How To Make Everyone In Your Vicinity Secretly Fear And Despise You

Ray Dalio’s “Principles” is a manual for turning workplaces even more hellish…

One of the hazards of becoming extremely wealthy is that you can be fooled into thinking that you are also extremely wise. Wealth is power, and power is dangerous, because people tend to go mad with it. Yet if you are surrounded all day by people who praise your genius and defer to your authority, you may have a hard time realizing when you have slipped into grandiosity and megalomania. One good way of checking is to ask yourself the following question: “Do the things I say sound like things a Bond villain might say?” If the answer is “yes,” you should probably rethink your life.

Ray Dalio is one of the richest and most influential men in the world. He is the founder and chairman of Bridgewater Associates, the world’s largest hedge fund. Bridgewater is known in the financial industry for two things: its extremely high levels of investment success and its extremely unusual corporate culture. The company operates according to a strict set of rules promulgated by Dalio that aims to eliminate emotion and ego from corporate decision-making. Dalio’s “principles,” of which there are well over 100, emphasize strict rationality, which Dalio believes necessitates radical honesty, transparency, and accountability. And by “radical,” I do mean radical. For Dalio, honesty means employees are encouraged to tell coworkers exactly what they think of them, even if it might be deeply hurtful. (“Pain + Reflection = Progress,” Dalio writes.) Transparency means that employees’ interactions and phone calls are taped and listened to by others in the company. And accountability means that employees are given intense scrutiny on their personal faults. Dalio even has employees use an app in which they rate each other constantly in real time, with the data compiled into individual profiles called “baseball cards” displaying the employees’ weaknesses and strengths as determined by their peers.

At Bridgewater, the culture of radical self-criticsm has produced an environment that has been likened to both a “cult” and a “social experiment” (though the latter is more accurate than the former). Reports from former employees have suggested a workplace rife with accusations, confrontations, and interrogations. There was, for example, an episode in which “former COO Hope Woodhouse was shredded in front of the management committee and the sessions were sent out to the company to learn from (she was brought to the point of crying in the recording).” Implementation of the Principles is just about as Orwellian as you might expect:

Two dozen Principles “captains” are responsible for enforcing the rules. Another group, “overseers,” [bit of an unfortunate choice of title, no?] some of whom report to Mr. Dalio, monitor department heads. The video cameras that record daily interactions for future case studies are so ubiquitous that employees joke about “the men in the walls.” … Each day, employees are tested and graded on their knowledge of the Principles. They walk around with iPads loaded with the rules and an interactive rating system called “dots” to evaluate peers and supervisors. The ratings feed into each employee’s permanent record, called the “baseball card.”

Firsthand accounts of meetings involving Dalio are also exactly what you would think they’d be. Here, the New Yorker’s John Cassidy describes an incident in which “Dalio had no qualms about upbraiding a junior employee in front of me and dozens of his colleagues”:

From the back of the room, a young man dressed in a black sweatshirt started saying that a Chinese slowdown could have a big effect on global supply and demand. Dalio cut him off: “Are you going to answer me knowledgeably or are you going to give me a guess?” The young man, whom I will call Jack, said he would hazard an educated guess. “Don’t do that,” Dalio said. He went on, “You have a tendency to do this. . . . We’ve talked about this before.” After an awkward silence, Jack tried to defend himself, saying that he thought he had been asked to give his views. Dalio didn’t let up. Eventually, the young employee said that he would go away and do some careful calculations. After the meeting, Dalio told me that the exchange had been typical for Bridgewater, where he encourages people to challenge one another’s views, regardless of rank, in what he calls a culture of “radical transparency.”

In another meeting Cassidy watched, Dalio chastized an employee for having answered a question “emotionally” during a previous meeting. When the employee said he felt attacked, Dalio wrote the word “felt” on a blackboard and announced: “‘Felt’ is the key word here . . . and it’s a challenge for people… What we’re trying to have is a place where there are no ego barriers, no emotional reactions to mistakes… If we could eliminate all those reactions, we’d learn so much faster.”

Until recently, it was easy to simply laugh at Dalio and Bridgewater as an amusing reduction ad absurdum of Wall Street culture, a parable about what can happen if you take “efficiency maximization” too seriously. The hedge fund has its headquarters in the woods of Connecticut, and the employees don’t seem to leave much. The ones who stay at the company apparently thrive there (and get obscenely rich), and it’s difficult to have much sympathy for hedge fund managers, meaning that Dalio’s eccentric philosophy (half Tom Peters, half Chairman Mao) was, to me at least, a harmless curiosity, or at least no more harmful than any other hedge fund (so, quite harmful actually, just not uniquely so). Last year, however, Dalio has brought out his Principles as a book, and recorded a TED talk that has several million views. The book has been favorably reviewed in the New York Times, hit #1 on the bestsellers list, and carries blurbs from Mark Cuban, Arianna Huffington, Michael Bloomberg, Bill Gates, and Tony Robbins. Dalio is no longer merely running an experiment on a few hundred haggard 20-something Harvard graduates in the woods of Connecticut. Now he is encouraging other employers to follow his lead, meaning that if one of the world’s “most influential” men has his way, more workplaces would conform to his “radically transparent,” emotionless, cruel, totalitarian vision.

I want to look a little deeper, then, at Dalio’s book, to display it in its full creepiness, and to ponder what can be said about a world that bestows disproportionate power and influence on men who think this way.

Principles is over 550 pages long, and is Part I of an expected two-volume set, the first of which focuses on “life and work” and the second of which will cover economics and investing. It lays out a comprehensive philosophy, first applying Dalio’s rationality to the pursuit of one’s life goals, and second applying them to the world of work. The “work” portion does not explicitly say that the assumed reader is a boss rather than a low-level worker, but it’s full of references to “the people you manage” and “building your organization” that make it clear Dalio is speaking more to aspiring startup founders than fry cooks and auto-plant workers.

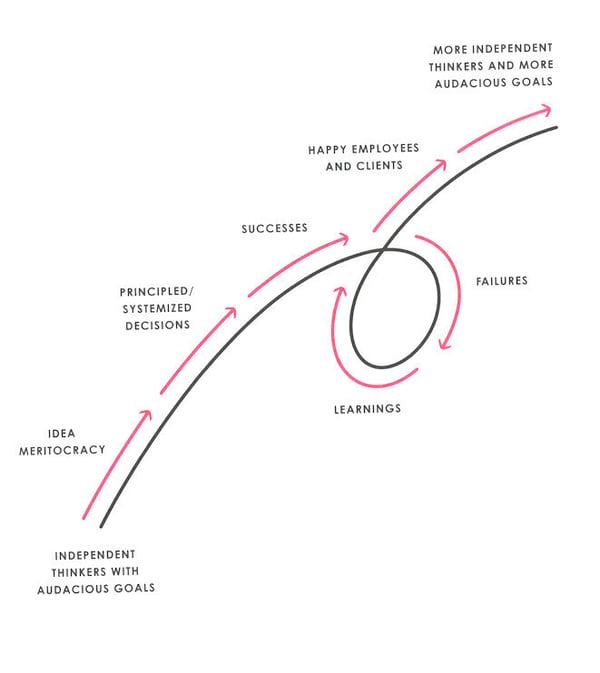

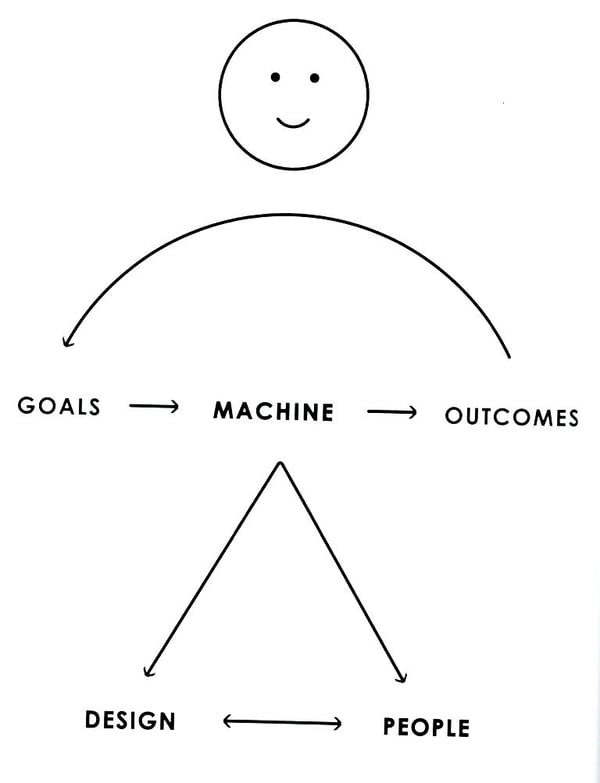

Considering Dalio’s reputation as a pathbreaker and experimenter (one Harvard education professor said Dalio was contributing to “as dramatic a transformation as the industrial revolution”) one could be surprised at how many Principles consist of the usual business-book mixture of the vacuous and the obvious. “Have clear goals,” “diagnose problems to get at their root causes,” hire the right people, examine your mistakes so you don’t make them again, “don’t worry about looking good—worry about achieving your goals,” and even “use principles”: All of these are perfectly sound, though it’s not clear why they warrant a portentous, lavishly-designed hardcover. Some of it, especially the visualizations, is so silly that I feel as if there must be a God, a malicious one who wants to fuck with me, taunting me with how intellectually insipid someone can be and still be extremely successful:

It’s not quite Jordan Peterson’s diagrams. But, man oh man: This is the sort of thing the Masters of the Universe take for profundity, let’s get going with the populist uprising already.

There’s also a fair amount of dubious pop psychology (“right brain”/“left brain” personalities, the Myers Briggs typology, Joseph Campbell’s hero schema, etc.) alonside categorical statements about the nature of life, the universe, and everything (e.g., “the primary purpose of every living thing is to act as a vessel for the DNA that evolves life through time,” which is not actually the primary purpose of every living thing unless you choose it to be). Some of this is helpful, if you don’t realize that failures should be treated as learning experiences and that a successful manager should hire good people. But this isn’t the stuff Dalio’s referring to when he says he likes to “imagine and build out new, practical concepts that never existed before,” and it isn’t the reason why the Principles have attained notoriety in the financial industry and beyond.

What radically differentiates Dalio’s business advice is its unsparingly calculating approach, and its insistence that people’s feelings are a kind of weakness that needs to be overcome rather than an aspect of themselves that should be dealt with sensitively and thoughtfully. Dalio encourages managers to embrace “tough love,” and the intentional infliction of “pain,” because, as his formula states, “pain + reflection = progress.” Citing (of course) Carl Jung, he says that “it is a fundamental law of nature that in order to gain strength one has to push one’s limits, which is painful.” Of course, that isn’t a fundamental law of “nature,” it’s a fundamental law of muscular development, and in other domains one can become stronger without experiencing much that resembles the painful testing of one’s limits. (For example, I have become a stronger listener and a stronger graphic designer, and neither involved much pain or the pushing of my “limits.”) Dalio has a struggle-centered view of the world, and says this often involves pitilessly deciding to withhold assistance from people for their own good:

In pursuit of my goal to give them strength, I will often deny them what they “want” because that will give them the opportunity to struggle… Watching people struggle and having others watch you struggle can elicit all kinds of ego-driven emotions such as sympathy, pity, embarrassment, anger, or defensiveness. You need to get over all that and stop seeing struggling as something negative.

Dalio, for example, knew that employees might “want” a dental plan, but realized that it was better for them to learn responsibility:

I didn’t provide dental insurance any more than I provided car insurance, because I felt that it was their own responsibility to protect their teeth… If they needed dental insurance, they could pay for it out of their own pocket. My main point is that I didn’t approach benefits in the impersonal, transactional way most companies do, but more like something I provided for my family. I was more generous with some things and expected people to take personal responsibility for others.

One might think it odd for Dalio to suggest that declining to provide dental care resembles the way people provide for families. But elsewhere he insists that “struggle” is what he wants for his children, too:

… I had determined that I wanted my sons to have only enough to afford excellent healthcare, excellent education, and an initial boost to help their careers get started. My perspective was influenced by my own journey through life, which took me from having nothing to having a lot. That taught me to struggle well and made me strong. I wanted the same for the people I loved. So, when I had earned a lot of money, I felt I had plenty of money to give away to others… I studied how other families approach the question of how much to set aside for family and how much to give away at what pace. While our family still has not answered these questions definitely, I know that I personally will give more than half of my money to those beyond my family.

(We might note that since Dalio is worth $17.4 billion, giving “more than half” of his money away could still leave his children with $2 billion each, but perhaps among the small group of people who own America, that is considered a mere “initial boost.”)

When it comes to employees, Dalio says you should show little mercy. Be willing to “shoot the people you love,” he says. And “evaluate accurately, not kindly,” because (paradoxically) “in the end, accuracy and kindness are the same thing.” This means taking care not to be too nice, because explaining someone’s weaknesses to them is what you do if you really care about them:

Compliments are easy to give but they don’t help people stretch. Pointing out someone’s mistakes and weaknesses (so they learn what they need to deal with) is harder and less appreciated, but much more valuable in the long run.

Make sure, of course, that you always make specific people feel bad about mistakes: “Instead of the passive generalization or the royal ‘we,’ attribute specific actions to specific people: ‘Harry didn’t handle this well.’” And make sure everyone knows it: “Use ‘public hangings’ to deter bad behavior,” he says, by which he means making sure to belittle (I’m sorry, accurately explain the failings of) employees in front of their coworkers so that the lesson is learned widely. But, he says, because employees tend to resist this at first, you must make sure that they understand that it is meant to help them. (Principles is therefore, in part, a handbook for treating people around you like absolute shit and then telling them it’s because you love them and it’s for their own good. In other circumstances we would call this textbook abusive behavior, but in the business world we call it “bestselling management advice.”)

Dalio says that people will resist harsh judgments and criticisms of their ideas, but so long as you are “open-minded” yourself you can chalk it up to the biases built into their nature: “It is human nature for people to want you to believe their own opinions and to get angry at you if you don’t, even when they have no reason to believe that their opinions are good.” There’s nothing wrong with feeling that the boss knows best: “It is not illogical or arrogant to believe that you know better than the average person, so long as you are appropriately open-minded.”

Dalio tells readers that they need to get over their mushy, sentimental reactions, and embrace radical truth for the sake of the common good. He gives the example of a wildebeest being eaten alive, witnessed on one of his many hunting trips, in order to show that what appears to be horrific suffering might actually be “wonderful”:

When I went to Africa a number of years ago, I saw a pack of hyenas take down a young wildebeest. My reaction was visceral. I felt empathy for the wildebeest and thought that what I had witnessed was horrible. But was that because it was horrible or was it because I am biased to believe it’s horrible when it is actually wonderful? That got me thinking. Would the world be a better or worse place if what I’d seen hadn’t occurred?… I could see that the world would be worse. I now realize that nature optimizes for the whole, not the individual, but most people judge good and bad based only on how it affects them. … Most people call something bad if it is bad for them or bad for those they empathize with, ignoring the greater good.

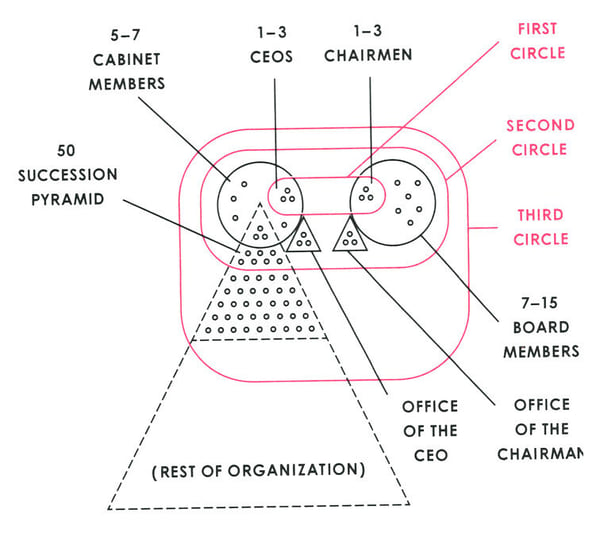

Imposing human normative judgments on the animal kingdom is, of course, tricky to say the least, but less important than Dalio’s classification of suffering as wonderful is the lesson he draws, which is that most people “ignore the greater good” and are narrowly focused on themselves and those they happen to care about. This kind of thinking helps Dalio rationalize his hatred of equality and democratic decision-making, and his belief that since people don’t know what is good for them, they must be corrected through the ruthless application of principles. As he says “treating all people equally is more likely to lead away from truth than toward it.” Instead, in the “idea meritocracy,” people are evaluated according to their ranking in the “believability index,” with the opinions of more “believable” people given greater weight in decision-making (Unsurprisingly, Dalio’s “believability matrix” ranks Dalio himself as the most believable of Bridgewater’s 1000 employees.) It is Reason that rules, not the majority. Dalio warns that nobody should mistake the idea meritocracy for a democracy, even though his employees sometimes do:

Make sure people don’t confuse the right to complain, give advice, and openly debate with the right to make decisions… At Bridgewater, I have encountered some people, especially junior people, who mistakenly think they are entitled to argue about whatever they want and with whomever they please. I have even seen people band together to threaten the idea meritocracy, claiming that their right to do so comes from the principles. They misunderstand my principles and the boundaries within the organization… Crowds get emotional and seek to grab control. That must be prevented. While all individuals have the right to have their own opinion, they do not have the right to render verdicts.

(You will not be shocked to learn that Dalio fears “populism” in politics as well.)

But even the “meritocracy” has its limits. While most decisions should be made by those who have the best ideas, there is an exception: if the Believable People ever propose anything that threatens the financial interests of the owners.

Even in an idea meritocracy, merit cannot be the only determining factor in assigning responsibility and authority. Appropriate vested interests also need to be taken into consideration. For example, the owners of a company might have vested interest that they are perfectly entitled to that might be at odds with the vested interests of the people in the company who, based on the idea meritocracy, are most believable. That should not lead the owners to simply turn over the keys to those leaders…

The principles, with all their radical transparency, can also be suspended for people’s own good. As he says, “while all these principles exist for the well-being of the community, there may come times when adhering to them could threaten the community.” He gives the example of a time when press reports were painting “distorted and harmful pictures” of Bridgewater, and he was forced to declare “martial law.” This was necessary because the idea meritocracy was under existential threat.

Dalio can often seem, to put it charitably, a wee bit paranoid. As he says:

There will be people who put what they want above the idea meritocracy and threaten it. Consider those people to be enemies of the system and get rid of them…. Don’t share sensitive information with the organization’s enemies. Both inside and outside of any organization, there are some people who will intentionally cause the organization harm. If these enemies are within your organization, you need to call them out… If the enemies are outside your organization and will use the information to harm you, of course don’t share it.

(Of course, Wall Street is swimming with some rather unpleasant sharks, who would knife their mothers for a primo stock tip, but encouraging people to see themselves besieged by potential enemies seems more likely to turn them into Moammar Gaddafi than Warren Buffett.)

Ray Dalio’s Principles are, as I hope readers have realized by now, comically delusional. He doesn’t even contemplate the possibility of working with people’s feelings rather than trying to shame them out of having them. He states explicitly, over and over, that people are “machines.” But since he has to impose all of these rules through what even he describes as a “benevolent dictatorship,” a lot of people don’t seem to want to be treated as machines whose emotions are a coding error. He has to turn them into machines. In fact, Dalio knows this: When it has been pointed out that nearly 1/3 of Bridgewater employees leave the company within their first two years, the hedge fund’s defense has always been that only a very select few are a good fit for this sort of environment. Dalio has said that while a negative picture is painted by the disgruntled people who couldn’t handle the culture, those who stay thrive, because they “self-select.” But that means that, even on the assumption that Bridgewater employees love all the surveillance and struggle sessions, there’s no reason to believe these are good management principles for anyone except the tiny fraction of the population that wants to grow up to become an emotionally neutered finance drone.

In fact, while my main objection to Dalio is moral rather than empirical, it’s worth noting that he cites almost no evidence supporting the efficacy of his most controverial principles. Dalio says the rules are “systematic and scientific,” but the proof that they work seems to consist solely of the fact that Dalio is very rich and Bridgewater is very successful. But Bridgewater is in part successful because Ray Dalio is a skilled investor who hires highly qualified and capable people. It’s also in part successful because of the proprietary trading algorithms Dalio has developed. Matt Levine of Bloomberg, who has observed Bridgewater for quite some time, has said that the company never seems to offer any real substantiation for the link between management culture and the high investment returns:

Does Bridgewater ever analyze whether its culture of constant self-examination and radical transparency is actually good for its investing? … [In Bridgewater’s self-descriptions] it’s never “our culture of constantly rating each other on iPad apps leads to better investment returns,” always “our culture of constantly rating each other on iPad apps leads to better ratings on the iPad apps.”… I am always left with the sense that the group therapy is the point, that the investor returns are a happy accident that subsidize all the introspection, and that Bridgewater is an odd little eddy in financial capitalism that uses investor money to fund the pursuit of personal enlightenment… I have joked before that Bridgewater’s business model is that it has a computer that does its investing, and that the computer uses the personal-rating games to distract the human employees so they don’t interfere with the investment process. If you spend all your meetings debating what the meetings should be about, then sure, you’re probably not going to have time to monkey with the investment algorithms.

Indeed, in Principles, Dalio does spend a lot of time talking about the various apps he makes employees use, and the way those apps improve themselves over time (one of them, for instance, spits out the relevant Principle for any given situation you happen to find yourself in). But on the few occasions when he tries to actually prove that his system works, he says things like: “While the believability-weighted answer isn’t always the best answer, we have found that it is more likely to be right than either the boss’s answer or an equal-weighted referendum.” Look how evasive this is! “More likely to be right.” How much more likely? And okay, it’s better than just letting the boss decide or putting it to a majority vote. But that doesn’t actually provide real evidence for the complicated system of public dressing-downs and real-time performance ratings. It might just show that there are some people in the office that lots of people think are qualified, and those people are qualified, and when you give them a greater say, decisions are marginally better. The question is: How would the system fare against one that didn’t have a culture of fear, but had some other way of deferring more heavily to people seen by their peers as experts?

Dalio shows little interest in testing whether his principles actually work, whether it does actually help if you tell a person all of their faults and then they cry in the bathroom and come back apologizing for having let their emotions get the better of them. My personal experience makes me doubtful. I run a small organization myself, with a team of seven people, and there would be no quicker way for me to destroy the entire enterprise than to begin acting on Dalio’s principles. Our magazine is succeeding because our editors are kind, understanding, and supportive, and we make each other’s work better rather than telling each other why it sucks. But don’t just take my word for it (though if Dalio gets to treat anecdotes as evidence, I don’t see why I shouldn’t get to). Accounts from Bridgewater itself offer reason to suspect that the system isn’t actually very efficient at all:

Meetings occasionally last for hours, sometimes simply because of a debate over why certain subjects are on the agenda or the quality of an employee’s presentation. Workers described being publicly berated for not completing homework assignments related to the firm’s culture or, sometimes, for “below-the-bar thinking.” … “I have never seen so many smart people in a room who never get anything done.”

But if Dalio isn’t conducting any social science research to determine that “public hangings” and the suppression of emotions produce positive outcomes, why are people like Gates, Cuban, and Bloomberg so enthusiastic about a book like this? Well, call me cynical, but I suspect there’s good reason why the billionaire class would be captivated by unscientific rationalizations for humiliating employees. Dalio’s principles simultaneously create the appearance of a fair and meritocratic workplace while making sure that the people at the top stay at the top and giving them license to ignore ordinary norms of respect and sensitivity. (You’ll be shocked to find out that in John Cassidy’s time visiting Bridgewater, “I saw senior people criticizing subordinates—but not the reverse” and that one former employee “says those close to Dalio aren’t criticized in the same brutal fashion as others.”)

Billionaires do not want to feel like bad people. They need ways to justify their power and the way they use it. So, Dalio, of course, has said that “People get what they deserve in life” and that “how much money people have earned is a rough measure of how much they gave society what it wanted.” (Strangely, nowhere in Principles does Dalio cite a single socially valuable thing that his company produces. It’s interesting, actually, to be lectured on principles by a hedge fund manager. Even among rich people, hedge fund managers stand out for the uselessness of their contributions to the world. At least Mark Zuckerberg made a website. These guys just place bets for other rich people. Actually, Peter Thiel has said that genuine scientific and technological innovators rarely make much money from their contributions, which undercuts Dalio’s contention that people who “give society what it wants” end up with an equivalent amount of money.) Principles does an excellent job at granting the reader license to be a huge dick, while insisting it is actually counseling modesty. Dalio says he dislikes “authoritarian” leaders and thinks people should challenge the boss just like the boss challenges them, yet he reserves the right to declare “martial law” and, of course, he wrote all the principles in the first place. (The book is overflowing with false modesty, with Dalio calling himself a “dumb shit” even though he is writing a bible full of grandiose rules.)

But one frightening thing about Dalio’s book is that, even while it talks frequently of “principles” and “values” (and even uses words like “love” and “caring”), there is a deep moral void at its center. I realized, about halfway through, that the entire manifesto is about helping you “pursue your goals” and “become successful,” but has nothing to offer on what principles should guide the setting of goals and the definitions of success. (Dalio does insist that he doesn’t care about making money—even though that’s all a hedge fund is for—which is good because it means he’ll have no objection to having his wealth appropriated and used to fund Medicare for All and the establishment of community land trusts in Detroit and Baltimore.) That means the book could equally apply whether your stated aim in life is something as benign as “start a small magazine” or as malevolent as “exterminate an entire race of people.” (Although while the principles would be a disaster here at Current Affairs, one place I can actually envisage them being used is in the upper echelons of a Nazi bureaucracy.) If you turn away from human morality, and treat corporate mission statements as your “principles” and “values,” you might be following some kind of “code” within the logic of the institution that actually produces totally indefensible consequences outside of it. This is one reason I speak so disparagingly of “capitalist ideology”; seeing corporate efficiency as a primary measure of worth means you have a busted moral compass that will keep you from recognizing suffering and your obligation to alleviate it. (It does not surprise me that Ray Dalio engages in the barbaric practice of big game hunting.)

It’s concerning that a book encouraging managers to mistreat their employees is a #1 bestseller. Most ordinary people, of course, would never want to sign up for the Bridgewater experience, but even people who do sign up for it can find it miserable:

[According to one former employee] “People who succeed at Bridgewater “are not afraid to get in your face. They believe you should have no emotion in anything you do. For many, because we’re all human beings, it’s a hard thing to get used to.” Says another: “What [Dalio] doesn’t understand is that if you kick a dog enough…[the dog] curls up and just whimpers. And he kicks pretty hard.”

It is an approach that is quite deliberately “inhuman,” that openly advocates treating workers as machines who are there to serve the company mission maximally effectively. It eliminates any obligation that a boss has to be warm, sensitive, and supportive. (Except in Dalio’s twisted sense of words like “support” and “compassion.”) Instead, it shifts the burden to employees: Their feelings are not parts of their essential self, but weaknesses getting in the way of productivity. For most of us, the Dalio world is a nightmare world, quite literally something out of the pages of Orwell. Matt Levine points out, though, that the Principles might actually be arriving at your job sooner than you think:

Every time you read about a discomfiting new management approach — getting rid of desks, continuous employee reviews, baseball cards – you should expect that it is coming to your own workplace in a year or two. Managers love experimenting with management, and the weirder a management approach is, the more it looks like management. “Just leave people alone and let them do their work, at their own desks” does not get you a Harvard Business School case study. “Make them hop on one leg while shouting self-criticism”: Now you are doing something.

The success of Principles can tell us something about the 21st century economic elite. “Liberal” Hillary Clinton supporters like Arianna Huffington and Bill Gates are proudly endorsing a handbook for creating a invasive hierarchical dystopia. In a blurb, the New York Times called Principles “both instructive and surprisingly moving.” It’s certainly instructive. But what it should mostly teach us is that the top levels of the economy are inhabited by cruel, delusional, selfish people who have no problem treating underlings as experimental subjects. Principles should sit on leftists’ bookshelves next to Capital as a clear argument that those who have amassed an obscene portion of the world’s wealth do not deserve it and are morally dysfunctional. If it can teach us a single principle, it is that workers should respect people like Ray Dalio exactly as much as he respects them.

If you appreciate our work, please consider making a donation, purchasing a subscription, or supporting our podcast on Patreon. Current Affairs is not for profit and carries no outside advertising. We are an independent media institution funded entirely by subscribers and small donors, and we depend on you in order to continue to produce high-quality work.