Are NFTs The Dumbest Thing To Happen In The History of Humanity?

People attach value to all kinds of nonsense. While “NFTs” are not uniquely ridiculous, their rise is an extreme illustration of status anxiety in our grossly unequal economy.

Earlier this year, the news media began reporting on a strange phenomenon in the art world. Instead of selling physical paintings, some artists were now selling digital files, with many going for astonishing amounts of money. A JPG file of a work by the digital artist “Beeple” had sold for $69 million at the auction house Christie’s. A pixelated graphic of a man smoking a pipe sold for over $7 million. The works are sold as what are called “non-fungible tokens” or NFTs, which means that the sale of the work is recorded in a secure digital ledger, giving buyers permanent proof of their “ownership.”

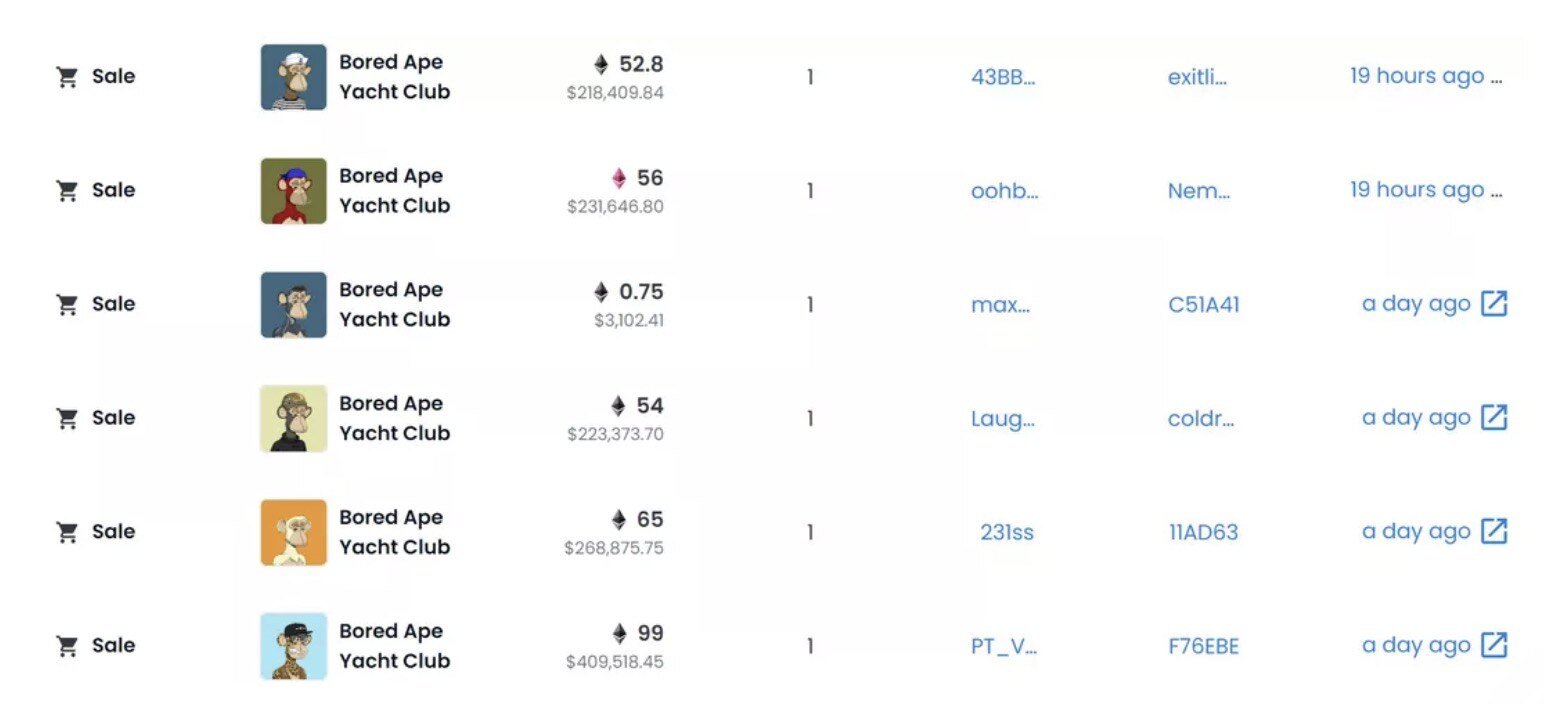

The trend went beyond artwork. Twitter CEO Jack Dorsey sold his first tweet as an NFT, and fetched over $2.9 million. A New York Times writer reporting on the phenomenon was shocked when he sold his column as an NFT and received $560,000. Tesla CEO Elon Musk offered an NFT of a tweet containing a techno song about NFTs. Bidding reached $1.1 million before Musk announced he had decided not to sell after all. Things have only gotten stranger since. People apparently pay hundreds of thousands or even millions of dollars to get a particular custom cartoon of a monkey to put on their social media profiles. A few weeks back, a simulated yacht in a computer game sold for $650,000 in real money. Not an actual yacht, a 3D image of a yacht.

What the hell is going on here? Why would you pay for a digital image of a man smoking a pipe? Couldn’t you just screenshot it? The work that sold for $69 million at Christie’s is available to look at for free on the internet. How does it make sense to pay these astronomical sums? Is the NFT some kind of unique derangement of our time?

But what looks like a unique kind of stupidity at first may just be the latest example of a very common kind of stupidity. I remember when I was in middle school, Pokémon cards were hugely popular. Cards with particularly rare Pokémon on them would sell for fortunes (the rarest has gone for $200,000). Pokémon cards were, from one perspective, an incredibly stupid thing to place value on. They were a piece of paper with a drawing of a fictitious monster on them. You could use them as part of a game, but people seemed to care about the collecting more than they cared about the game.

In the case of Beanie Babies, there wasn’t even a game. There was just a sack of plastic pellets made to look like an animal, mass produced in China. But adult human beings paid thousands of dollars for the “rare” ones, before everyone lost interest and moved onto the next fad, making Beanie Babies nearly worthless. (An actor from General Hospital spent $100,000 on Beanie Babies, hoping his investment could fund his kids’ college educations. He lost every cent.)

We are used to these types of crazes, and it’s easy to see why they happen. Market value is subjective, and sometimes people come to share the valuations of those around them: everyone in school wants a certain pair of sneakers, so I want that pair of sneakers, regardless of whether I would make the same choice independently, without the influence of others. I actually remember a moment as a kid where I wanted to get a rare Pokémon card. I even bought a pack of the damn things, even though I had no interest in the game. I remember distinctly the excitement of taking off the metallic wrapping and rifling through to see if there was a “good” one in there. (Nope. Bupkis.)

Why on earth did I, a child with no interest whatsoever in Pokémon, briefly become interested in acquiring a special Pokémon card? Well, because collecting was its own sort of game being played among my peers, and I didn’t want to be left out. I was willing to (once) spend a small amount of money to participate in that game. But I can see how others, especially those with money to burn, would get caught up in it.

The NFT “collecting” trend just transfers this silly game to the digital realm. It’s not that much different than a Pokémon card. We may have a sense that a digital image is less “real” than a sack of plastic pellets, and in one way that’s true, but in both cases the value being attached to the possession is being generated psychologically. It’s not inherent. A Beanie Baby has market value because a community of people is willing to pay money for it, and when they cease to be willing, it ceases to be “worth” anything. It is not necessarily more absurd for people to value an online picture of a monkey than a real-world sack of beans, or to see a huge difference between a watch that says Rolex and a watch that doesn’t.

Arguments can be made that the NFT is a slightly sillier thing to attach value to than a Pokémon card. After all, a Pokémon card is a physical object and so long as you have it, other people don’t. It’s your property, and traditionally a core private property right is the right to “exclude” others from use. If someone sells you a sandwich, you have exclusive ownership over that sandwich. It’s yours to eat. Nobody else can eat it. If I sell you an original Joan Miró painting, the physical painting is exclusively yours. If someone breaks into your house and tries to take it, the government will pay to have an armed force go and try to find it for you (the police).

The NFT is a far stranger thing. You’re not even buying the copyright to the image you’re buying. You’re just buying, essentially, your name in a ledger saying that you “own” a thing, without it being clear what “ownership” means in this context. You can’t call the police and have them prevent someone from copying or using your NFT. Is the right to have your name listed as the “owner” of an easily reproduced digital thing, without that listing conferring any rights on you, worth paying money for? What do the people who buy these things think they are getting?

A full answer would require a psychoanalyst. But my guess is that what they are getting is a feeling that a thing belongs to them, the same as you get when you “purchase” an asteroid or a plot of land in Utah that you can never develop. It feels like yours, and if there are others willing to recognize it as yours, then you are getting status. Imagine, for instance, a painting that is housed in a museum but technically owned by a private collector. Let’s say the artist sold the painting with a stipulation that it always had to be housed in the museum, regardless of who owned it. “Owning” the painting might then mean, in practice, little more than “publicly having one’s name attached to the painting and being seen as the person who ‘owns’ it.” We might wonder why anyone would want to spend money on this, but the answer is that they are not really buying a thing, they are buying social recognition. They are doing “conspicuous consumption” where one buys things to display how much money they have, or to remind themselves of how much money they have.

It is also not the case that just because a thing can be easily reproduced, there is no reason to buy the original. People want original artworks even though they may be indistinguishable from well-executed forgeries, because they value authenticity. It may have been possible to produce a Pokémon card at a good print shop, but these would have been fake because they were not produced by the Pokémon Company. People who discover that their diamonds are “fake” have the same necklace on Tuesday they had on Monday when they thought the jewels were “real,” but they cannot look at it the same way, because the quality of being “real” was what they cared about. But the value attached to things like “did an artist’s hand touch this?” or “is the chemical composition of this jewel X or Y?” is purely subjective. Likewise, people who have “knockoff” ape avatar will know they have a knockoff, and people who paid money for a “real” one will know theirs is “official.”

There are plenty of reasons one might buy an NFT, then, even though it is like buying an imaginary dog. I do not think they are good reasons—personally, I would never waste a penny on this nonsense, and think it is like setting your money on fire. But rather than seeing this as some strange new development, whereby things that are “objectively” immaterial or valueless are given value, we should instead see this trend as an extreme example that illuminates a common kind of human irrationality, whereby worthless trinkets are invested with magical properties, and status goods take on value independent of their practical use-value. One buys a Tesla partly because of its qualities as an electric car, but partly because it is a Tesla, and owning it grants entrance into a community of high-status people.

So we can see why even something that is, in practical terms, nothing at all, could attain market value if it is branded well enough. We can imagine a company called The Club, and for $10,000 they will put your name down to say that you’re “in The Club.” That’s all they’ll do. What you make of Club membership is up to you. (Maybe they’ll send you an official pin.) But in the meantime they’re getting celebrities to join The Club (Jimmy Fallon bought one of the monkey avatars) and hyping up Club membership and making sure they carefully restrict the number of Club members, and maybe if they’re extra sneaky the very people trying to convince people to join the club will engineer some exorbitant resales of Club memberships (“a membership just went for $1 million!”) to get some press, and the hope will be that eventually people attach some meaning to this thing. Because many people seek meaning in their lives, there is always a market for meaning, and those who seek status will indeed spend money just to be told that they’re In The Club.

In fact, some NFT “communities” explicitly call themselves “clubs.” There are the “bored apes.” Then there are the “pudgy penguins.” A few thousand different cartoons of pudgy penguins have been generated, and people buy them so that they can be in the penguin club. Would anyone really do this? Yes, apparently “the original collection sold out within 20 minutes, and more than $25 million worth of [the penguins] have changed hands overall.” For the idle rich of a new generation, collecting online drawings of penguins or monkeys is what collecting classic cars or paintings was to a previous generation. If you see it as strange, remember that it was never about the “thing itself” for many who collected the more “real” objects. Many car collectors didn’t drive the cars, stamp collectors didn’t mail the stamps, beanie baby collectors weren’t children, and art collectors didn’t appreciate the art. So why not cartoon penguins this time? One of the founders of the pudgy penguin club told the New York Times explicitly that this was about the display of status:

“The way I describe it to my family members and friends is like, people buy Supreme clothes, or they buy a Rolex. … There are all these ways to tell everyone that you’re wealthy. But a lot of those things can actually be faked. And with an NFT, you can’t fake it.”

Well, you can fake it—because I could draw one of those damn penguins—but the point is that the insider group (those who know real penguins from not-real penguins) has an easier way of spotting outsiders than they do with fake Rolexes, which they might need to take off your wrist to examine. Here we have a direct admission: if you’re wondering why people would spend a fortune on a picture of a cartoon penguin, one answer is that status hierarchies need to have ways for those at the top to identify one another, and what a Yale tie may have been to Old Money rich people, an exclusive cartoon avatar is to idiot crypto billionaires.

Another important element here is speculation. People buy the thing not because they themselves want it, but because they think other people will want it, or can be induced to want it. Plenty of people bought Beanie Babies not because they themselves gave a damn about them, or wanted to caress and treasure a particular rare one, but because they saw that people were buying them like crazy and wanted to cash in. One reason to buy a pudgy penguin is because you want to be in the pudgy penguin club. Another is because you think other people will want to be in the club, and you want to have control over access to it so you can make them pay through the nose.1

You can gamble with pretty much anything. If people want to play Monopoly with real money, they can do it. If they want to play The Sims with real money, they can do it. If they join a collective fantasy community where people see ownership of an imaginary yacht as valuable, well, it’s just one more of the games people play. I think what makes all of this grotesque and disturbing is the sheer sums of money that are involved. People are paying hundreds of thousands of dollars in real money for imaginary monkeys or digital plots of land in a computer game.2 When people in America die because they can’t afford their monthly insulin, these transactions seem utterly horrifying.

This part, however, is even easier to explain. If the question is: “How could they spend hundreds of thousands of dollars on a cartoon penguin?” the answer is that to a certain class of people, hundreds of thousands of dollars mean nothing more than one or two dollars mean to you and me. These amounts seem exorbitant to us, but our economy has created a class of people so rich that the kinds of sums that could transform the lives of a working-class person are peanuts, trifles to be tossed around. The rich can spend $200k on a cartoon the same way you might pay $1 to a child for a cute drawing of a penguin and membership in the Penguin Club. Joining a silly club might be a fun novelty experience, if it was cheap, and for people with too much to spend it, it is cheap. Money simply doesn’t mean the same thing to those who have such ungodly amounts of it that they can never possibly spend it all. They might as well be playing with Monopoly dollars.

The absurd thing here, then, is not really that people are paying for digital art. If digital art cost a buck, the phenomenon would be less mysterious to us. The absurd thing is that huge sums are flying around, and that’s happening because some people are just too damn rich. The insane thing about someone paying $120,000 for a piece of “art” consisting of a banana taped to a wall is not that they paid for it—if it was five dollars, we might understand it. The insane thing is that some people can spend that much on something so stupid while there are some people who have nothing. NFTs themselves are less disturbing than inequality; it’s the market for NFTs that reveals the horribly unjust distribution of wealth. That would be the case whether people were buying “material” things like McMansions, Teslas, postage stamps, Beanie Babies or “imaginary”/digital things like NFTs, cryptocurrency, and land in computer games. The fact is that there is a class of people who have too much money, and this is evidenced by the fact that they are able to fritter it away on nonsense while other people struggle to acquire the basics.

NFTs do have unique problems—they’re catastrophic for the climate, which is the one thing you’d hope that consumption of “imaginary” goods would actually not be. But I would caution against seeing them as something different or separate from other parts of the capitalist economy. The fact is that a large amount of economic activity consists of rich people buying useless bullshit that destroys the environment solely because it brings some semblance of meaning to their pitiful vacuous lives, makes them feel included in a group of Important People who are better than others, and allows them to forget temporarily that they are mortal and will someday turn to dust just like the rest of us. And, whether “imaginary” or “material” goods are involved, this kind of consumption is both (1) a sign that the rich are living empty, pointless lives and (2) a sign that we have given some people far more money than they know what to do with and need to radically redistribute wealth so that everyone has enough to live on—rather than allow some people to struggle to pay for food or basic medical care while other people speculate on imaginary land.

The best description of how NFTs work that I have seen is this response a commenter gave to someone online who said “I don’t know what an NFT is and I’m too afraid to ask”:

imagine if you went up to the mona lisa and you were like “i’d like to own this” and someone nearby went “give me 65 million dollars and i’ll burn down an unspecified amount of the amazon rainforest in order to give you this receipt of purchase” so you paid them and they went “here’s your receipt, thank you for your purchase” and went to an unmarked supply closet in the back of the museum and posted a handmade label inside it behind the brooms that said “mona lisa currently owned by jacobgalapagos” so if anyone wants to know who owns it they’d have to find this specific closet in this specific hallway and look behind the correct brooms. and you went “can i take the mona lisa home now?” and they went “oh god no are you stupid? you only bought the receipt that says you own it, you didn’t actually buy the mona lisa itself, you can’t take the real mona lisa you idiot. you CAN take this though.” and gave you the replica print in a cardboard tube that’s sold in the gift shop. also the person selling you the receipt of purchase has at no point in time ever owned the mona lisa.

unfortunately, if this doesn’t really make sense or seem like any logical person would be happy about this exchange, then you’ve understood it perfectly

This is funny and pretty accurate. But it suggests that NFTs are a unique kind of scam that only idiots would believe in. In fact, the factors that lead people to buy these imaginary assets (it seems “cool,” their friends are doing it, it carries prestige, it looks like they can sell it for more money later) are the same factors that underlie a wide range of everyday economic transactions. It would be a mistake for us to point and laugh at the NFT-buyers without also mocking those who buy big houses and brand-name clothes and art they don’t understand. The real problem here is not that people are buying art the way you “own a comet,” but that too much wealth is concentrated in too few hands, meaning that the consumption of expensive fake nonsense is absolutely out of control. I realize nothing is more predictable than for a grouchy socialist like myself to grumble that the real problem is capitalism itself, but, my friends, I insist that if you look beyond the NFT, you will indeed see that the real problem is capitalism itself.

I am grateful to Sparky Abraham for helping me think through and understand this and contributing ideas to this piece. Artwork is by Helen Geiger.

This is part of why you see such aggressive pro-cryptocurrency propaganda, with the guys who are into it insisting that it’s the currency of the future. Trying to convince others to believe in cryptocurrency is necessary in order to increase the value of their asset. If people stopped believing in its value, it would cease to have any, and they would go bust, thus every psychological technique possible must be deployed to get people to buy into the collective illusion that cryptocurrency is valuable. (Note: I am not saying cryptocurrency differs from other forms of currency in having its value based on a collective illusion.) ↩

Be warned that I do suspect some of this involves the very people who are trying to convince us that imaginary land is valuable, buying the land themselves to prove that it is valuable in the hopes that they will thereby spur others to invest. ↩