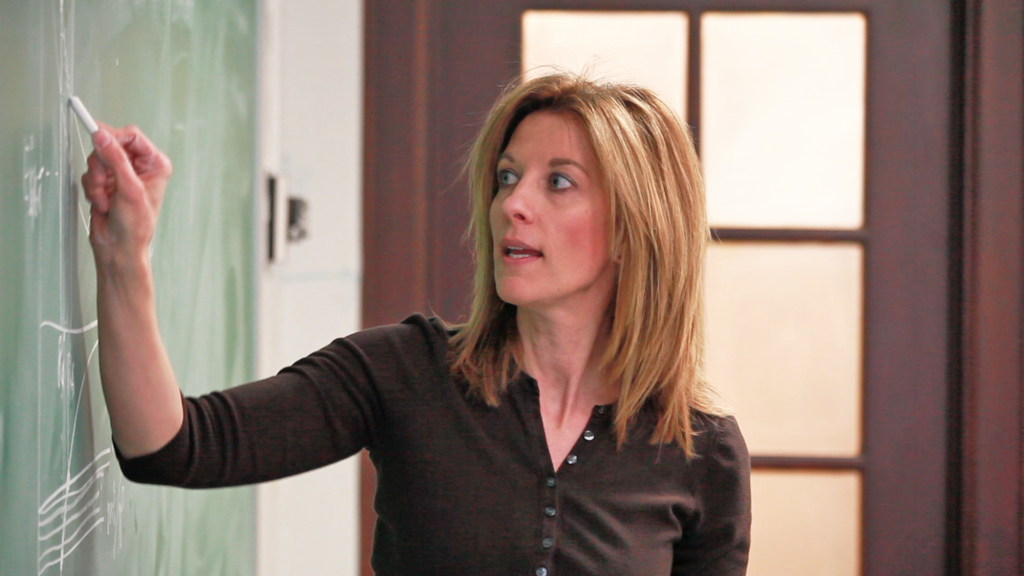

Interview: Stephanie Kelton Talks MMT and More

Stephanie Kelton, economics and public policy expert, talks the mythical and oft-misunderstood modern monetary theory with Nathan and Sparky.

This transcript has been lightly edited for clarity. The original interview can be found here.

Stephanie Kelton is a professor of public policy and economics at Stony Brook University. She’s also one of the world’s foremost experts on modern monetary theory, which has sparked heated debate in the field of economics. Recently, Kelton appeared on the Current Affairs podcast with editors Nathan J. Robinson and Sparky Abraham to discuss what an MMT-flavored future might look like. You can listen to the interview in its entirety on Patreon. The following transcript has been lightly edited for clarity and grammar.

NATHAN J. ROBINSON

Good evening, Current Affairs listeners. My name is Nathan Robinson and I’m the editor of Current Affairs. I’m here with my colleague, financial editor Sparky Abraham. Hello.

SPARKY ABRAHAM

Hello, Nathan.

NJR

And we are joined by an incredibly special guest today. Stephanie Kelton is professor of economics and public policy at Stony Brook University. She previously served as chief economist for the Democratic Minority Staff in the Senate Budget Committee. She was an economic advisor to Bernie Sanders’ campaign in 2016, she is a columnist for Bloomberg, and she is the author of The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy.

Professor Kelton, thank you so much for joining us.

STEPHANIE KELTON

My pleasure. Thanks for having me.

NJR

So, this book challenges a lot of people’s preconceptions about the way money works, the way the federal government works. People are going to have to read it to fully understand what you’re talking about, but I wonder if the place to start is with the way that everyone has kind of been conditioned to think about the federal government’s budgeting the same way they think about households.

You talk about when you were working with senators, those that came out of [the] business [world] thought of the federal government the same way they thought about business accounting: you had to take in money and you had to make sure that your checkbook was balanced. You talk about the way this has sort of, even among Democrats like Barack Obama, [become] the way that we all think of government.

Why is that wrong?

SK

Well, I like that you said this. It is probably the place to start because that’s where I started the book. Chapter 1 is called “Don’t Think of a Household.” I think that is in almost every respect where people tend to start and where everything goes off the rails, and if you can correct that, then I think it’s pretty easy to correct a lot of other wrong-headed thinking. It’s not our fault because almost all of the public discourse around government finances is presented to us through this lens of a household.

So we hear our politicians, we read articles, newspapers, we turn on the news and we hear somebody talking about the federal government’s finances using language that is most familiar to us: our own personal finances. So people will say the government needs to get its fiscal house in order. Just the use of the word “house,” invokes that household budgeting, that kitchen table. You know what it’s like to sit around the kitchen table and make sure that the money coming in and the money going out is balanced. You’re not living beyond your means and taking on debt that you can’t afford to pay back and so forth. That is correct.

We have been conditioned to understand the government’s finances through a lens that we’re most familiar with. That is our own [household finances]. What’s wrong with that is that the federal government is nothing like a household. The key difference between them and the rest of us is that they get to issue the currency. The U.S. government is the issuer of the dollar, and the rest of us just use it. So households, private businesses, state and local governments have to get the dollar before they can spend it. They have to get money. The federal government has to spend a dollar before the rest of us can get it, so they play by an entirely different set of rules.

NJR

Even Bernie Sanders, who you advised, often lapses into talking about the “how do you pay for it?” question and coming up with the answer, “Well, this is the way that the taxes would cover it.”

But what you suggest is that we shouldn’t even think of a one-to-one correlation between taxes and government spending. Taxes are important, but they serve a very different function and these two things should be [taken] apart in our minds. That’s very difficult because we always think, “Well, [for] a sensible universal healthcare program, here’s the taxes that would cover it and here’s why the budget adds up.”

But you kind of suggest throwing away the whole framework.

SK

Yeah, you’re right. It is not helpful, nor is it good economics, and I don’t think it’s good politics, either, to continue to link these two things. To insist that every time you want to spend a dollar into the economy on some program—maybe it’s healthcare—you have to have a dollar coming out of the economy to pay for it. I think it would be much better, both politically and in terms of the actual budgeting process and the economics, if we decouple these things and we have separate analysis. Should we raise a tax? And what tax should we think about raising? And why might we increase that tax? Should we increase spending? On education, infrastructure, healthcare, and by how much? And to what aim? What is the policy goal?

These can be, and I think should be, separate discussions. But you’re right: We are locked into this mentality that tells us that if the government wants to spend another dollar, it’s got to come up with a dollar, and that then forces politicians to put out a blueprint so that they can say, “I’m for this program.” You say, “Well, how are you going to pay for it?” [They respond,] “Well, I’m going to collect up all the dollars I need by raising this tax or closing these loopholes,” or whatever the case may be.

NJR

I just want to be clear—so the framework that you operate in is called modern monetary theory. You are part of a school of what is called “heterodox economists” who are challenging a lot of conventional dogmas. The caricature of your framework is that the government can spend infinite money because it has access to the printer, therefore it is sensible to spend infinite money and there are no constraints on the government’s purse. The cruel thing is MMT stands for “magic money tree,” we can just have anything we want because the government can print as much money as it wants.

Now, you’re not saying that. You say there are very real constraints on what the government should spend and excessive spending will have negative consequences. How should we think about how much the government can or should really spend?

SK

So first, let’s recognize that even having the so-called printing press, or the power of the purse, doesn’t mean that you can have anything you want. Right? Look at where we were three months ago, or frankly even today, in terms of ventilators, masks, and other personal protective equipment (PPE). Congress could authorize all the spending it wanted, but guess what? We couldn’t have those things because they weren’t available. They hadn’t been produced or they were going to other countries or whatever. We could not have them even though we could afford them. So that’s the first point.

The second point is that you’re absolutely right. [Recognizing] that governments that are issuers of a sovereign currency face no hard financial constraint is not the same as saying governments that issue their own currency face no constraints. There are limits. Right now Congress is spinning out multi-trillion dollar spending bills. The House has passed five, the Senate has passed four. The House has teed up another $3 trillion, they’re ready to go. We could see Congress spending $6-7 trillion, something like that [in] very short order.

The question is, would that be excessive? My response is no, not in this economic environment. Why? Because the economy is so depressed because tens of millions of Americans have lost jobs. Because businesses are struggling to get customers into the door where it’s safe and open to do so. There is a lot of room for the government to provide [fiscal support] in this economic environment.

Now at some point, God willing, the economy will get closer to full employment. We will recover and the labor market will tighten up and the fiscal space will begin to diminish. That’s a good thing, because then Congress will not need to provide as much fiscal support and if we were to continue passing multi-trillion dollar bills at that point, the punishment for that would show up in the form of inflation.

[The] limit that you’re asking about is our economy’s real resource capacity. We have the people we have, we have the machines we have, we have the factories we have, we have the technology we have, we have the raw materials. Those are our means of production. Those are our material means. Once we exhaust them, once they’re all used and being put to use, then any additional attempt to spend into an economy that is maxed out is going to produce bottlenecks in production and inflationary pressures.

SA

So how do you determine that? How do you calculate that? How do you figure that out? Because the wrong thinking about the budget [goes]—it’s almost just a rule of thumb—if you spend more than you take in, that’s bad. But if you accept that that’s not the right way of thinking about it, then how do you figure out what’s too much?

SK

It’s a good question. [Imagine] I’m holding up a 12 oz. can of delicious Diet Dr. Pepper. Now, suppose I had a 12 oz. glass. It’s empty. I have an empty 12 oz. glass and I have a 12 oz. can of soda. I know that I can empty that can of soda into my glass and I can fill it all the way to the top, and I can do it in a way that is measured and controlled, because I can see if I’m pouring too fast the foam is going to pour over. [In that case] I’m going to have a sticky mess on my counter and so forth. Or I can do it in a very controlled and deliberate way and I can avoid the spillover.

Now that’s easy because I can see the glass. I know it’s a 12 oz. glass and I know exactly what I’m working with and I can control the whole thing.

The economy is not like that. We can’t see the economy’s full capacity. What we can do is attempt to get measurements. You’re trying to take a temperature for the economy’s heating up. How hot is it getting in here, right? What do you look at? You look at unemployment. You look at capacity utilization rates. We have the data for things like this. People go out and actually survey businesses and say, “How much of your total capacity right now are you using?” They say, “We’re using about 68 percent.” Okay, well I know that there’s a lot of spare capacity.

You can do it by occupation. If you’re looking to do a big infrastructure project and you look at the unemployment rates by occupation and you see: wow, construction workers, there isn’t much unemployment in construction. [Engineers], architects, they’re almost all fully employed. You don’t want to roll out a big infrastructure project in that because you’re going to put pressure on prices in that industry.

What I’m saying is we have been here before. We did this in World War II. We massively ramped up government spending and we did it without a whole lot of forethought because it was war so you’ve got to act fast. We had workers working double and triple overtime, wage pressure, price pressures, but we managed it pretty well. We didn’t have a hyperinflation episode or anything like that. We won the war and then we ended up with the longest period of peacetime prosperity in our nation’s history to that point.

It’s going to be imperfect. You can’t operate an economy with perfect certainty, but economists have models and surveys and ways to attempt [to] avoid pushing things beyond the limit.

SA

One way that I sometimes catch myself thinking about this is it’s kind of just like one big bucket, right? It’s like the one glass and the one can. But it sounds like what you’re describing [is] a little bit more nuanced than that. You have to actually look sector by sector, you have to figure out [where exactly] you’re putting the money in to determine whether you’re doing the right amount or too much or too little.

SK

Exactly. That’s what they did during and after the war. There was something called [the] National Resources Planning Board or Bureau or something. It brought together union leaders, industry, business leaders, government officials, economists, and statisticians, and people worked together to try to manage inflationary pressures post-war as the government scaled back spending on defense with an increased spending in the GI Bill. There was a lot of additional education and then pretty soon with [Lyndon B. Johnson] you got Medicare and other programs. People have to do the hard work, but you’re absolutely right, it is nuanced.

NJR

You mentioned inflation, and this is, of course, the first thing that everyone brings up the first moment they hear of MMT. They say, “Printing a bunch more money, that will devalue [the currency]. The more money we have, the less it’s worth. Inflation is going to take off. This is all absurd.”

But what’s interesting about the book is actually how much you talk about inflation. You say, in fact, that’s what matters. [What] you should be concerned about is not revenue but the effects of spending on the economy.

SK

Exactly. [We] could get away from thinking of the object and aim of public policy being to promote a balanced budget and instead think what are the problems we’re trying to solve. I have a chapter called “The Deficits That Matter” where I try to get us to focus on the myriad of challenges and crises in our economy and recognize we can’t fix everything. Just because you can financially afford to spend whatever Congress budgets, it doesn’t mean you have the real resource capacity to do everything. You still have to prioritize. Budgeting is still about prioritizing.

If we could get away from thinking about the budget as a thing we should try to balance and think about the budget as a tool to achieve or to build a broadly balanced economy, how can we re-balance conditions in education or in infrastructure or all of these deficiencies? How can we address those problems? And if we’re able to tackle those problems using the budget in ways that don’t create inflationary problems, I don’t care what number falls out of the budget box at the end of every fiscal year. It’s unimportant. What matters is: Do I have a healthy balanced economy?

NJR

You mention in the book that people are often told about the vast amounts of money that they owe. It’s like this TIME magazine cover that says “You owe $46,000,” [because] this is [your chunk of] the national debt. Your point is that people shouldn’t think of it this way. How should they think of what the deficit is, if it’s not the amount that America owes?

SK

There are two words that are important in what you just said: the deficit and the debt, and they’re different. They’re often conflated, so let’s make sure everybody listening knows the difference between those concepts.

The deficit is the difference between two numbers. It’s the difference between the number of dollars the government spends into the economy each year, and the number of dollars the government subtracts out of the economy each year (mainly through taxation). So if the government spends $100 in, and taxes $90 out, we label it a government deficit, because the government has spent more than it collected in taxes. The deficit on the government’s books will read -10. We’ll say that’s a deficit we’ve recorded. What we forget to do is pay attention to the fact that the government’s deficit is making a financial contribution. If they put 100 in and subtract 90 out, somebody got 10, right? So that’s a +10 on somebody else’s balance sheet, so government deficits create financial surpluses in some other part of the economy.

Now each year that the government runs a deficit, it matches up its deficit spending by selling government bonds, U.S. Treasuries. So if the deficit is $10, the government will sell a $10 government bond. What happens is that it takes the $10 away from someone and replaces that with a government bond. All the government bonds that exist are what we call the national debt. I think it’s awful that we use that word to describe the outstanding stockpile of U.S. Treasuries because those are people’s assets. They’re holding onto them and it’s basically an interest-bearing form of U.S. currency. They’re dollars that [accumulate] interest.

The government doesn’t have to offer people interest-bearing dollars, but it does. It chooses to do so. Historically all of the bonds that have been issued and reissued comprise this thing we call the national debt. The national debt is nothing more than a historical record. It’s kept track of every past deficit the government has ever run, where it has placed U.S. Treasuries into somebody’s hands, and we call that the national debt.

SA

Why do we do that? And do we need to? Why do we issue treasury bonds for every dollar of the deficit?

SK

It’s the most under-asked and important question maybe in all of public finance. I’ll tell you a story that might help [answer] your question.

The Australian government in the 1990s balanced its budget and was running budget surpluses. Remember, when the government is running a deficit, it’s selling Treasuries. But when it’s running a surplus, it’s supposed to be paying down debt, retiring maturing bonds, letting them roll off and then people don’t get more.

So here’s the Australian government running budget surpluses, paying down Australian government debt, and investors went crazy. They started clamoring for government bonds. “Hey, where’s our risk-free reward?” Because these are safe, risk-free assets that pay interest. You get return without risk. It’s a sweet, sweet deal if you can get it. So investors clamored for more government bonds and the Australian government started issuing government bonds to satisfy the appetite of investors for this risk-free return, even though they were running budget surpluses. So at least part of the answer is that financial markets very much like these things.

SA

We’ve got whole structures in place now where there are various institutions that are more or less required to invest in government bonds, right?

SK

That is exactly true as well. All of that can be changed, of course, if Congress wanted to change it. Then I think the advantage of thinking about making changes like that is that the politics are so corrosive, that we understand [we] need Congress passing bills to support the economy right now and that that results in deficit spending. We understand that. The problem is that it increases this thing we call the national debt, and that gets everybody anxious. But if we could have the deficits that our economy needs without the added debt that makes people very crazy, maybe that’s worthwhile.

SA

Does [issuing] the bonds have any counter-balancing effect? Does that in some sense take money out of the economy to sell those bonds for every dollar of the deficit?

SK

It actually puts more money in. If the government ran the deficit without selling the bond, what would happen? It would spend $100 into the economy, tax $90 out, [and] leave $10 sitting on balance sheets. Now the [Federal Reserve] can choose to pay interest on those reserve balances, but they’re just trapped in the economy, they’re trapped in the banking system, they’re trapped in the financial system. But the Fed could pay the interest if it wants to.

What we do now is we sell Treasuries and replace the dollars with an interest-bearing dollar, so now you’re multiplying up the number of dollars over time, and those can be in people’s pensions. I can buy them, so they can become interest income to people who can turn around and spend that money.

SA

And [Treasuries] themselves can be traded as well.

SK

Right.

NJR

One question about your framework is the extent to which [you talk] about a very particular kind of government that the United States federal government is. One of the difficult things for people [to understand] is that local and state governments, because they don’t issue currency, still do have to think [like] households. And lots of other countries’ governments that don’t have [monetary sovereignty] have to think about their budgets the way households do. So are we talking about a very particular thing that happens to apply because the U.S. federal government is so financially powerful and has this exorbitant privilege?

SK

No, the conversation that we’ve had so far is equally applicable [to other governments]. We talked a little bit about Japan, right? Japan is another example of a currency-issuing government, that has, if you like, infinite fiscal capacity where the relevant constraint is inflation. The U.K. is one. Canada is one. Australia is one. New Zealand is one. China has an extremely high degree of monetary sovereignty. You don’t have to be the global reserve currency issuer to enjoy the policy space to run your macroeconomic policy in a way that’s aimed at maximizing full employment domestically, which is what we’ve been talking about.

But you’re right. Your other point was [regarding] state and local governments and countries in the Eurozone that gave up their sovereign currencies. They did place themselves in a very different position vis-à-vis the currency. Italy can’t do what the United States of America can do. California and New York can’t do what the federal government can do—which by the way is why the governors in both of those states have been pleading with the federal government, imploring Congress to get aid to state and local governments. Because as you said they don’t have the currency-issuing capacity.

NJR

There was a very critical article about MMT written in Jacobin, which is a leftwing magazine that is in many ways very sympathetic to the same policy goals [as MMT advocates]. I want to ask the question that was posed to you in this article. It said sometimes it’s hard to figure out what modern monetary theorists believe. Are they just saying that it’s okay for the federal government to run a small deficit in normal times and big ones during crises? Or that we shouldn’t worry about deficits at all? Should we not worry about the rising ratio of federal debt to gross domestic product (GDP) and the increased share of spending devoted to debt service, which is a gift to rich bond holders? And [the author of the Jacobin article] said at what point would debt become worrisome, and then concludes MMT’ers never tell you this.

SK

I don’t know the piece you’re referring to, but it sounds like it was written by someone who hasn’t read the MMT scholarship, or the literature. Because every single point that you just raised is, I would say, omnipresent across two and a half decades of MMT scholarship, videos, and lectures. It’s all readily available to anyone with a Google machine. We could take those one at a time, but I can tell you that we’re very clear [on] every one of those points. Not just myself, but Randy Wray and Bill Mitchell, Warren Mosler, Scott Fullwiler. There are a whole bunch of us who have been quite clear on each of those points.

You and I just sitting here have talked about debt to GDP ratios and what the real limits are. I’ve answered that question already. I can’t remember what some of the others were that you just raised.

[Regarding] deficits, [we] also said I don’t care what number falls out of the budget box at the end of any particular year. So MMT is not about deficits in a weak economy, surpluses or balanced budget over the cycle. That’s not it at all. The budget outcome is never the right policy goal. The same goes for the debt ratio. The debt ratio is never the thing to target.

And on the income to bond holders, you and I have talked about this. I just made the case that maybe we want to phase this stuff out because it’s a risk-free reward. Warren Mosler has referred to it as UBI for rich people. It’s a universal bond-holder income, right? A payment that goes to people who are already wealthy enough to have some dollar savings that they can trade up into interest-bearing dollar savings. So I don’t know who wrote [the Jacobin article], but it sounds like they didn’t do their homework.

SA

Yeah. This is a little bit different from what Nathan was just asking you, but I just had this thought that occurred to me.

The government spends a lot of money on the military, right? A lot of money on the military. I don’t have the numbers in front of me, but what you’re talking about is basically that the government spending comes first and that’s what drives the economy and drives economic growth. [If] you were to be someone who thought that the government spent way, way, way too much on the military, [then] in MMT-speak it’s not just a matter of [reducing] spending on the military and then [achieving] a balanced budget. Really what that means is we need to find somewhere else to spend that money if we’re still below capacity. If we were to reduce military spending, you’d want to increase spending somewhere else. Is that right?

SK

I don’t think you need any justification for cutting the military budget apart from the obvious [fact it’s] a bloated, $700+ billion annually war machine, right? I could make a very strong case [for cutting] the military budget by 10 percent [without justifying it by saying it would free up money to] spend on poor communities or programs that help others or so forth.

Your question is a little bit different.

SA

It’s kind of the opposite. It’s almost, “can we cut military spending without spending somewhere else?” Don’t we kind of need to spend somewhere else if we’re cutting military spending in order to avoid deflation?

SK

I think that yes, if you cut some spending, every dollar the government spends is a dollar of income to someone, right? So the risk, if you want to call it that, in cutting the military budget without replacing that spending in some other category, is that you’ve deprived someone of—if we’re cutting it by 10 percent, let’s say, $70 billion. You’re pulling $70 billion out of the economy.

How harmful that’s going to be is going to depend on a lot of factors related to the multiplier effects associated with that spending cut and so forth. But mostly yes, you’re right. You don’t just go around whacking different line items in the government’s budget and expect that the economy is going to continue to grow at the same rate, or that there are not going to be negative consequences.

SA

I like this point in that it really shows it’s not just a zero-sum, one-to-one kind of thing. It’s not like our only goal should be cutting military spending. It should be cutting military spending [and joining it closely] with what we actually should be doing.

SK

The way I would think of it is: How many real resources are you freeing up when you reduce spending in whatever category? You free up real resources. Well, what is the further public purpose of doing that? If you’re going to free up a lot of real resources, including unemployed labor, you’re going to create some unemployment. You should have the intention of re-employing that labor, or else what is the public purpose associated with freeing that labor up?

SA

The key is the resources, not the budget.

SK

Exactly, yeah, exactly.

NJR

I just have two more questions for you that I think are quite important. The first is on taxes, because I think again one of the myths [people believe when they first hear about MMT is], “Ah, rich people are going to love this because it says that we can do everything we want without people having to pay their share in taxes.” Because their share isn’t actually needed, so this is a license to cut taxes or not increase taxes on the rich. But you talk about the fact that taxes are, in fact, incredibly necessary. [As a] matter of fact we might look at something that is similar to the current taxation regime even if we think about it a different way.

SK

Yeah. A couple of years ago I gave a talk at a conference in Washington, D.C., and I think it was the inaugural conference of the Patriotic Millionaires. You’re familiar with this organization? So this is a group of very wealthy people who came together, formed an organization for the sole purpose—[maybe] that’s a little bit of an exaggeration—but for the main purpose of saying, “Hey, we have a lot of money and you should take more of it so that you can afford to fund education more generously, or infrastructure, or whatever it is. Tax us, tax us!”

So they invite me to come to this conference and give some remarks and I do this from an MMT perspective. Which means I walk into this group knowing that we don’t need their money, that the federal government does not need their money in order to be able to afford infrastructure investment, education, healthcare, or whatever. But the message was not, “We don’t need your money therefore you guys are fine, we won’t touch you.” The message was, “We don’t need your money, but we need to take it anyway.” We don’t need your money to pay the bills, but we have such extreme concentrations of wealth and income (especially wealth) in this country that it’s not just bad for the working of our economy, it is corrosive to our democracy. And when those concentrations of wealth get that extreme, you need to do something about it.

A wealth tax that peels off 2 percent annually is a nice “pay for” and the message that was given to the billionaires was, “Don’t worry, actually you’re not even going to feel it. Because your wealth is going to grow at a much faster rate, so that in fact you’re still going to become richer and richer and richer. [Your] wealth is going to grow over time, 2 percent is [so low] you won’t hardly feel a thing.”

I would say that’s the problem. If they’re not going to hardly feel a thing, then you’re not addressing the concentration of wealth inequality that is so corrosive to our political process, our democracy. So I would go in much more ambitiously with an agenda aimed at reforming the tax code, dealing in an aggressive way with the inequities in an attempt to rebalance things.

So MMT is not cover for the wealthy. It’s just … let’s be real. We don’t need to depend [on billionaires’ taxes] to feed a hungry kid, or fix a crumbling bridge. I don’t like that. That idea that we can’t move forward without them. We hold hostage the entire progressive agenda or whatever public policy because unless we can tax the rich, we can’t pay for it so we can’t have it. I’m saying no to that.

NJR

[Although If] we think in terms of this real resources perspective, there is a sense in which concentrations of wealth are a segment of those real resources that are being controlled and directed towards the satisfaction of the needs of the rich rather than this. [So] there is a sense in which every resource that is directed to building yachts is not being directed towards fixing bridges.

SK

That is true. No question about that. But I don’t think that a 2 percent tax—I’m using this as an example—on the wealth of 75-78,000 people shakes free enough real resource space to allow us to do big, ambitious things. You see what I’m saying? They’re savers rather than spenders, so they’re not actually gobbling up a lot of the real resource space.

SA

So maybe [the] savers vs. spenders question is related to what I was going to ask. Which is: taxes are still, in addition to being a tool for equity in society, [still] a tool to control inflation, right? If we abolished all taxes and kept government spending where it is, I assume we would have inflationary problems pretty quickly.

SK

And a collapse of the currency.

SA

And a collapse of the currency. As you explained, the taxes are the thing that creates the money, basically.

SK

The dollars are a tax credit; they circulate as tax credit.

SA

Right. But it seems like you could still make the argument that as the economy approaches capacity, you still need taxes in order to spend. It’s just not because you’re spending the tax money. It’s because you are controlling inflation and taxes are a tool for doing that. Is that right?

SK

Yes. So if you reach the point where your resource capacity is exhausted, but you still think there’s something that is of such high priority that government ought to pursue it, even in a full employment environment, you say, “Well, we don’t have healthcare for every American” or “we don’t have the education system that we want.” [And] whatever the case is, [I] need to commit another half trillion or $200 billion or whatever.

But if I do that in this evaluation, I risk pushing inflation above a level that people are going to be comfortable with, so I need to create some offsets. I need to be able to add. Now I’ve taken my 12 oz. can and my glass is full, and I want to pour some more spending in. I’ve got to get a spoon and I need to make room for that. That’s what taxes do. They take some purchasing power away from some people, create that safe space for additional spending to come in.

SA

It’s funny because people talk about taxes as a redistributionary system, and it seems like in that circumstance they [become a redistributionaryl system], but it’s not direct. You’re not taking money from some people and giving that money to other people. It’s a little bit more complicated.

SK

Yeah. You’re debiting and crediting balance sheets. want to credit some balance sheets of people who provide educational services or healthcare services, and I’m going to debit some balance sheets to remove some dollars from subgroup of taxpayers.

SA

Right. And when and how much you have to do that is dependent on the real world, not on the budget.

SK

Exactly.

NJR

The last thing I wanted to ask you, Professor Kelton—because I think it’s such a crucial part of your book—is you have a chapter called “The Deficits That Matter,” and I think this is critical to people reconceptualizing what they think of as a deficit. [You] say that we should focus far more on the gap between what we’re capable of [vs] what we are actually doing. When we have this kind of real resource and we start to look at what our country could do, we see all these areas of massive failure and of massive lack of living up to the potential that we have. [That] is what should occupy most of our attention.

SK

Yeah, it’s such a shame because you look in the rearview mirror and you see how much inaction, right? All of the things we could have done—but didn’t do—have costs, right? There is an opportunity cost to inaction. All of the people who could have been provided healthcare but weren’t provided healthcare, who had illnesses that went untreated and died. That’s a real loss to society.

All of the infrastructure that was crumbling that wasn’t repaired, and the bridge fell down and killed 40 people. That has a cost, right? All of the potential output that could have been generated and produced has a real benefit that wasn’t captured. The income that would have been generated, the jobs that would have been available to people. The wealth, the savings, it’s lost to us in time because we didn’t live up to our means, our full potential.

[I] think that’s a tragedy and the goal going forward should be to recognize that you hear people describe deficits and deficit spending as [characteristics of] a country that’s living beyond its means, [but as] I try to say very clearly in the book, a deficit is not evidence of overspending. Inflation is evidence of overspending. So we have to get beyond that idea that deficits are in and of themselves evidence of mismanagement of finances and trying to do too much, trying to have too much. We are living well below our potential and now even more than when I wrote the book.

NJR

One reason I like your work so much is you’re the first economist I’ve ever heard who talks about just [how insane] it is that we accept millions of unemployed people as somehow a good or natural thing, when it’s such a squandering. [You] have all these people who could be productive and want to work and…

SK

It is really a human sacrifice [by design], right? As a policy choice we believe we need to hold some number of millions of people and lock them out of employment, hold them on the sidelines, keep them idle, forced unemployment, for the purpose of avoiding an acceleration in prices. This belief that if these people are allowed to find jobs, it would push inflation above some threshold that we consider intolerable. So unemployment is always a policy choice.

NJR

Sparky, do you have anything else?

SA

Yes, I have infinite other things, but I understand we’re running out of time.

NJR

We don’t want to keep you too long, but thank you so much, Professor Kelton. I really appreciate you taking the time to talk to us.

SK

You’re so welcome. Thanks for inviting me.

NJR

Everyone should read The Deficit Myth. There’s so much more to discuss, including the job guarantee, which we didn’t even get to, which is a major part of your proposal, but, yeah, pick up The Deficit Myth. Thank you.

SK

All right. Take care, both of you.