, introduce taxation and suspend government hiring,” while lamenting that these wonderful steps toward Progress stopped once oil prices recovered for a time and took pressure off Iraq’s budget.

In nearby Lebanon, huge protests broke out after the imposition of a tax on WhatsApp calls, following a scandal in which the prime minister was discovered to have given $16 million to a swimsuit model he met at a luxury resort, “a move that, for some critics, epitomized Lebanon’s ruling class,” as the New YorkTimesput it. “Austerity measures have hollowed out the middle class, while the richest 0.1 percent of the population—which includes many politicians—earns a tenth of the country’s national income.” And “[even] in Saudi Arabia, where the threat of government repression makes public protests practically unthinkable, an unusual rebellion erupted on social media over a 100 percent tax on bills at restaurants with water pipes, or hookahs.”

Latin America has also seen mass action against the Fund, as when they forced a major austerity program on Brazil after the sovereign debt crisis of 1997-8. (There certainly are a lot of debt crises for a supposedly functional and beneficial system! Makes you think.) The Journal reported that the IMF required “severe steps” for an emergency loan program to keep the country paying its alleged debts to the world’s wealthy, and the president publicly told the country to prepare for tough times, with higher regressive taxes and cuts to the public pension program. Unsurprisingly, the ensuing protests were extensive and volatile.

But Argentina has been the bigger headache for the IMF. The South American nation is big enough to get away with defaulting on its debt-extraction-model loan plans, most famously in a giant 2001 default—i.e., its failure or refusal to pay the country’s debt. (Debts, arguably, only really exist if you’re poor.) More recently, in 2019, conservative pro-business president Mauricio Macri found himself struggling with the country’s high foreign currency debt and an extensive drought, so he took a $57 billion loan from the IMF. Under the terms the state “dismantled the consumer subsidies that had curbed the cost of everything from electricity to public transportation, but had become impossible for the state to afford,” the Times reported.

As popular resentment broke into public protest and Macri’s popularity in the polls plummeted, the IMF actually withheld a planned $5 billion installment, and Macri ended up losing his next election to the more independent and free-spending Peronists, whose populist history includes a tradition of providing public supports like food and fuel subsidies. The new administration hopes to spread out foreign debt payments and avoid yet another default, but creditors are still annoyed, and they still hold a great deal of power.

The Peronist government is torn between its promises of greater welfare spending on housing and infrastructure and its need to placate the Fund. For now it’s imposing new taxes and looking to cut public sector salaries to begin meeting the IMF’s growth-killing but debt-paying demands. Because of this history, the Journalreports that “Hating on the IMF” has become “Argentina’s National Pastime,” since despite right-wing claims that “the Third World is socialist,” this large country has been under IMF supervision for 30 of the past 60 years. Argentinians probably remember the record of benefit cuts, the privatizations of important state bodies, and how “[the] fund also provided financial assistance to the ruthless military junta that seized power in 1976” which tortured leftists to death.

Chile has also become a prominent site of anti-austerity rioting, being arguably the birthplace of neoliberalism in action following the 1973 U.S.-backed coup that overthrew elected socialist president Salvador Allende and installed the brutal right-wing dictator General Augusto Pinochet. In 2019, civil unrest broke out in a number of Chilean cities after president Sebastián Piñera imposed a hike on subway fares, the last in a long line of IMF-promoted austerity policies. Huge demonstrations, including the traditional banging of pots and pans, demanded a reversal in the decreasing provision of public goods like transportation, education, public health, and pensions.

Buses were burned and subways trashed, and Chile’s fascist-trained military responded in its tradition of vicious brutality. The Times, no enemy of austerity, observed that as riot police purposefully targeted protestors’ eyes, “[the] image of a bandaged eye is now so common it has become a rallying symbol for the protesters in Chile.” Even as the fare hike was rolled back, demonstrations continued to demand a replacement to the Pinochet-era constitution, and a University of Chile study concluded that the “rubber pellets” used to target demonstrators were mostly composed of denser materials, including lead, which cause terminal damage to eyes and optic nerves, permanently blinding young people for demanding public services. Doctors observed that the rates of eye injuries in the Chilean demonstrations were far higher than other areas seeing unrest at that time, like Kashmir or the French general strike. One demonstrator shot in the eye, a hospital assistant, said police held him for hours afterward: “They were taunting me, saying that I will lose my sight, that I’ll have one less eye.” He lost 95 percent of his vision. Yet even despite this vicious response by the state, protests continued.

Perhaps the most impressive case of sheer ungovernable public outrage against austerity took place in Ecuador, where 11 days of giant protests erupted in 2019 after fuel subsidies for the poor majority were once again slashed, a policy the Times noted was “particularly hard on the rural poor” but “was a keystone of the broad austerity plan required by the IMF in order to extend Ecuador a credit line.” Notably the cost of the “popular subsidies” was about $1.3 billion a year, or about half of the military budget. The public reaction was so volcanic that President Moreno was forced to move the government 150 miles from the capital Quito to the coastal city Guayaquil. At that time the administration indignantly said it would never back down from the subsidy cuts. When it finally did, jubilant Indigenous and student demonstrators cleared the streets of debris.

IMF riots aren’t always guaranteed to follow austerity, though, as demonstrated in Egypt, the land of great hope in the 2011 Arab Spring (and terrible oppression both before and after). With declining support from traditional patron Saudi Arabia, Egypt recently had to turn to the Fund for new loans. Soon it made “painful” policy changes, including a regressive value-added tax and lower gas and power subsidies. It also bowed to pressure to float the national currency—allowing its exchange rate to fluctuate with the currency markets—and it immediately lost half its value. This triggered explosive inflation that the IMF is supposed to help stop, along with “wiping out savings and halving salaries,” according to the Times. But with Egypt’s long, painful history of U.S.-financed repression, there were few protests: “[security] forces in armored personnel carriers, including masked men carrying assault rifles, were deployed across Cairo and other parts of the country to discourage such demonstrations.”

Even Iran, which the West has targeted with military action and heavy sanctions since the overthrow of the U.S.-backed Shah dictator in 1979, has been given no choice but to submit to the IMF. As America tightens sanctions despite the humanitarian crisis posed by the COVID-19 pandemic, the Islamic Republic was recently forced to turn to the IMF for emergency financing. Iran hadn’t borrowed from the Fund since before the revolution; now (you guessed it) they are forced to contemplate the IMF’s austerity cuts.

For countries in desperate need of money, the IMF has simply been the only game in town—until the last few years. Amusingly, Western analysts are widely suspicious of the rise of China and its enormous Belt and Road Initiative, a program which makes large loans to developing countries for building trade-related infrastructure like highways and commercial ports. Former U.S. national security adviser and prominent war-mongering dick John Bolton claimed China is making “strategic use of debt to hold states in Africa captive to Beijing’s wishes and demands.” You might ask: holy shit, where did they get the idea that you can get away with that?

If you live in one of the developed world’s rapidly crumbling democracies, remember that each night as you sleep, governments in the poorest countries on the planet are cutting social supports and raising taxes to line the pockets of rich foreigners. This is the way of the (neocolonial) world. And as long as these practices continue in the name of progress, there will be more IMF riots, and potentially revolution to come. Bet your bottom dollar on it.