Manufacturing Nostalgia

An avid collector puts the sports card hobby into focus. The hobby isn’t so much a parallel of the free market as it is the free market emulating itself.

For much of my childhood in the early 2000s, my parents would drive me to the local sports card shop to pick a pack or two from the ever-rotating boxes of licensed card products. Like top shelf liquor, their names emphasized swank: Topps Finest, Bowman’s Best, Skybox Premium, Donruss Elite, Playoff National Treasures, Leaf Limited, Pacific Crown Royale, Upper Deck Black Diamond. The cards and foil wrappers alike conformed to a simple visual grammar, with action shots of professional athletes printed on the fronts and rows of statistics printed on the backs. In place of seasonal batting averages or shooting percentages, the foil wrapper versos instead reported statistical probabilities concerning the manufacturer: the odds of “pulling” an autographed card, a holographic card, or a card containing a clipped swatch of a game-worn jersey. Accompanying the mathematical ratios were instructions for entering “No Purchase Necessary” promotions for a chance to obtain free cards by mailing in a 3×5 index card with one’s name and address. Initially codified in response to a prevalence of contest scams, North American sweepstakes laws compelled trading card companies—purveyors of chance—to run these NPN promotions, as they were called, in order to put their products on shelves. Legally speaking, the NPNs were all that separated opening the foil packs from buying scratch-offs, or betting on horses.

For an adolescent, the local card shop was a crash course in the economics of nostalgia. Sports card enthusiasts waxed poetic about their youths spent collecting and cards that their mothers had thrown away, while speculating on the futures of rookies and stars and speaking of “investments.” Glass display cases housed rows of rare cards for sale or trade. Dollar bins held countless others strewn about, the mass-produced cards from the late ’80s and cards of forgotten draft picks. Always within the line of sight was a Beckett Sports Card Monthly price guide, which standardized card values across the country based on an inscrutable combination of variables such as upcoming Hall of Fame inductions, recent Super Bowl victories, previous sales, and card condition. And so the price stickers in the card shop’s display cases bore the markings of grades and other signifiers: “gem mint,” “3x MVP,” “#/100.” Within the brick and mortar confines of the suburban Maryland strip mall, the local card shop was a veritable marketplace with liquid assets, commodities forecasting, and market making.

Like many other card shops across the country, my local card shop had sprung up in the 1990s to capitalize on the demands of a growing hobby. To increase profit margins with this cardboard craze, trading card companies began releasing hobby-only versions of products, distinguished from retail products by exclusivity—they couldn’t be found at the local drugstore or K-Mart—and named accordingly as luxury brands. With these hobby products, the card companies followed a simple economic calculus: a higher price tag meant more favorable probabilities on the foil wrappers, as well as exclusive, “hobby-only” cards. The mark-ups were lucrative. By the time I had started collecting in the early 2000s, hobby products were already reaching unconscionable prices ($100 for a sealed box of sports cards was a common sight). But 2003 saw the release of a new tier of product: Upper Deck’s Exquisite Collection. Replacing the foil wrappers, each etched wooden box housed just five cards and retailed for $500. Exquisite Collection was seemingly a reductio ad absurdum of manufactured scarcity. Each card on the checklist was individually serial numbered to no more than 225 copies. The basketball card release built on an already exciting year for the hobby, the rookie season of budding phenom LeBron James. The product sold like wildfire. Fifteen years later, an unopened box would sell for $43,200 at auction.

Today, the situation is, astonishingly, even worse. The $5,000 padlocked metal suitcases of Panini Flawless have replaced the $500 wooden boxes of Upper Deck Exquisite. A secondary industry of live-streamed “box breaks” has cropped up, enticing collectors to bid on the right to receive all cards of a specific team or player in a box opened via livestream by professional “breakers,” viewed on Twitch with masturbatory anticipation. Opportunistic middlemen waited for hours in lines at Target during COVID in order to clear the shelves of boxes and packs ostensibly intended for children. Card grading companies are backlogged by months due to the paucity of staff trained to numerically evaluate card condition, including corner sharpness and centering. Condition is so critical that card companies have started releasing cards that are already encased in thick plastic holders in boxes. Auction houses plug sports card investment portfolios and justify ROIs with charts and graphs. The sports card economy is so robust that in just a year, rare rookie cards of the Charlotte Hornets basketball star LaMelo Ball have completed entire life cycles within the hobby: from production and quality control in a factory to transitory placement on Walmart shelves; to unveilings in YouTube box breaks; to evaluation by grading companies; to hyperbolic description in auction house catalogs, culminating in gavel sales for tens of thousands of dollars. Each step in the life cycle entails speculation on monetary terms: whether the release will be successful; whether a quick profit on retail boxes can be turned; whether a box contains a “grail”; what grade a card will receive; whether LaMelo Ball will have a Hall of Fame-worthy career. For each one of these LaMelo rookie cards pulled, encapsulated, and sold for bloated hammer prices, there are thousands of other cards with stories attesting to a different kind of wastefulness, instead digested and offloaded in dollar bins or Goodwill donations or simply thrown away.

The sheer complexity emerging from the marketization of the sports card hobby begs a simple question: what happened to the days of baseball cards in shoeboxes or dime-store wax packs with slabs of bubble gum? And what does this tell us about nostalgia?

The history of trading cards is a 140 year history of targeted marketing to children. Though “trade” cards were packaged with tobacco products throughout much of the 19th century as a form of advertising promotion, the 1880s saw the first collecting craze in the United States. Tobacco companies such as Allen & Ginter and W. Duke, Sons & Co. produced cards depicting actresses, athletes, tropical birds, race horses, coat of arms, flags of nations, Native Americans, and generals of the Civil War with the explicit intent of enticing children either to purchase tobacco products themselves or harass their parents into doing so. As described by Dave Jamieson in Mint Condition: How Baseball Cards Became an American Obsession:

“The cigarette ‘would lie down and die tomorrow’ if it weren’t for the high volume of sales to ‘small boys,’ one tobacco man told the Chicago Daily Tribune in 1888 … [S]ome tobacco salesmen grew convinced that the pictures were instrumental in turning a generation of city boys into cigarette ‘fiends’ in the 1880s. One dealer told the Tribune that, ‘It would do away with half this boys’ trade, I think, if there was a law prohibiting the giving away of pictures in packages of cigarettes.’ Politicians in several cities around the country tried to put just such laws on the books. Charleston, South Carolina, effected an ordinance in 1887 prohibiting the sale of cigarettes with baseball cards.”

The cards were an exploitative marketing tool intended to grow brand loyalty, printed by the tens of millions.

In 1890, James Buchanan Duke (namesake of Duke University) formed the American Tobacco Company through a series of mergers, cornering the market on tobacco sales in the United States. As reported in local papers, the merger was brought upon largely by the strains of the trading card arms race that had developed among companies, which cost the companies an estimated combined $2 million a year. “The central object of the [American Tobacco] trust is to reduce the cost of advertising to a minimum, and, as the pictorial end has been the most expensive, it is sure to be curtailed if not dropped altogether,” reported the Indianapolis Journal. And yet, despite the production costs incurred and the temporary bans on distribution, the cards proved essential to the business model. The merger would usher in the golden age of tobacco cards. The American Tobacco Company produced hundreds of trading card series to be packaged with cigarettes and chewing tobacco, with each printed card bearing subsidiary brand names such as Sweet Caporal, Piedmont, and American Beauty on the back. Though the Supreme Court dissolved the American Tobacco Company in 1911 under the Sherman Antitrust Act, the cards had proven successful marketing ploys as they had been imprinted on the American collective memory at the turn of the century. “Every American over thirty remembers the colorful little cigarette cards distributed with such a lavish hand by the fiercely competitive tobacco companies between 1886 and 1915,” read the opening lines of the 1945 Esquire article “The Era of the Cigarette Card.”

Today, many collectors ask why so few of the mass-printed tobacco cards have survived to this day, but the real surprise is that so many remain. Unlike the cigarette cartons or tobacco pouches themselves, of which virtually none survived, the cards were saved by the millions. Even a century later, “estate fresh” collections of tobacco cards still turn up in attics and drawers and Antiques Roadshow segments with predictable regularity. It is for this reason that the designation of cards as “ephemera” within collecting circles is a misnomer. Manufacturers always intended for the cards to be collected and thus valued. That they still are is a measure of the totality of marketing success.

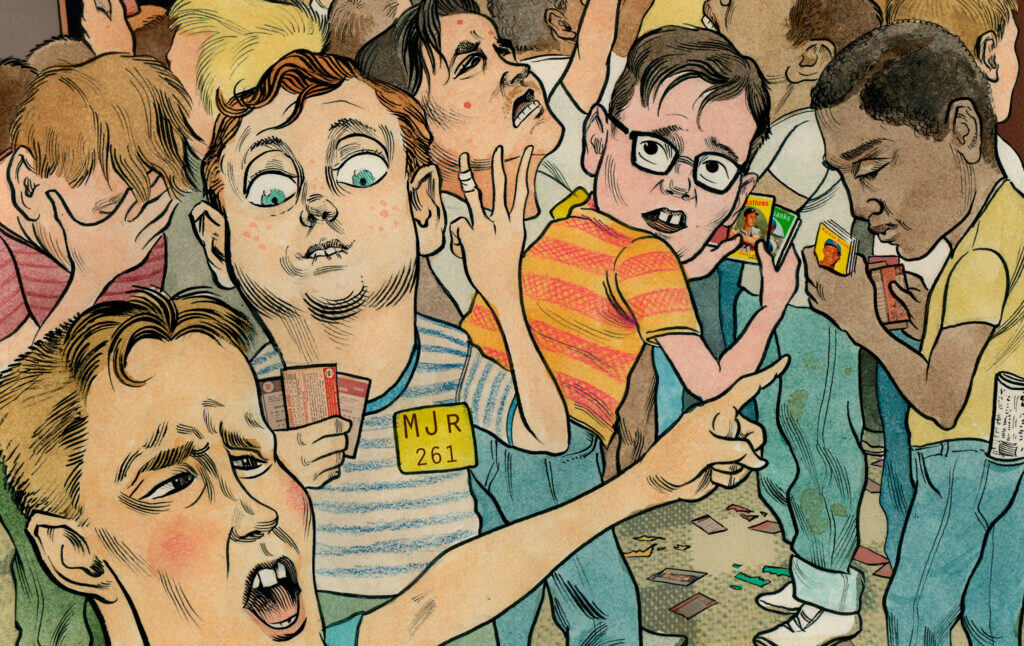

It was because American boys ascribed value to trading cards that collecting became a ritualized way of learning basic economic principles. From teachers in New York City to President Taft in the White House, adults caught children exchanging cards via trades, sales, and bets. “Virtually every boy for almost three decades not only avidly collected and treasured these gaily-colored and educational little pasteboards, but generally, in order to complete some highly-prized set, conducted an exchange with all the shrewdness and persistence of a Yankee horse-swapper,” noted the 1945 Esquire article. Local newspapers at the turn of the century were littered with articles describing the trading card proto-market. In an 1890 article “Youthful Picture Dealer: Cigarette Cards are His Wares and He Does a Good Business,” the Twice-a-Week Plain Dealer reported:

“One of the queerest of many ways of getting a livelihood is that adopted by a boy who runs the streets of Louisville, KY. This boy is generally to be found among the newsboys and bootblacks, but he never sells a paper or blacks a shoe, says the Louisville Commercial. His business is the buying and selling of cigarette pictures. … For new pictures which have just come out of the boxes he gets twenty-five cents a hundred. Sometimes he has special pictures which bring as much as one cent apiece. Not very long ago he sold 1,000 pictures for eight dollars.”

An 1890 Indianapolis Journal article entitled “A Kindergarten for Gamblers” described: “In almost any street in this city, even in the most fashionable neighborhoods, you can see little clusters of children between the ages of six and twelve years playing dice, pitching pennies and cigarette cards.” “We all know the craze of boys for cigarette pictures which they match and trade with,” read a 1911 op-ed in The Washington Times. The juvenile exchange of cards was an economic playground where children first learned of valuation, trading, and demand, thus becoming familiar with the terms of the free market.

The long-term consequence of the aggressively marketed and traded tobacco card was the emergence of a new form of nostalgia—one for the childhood collecting days of yore. Consider, for example, the 1929 New Yorker article “A New York Childhood: Cigarette Pictures,” a saccharine piece dripping with sentimental recountings of boyhood collecting in Brooklyn:

“The honeycomb man plods by at intervals, the honey in a large china platter which he carries on his head. The policeman is fat, and wears a big blue hat. …The tinkle of the bells on the car horses is soft, in a minor key. … In this setting, forty years ago, I made my collection of cigarette pictures.”

This boyhood nostalgia bore out in the emergence of the adult card collecting hobby, which, by 1945, was robust enough to pique the interest of major periodicals. “Collectors Still Continue Fad That Faded Long Ago: Sports Writer, Who Saved Pasteboard Portraits in Youth, Finds Many Continue to Cherish Old Sets,” reported a 1945 Sporting News headline. The Esquire article published in the same year concluded with a reflection on the nascent adult card collecting hobby and its connection to sentimentalization:

“The hobby enjoys a … great advantage: these cards have a strong nostalgic and sentimental attraction in that every American boy once treasured them as his most priceless personal possession, an appeal that coins, old silver, antiques, first editions, old prints, buttons, street car transfers, match book tops or beer bottle caps cannot possibly equal.”

Lost amid this sentimental attachment to sports cards was the fact that it was purposefully concocted by aggressive corporate marketing. The irony of the card collecting hobby—itself predicated entirely upon valuation and monetary exchange—is that its mythology of nostalgia has always blotted out the explicitly economic conditions that gave birth to it.

Though people often associate baseball cards with bubblegum, it wasn’t until the 1930s that the two were sold together, an innovation widely credited to the Goudey Gum Company. “Big League Baseball hit like a bombshell in the early spring of 1933 and was an instant success,” noted a 1970 nostalgia piece in The Ballcard Collector. “Every kid in school had at least a few and more than one stack was commandeered by the teacher to rest on her desk until school was out.” The Big League Baseball series was a marketing boon, driving total sales up from $335,000 in 1932 to $1.4 million in 1933. Among card collectors, the set is remembered for a deliberate arithmetic manipulation intended to keep children purchasing gum: card #106 was never issued in packs, instead printed a year later and mailed to the disgruntled kids who wrote to the company asking why they couldn’t find the card. Such marketing gimmicks were ubiquitous among companies, including checklists to encourage children to complete sets, mail-in incentives such as photographs or baseballs issued in exchange for an accumulation of enough cards or wrappers,1 and withheld “chase” cards in order to make set completion extremely unlikely, if possible at all.2 These schemes showed that company profits were ultimately at the root of the whole trading card phenomenon and also ensured the existence of a flourishing secondary trading market among kids.

Indeed, the history of trading cards is marked by targeted and exploitative marketing, children exchanging cards in ritualistic fashion, and the commodification of adults’ sentimental attachment to their youth. In the ’50s, Topps Chewing Gum, Inc., began to emphasize the cards rather than the gum as the primary product. The cards were a hit. “The most furious trading in the U.S. nowadays goes on not in Wall Street or the Chicago grain market but among youngsters out to collect a connoisseur’s fistful of baseball trading cards,” the first issue of Sports Illustrated reported in 1954. Topps sold hundreds of millions of cards a year.3

It was the nostalgia of the ’50s and ’60s Topps generations, with deep pockets in adulthood, that elevated sports card collecting into a booming exchange with real money, codified with valuation standardization (Beckett Sports Card Monthly price guides) and trading floors (card shows in VFW halls).

As reported by The Atlantic:

“By the ’80s, blue-chip cards were outperforming the S&P 500 and collecting had transformed from a sleepy novelty into a billion-dollar industry. In 1991, approximately 18 million people in the United States bought at least one newly issued pack, spending $2 billion to acquire nearly 21 billion baseball and other sports cards. A 1990 market study found that 77 percent of collectors were drawn to cards partly or fully because they considered them a ‘good investment.’”

The sentiment is echoed in Mint Condition:

“By the ‘80s, baseball card values were rising beyond the average hobbyist’s means. As prices continued to climb, baseball cards were touted as a legitimate investment alternative to stocks, with the Wall Street Journal referring to them as sound ‘inflation hedges’ and ‘nostalgia futures.’ Newspapers started running feature stories with headlines such as ‘Turning Cardboard Into Cash’ (the Washington Post), ‘A Grand Slam Profit May Be in the Cards’ (the New York Times), and ‘Cards Put Gold, Stocks to Shame as Investment’ (the Orange County Register). A hobby bulletin called the Ball Street Journal, claiming entrée to a network of scouts and coaches, promised collectors ‘insider scouting information’ that would help them invest in the cards of rising big-league prospects. Collectors bought bundles of rookie cards as a way to gamble legally on a player’s future.”

The remaining years in the hobby’s development are often understood through the dialect of finance: the sports card “bubble” burst in the early ’90s due to overproduction, and the hobby only stabilized when manufacturers artificially throttled the sports card market with scarcity in the form of luxury products with serial numbers, autographs, holograms, and swatches of game-worn jerseys embedded into the cards themselves.

Like clockwork, cards printed a few decades earlier surge in value when kids of that era reach middle age. Rare basketball cards from the ‘90s are currently skyrocketing in this era of sports card modernity, regularly eclipsing thousands of dollars. First-edition Pokémon cards can be traded outright for luxury cars. “Nostalgia Boosts Baseball Cards of the ’80s and ’90s” read a recent Wall Street Journal headline. Nostalgia is a hell of a market force, Forbes et al. insist.

A curious fact about card collecting is that any person in the street will react the same way when confronted with its economics: “Why would anyone spend that much money on a sports card?” they’ll ask. The incredulous reaction is an incisive critique. It embodies a visceral skepticism of the market forces that drive the value of a cardboard rectangle up simply because it is a Baudrillardian simulacrum of Michael Jordan or has razor-sharp corners or is made scarce through limited print runs. No one in their right mind could possibly rationalize away the kinds of downstream behaviors that the marketization of sports card trading has induced. Who, after all, would ever guess that an entire workforce would be devoted to grading sports cards? Or that posters on blowoutforums.com would actively monitor weather predictions in Tampa Bay in the days running up to Super Bowl LV, due to projections on how well Chiefs quarterback Patrick Mahomes would play in rain, which would in turn affect his card prices? To that person in the street, the unmistakably contrived nature of card collecting is precisely what makes the hobby such an odd and aberrant spectacle to behold.

And yet, it is the hobby’s proximity to the contemporary financial markets that makes its perceived absurdity so significant. Card collectors’ meteorological forecasting bears an uncanny resemblance to oil futures speculators’ obsession with typhoon patterns. Automated eBay sniping software for placing auction bids at the last possible second is reminiscent of high-frequency trading algorithms. The list goes on, and the parallels run deep. If we are to accept the frivolity of the sports card market, we must also accept just how frivolous the free market itself is, with traders exchanging stocks and derivatives and derivatives of derivatives ad infinitum; workers drilling tunnels for fiber-optic cables from New York to Chicago to reduce the latency of algorithmically-executed trades; and hundreds of thousands of people monitoring GameStop stock due to the phenomenon of the “short squeeze.” Like the sports card hobby, the free market writ large is a process of alimentation and digestion. It is thus a process of immense waste production—wasting time, wasting resources, wasting labor, and laying waste to those caught in its wake.

Only when considering the market forces that have created and inflated the sports card hobby—the incessant, manipulative, and highly litigious corporate marketing, the ritualized exchanges of cards by children, and the “nostalgia” induced by it—does the truth of the hobby come into focus. The hobby isn’t so much a parallel of the free market; the hobby is the free market recursively emulating itself, with contrivance begetting contrivance, waste begetting waste.

It was in the pages of Beckett Sports Card Monthly, sandwiched between pricings of LeBron James rookie cards and advertisements for a never-ending stream of upcoming products, that I first learned of the National Sports Collectors Convention. Sports memorabilia enthusiasts, trading card companies, auction houses, and dealers converged for four days during the first week of August each year to buy, sell, trade, open, and grade cardboard of all shapes and sizes. I was 11 when I saw the advertisement, and I was transfixed. Until the pandemic, I had attended every “National” since 2006.

The National is an intensely multisensory experience, with colors and sounds incessantly vying for one’s attention and drawing one in. Refractor cards glisten under display case lighting. Synchronous screams emanate from promotional events as unopened boxes are passed out by trading card companies. Enormous banners showing promoted cards and consignment opportunities hang from the rafters. Bells ring in the convention hall, signifying new raffle winners at booths At the Atlantic City 2016 National, it was insidiously unclear where the show floor ended and the casino floor began.

As a marketplace, the National has always been something of an extravaganza. No individual seems remotely coherent unless one considers the broader market forces at play. Year after year, grading companies offer onsite services behind drawn curtains, as if to hide the inherent subjectivity of the process. The UltraPRO™ guy sells a range of hobby paraphernalia, from card sleeves to binder sheets to display cases. Collectibles insurance companies set up shop to offer quotes in the event of an “act of God.” Dealers offer candy and koozies to attract prospective buyers to their booths (while leaving condiment-laden hot dogs on display cases housing millions of dollars worth of cards). Auctioneers market bloodied, game-worn jerseys by stressing potential ownership of superstar athlete DNA (the utility of which would be left to the imagination of the prospective buyer). Hobbyists pull out tens of thousands of dollars in cash from their pockets or impossibly rare tobacco cards from backpacks for exchange. Famous and semi-famous athletes and celebrities are escorted to and from booths for autograph signings (I exchanged pleasantries with the Soup Nazi from Seinfeld on not one but two separate occasions). FBI agents appear from time to time to investigate fraud rings and make arrests. My 14 years of attendance have revealed these enduring consistencies among the National’s main cast.

The latest nostalgia surge is leaving its marks. With each passing year, my college roommate and I seem to encounter larger and larger crowds surrounding the box breakers—seated men live streaming their hands and hands alone as they open tens of thousands of dollars of sealed foil packs in rapid succession. No matter the pack ripper or box breaker, the speculative euphoria among the crowd inevitably dies down with the opening of the last pack, leaving behind the settled dust of foil wrappers strewn about. Like confetti long after the Gatorade showers and trophy presentations, the shimmering wrappers can be spotted on the floor, overflowing from trash cans, stuck to shoes. As soon as the cards inside have been revealed, and the statistical probabilities have turned into economic certainty, the wrapper goes from an object of enticement to pure detritus. With the memories made and the seeds of nostalgia sown, it is someone else’s job to clean up the mess left behind.

Premiums were a common promotional device; the Old Judge cabinet photographs and Goudey R309-1 premiums are two representative examples. ↩

See, for example, the 1933 George C. Miller set and Ivy Andrews (“To avoid being obligated to supply too many valuable prizes, the George C. Miller Company withheld from circulation all but a very limited number of Ivy Andrews cards”), or the 1932 U.S. Caramel Presidents set and William McKinley (“The McKinley card was actually not confirmed to exist until the early 1990s and is so scarce that the set is considered to be complete at 30 cards rather than the 31 with McKinley included. Distributed in limited supply to encourage continued sales of their product to children attempting to complete their set. A redemption was available by sending in a complete set of cards to be exchanged for a one-pound box of assorted chocolates.”). See “Robert Edward Auctions – The Premiere Sports Auction House” and “Non-Sports Cards – 1932 U.S. Caramel Presidents | PSA CardFacts®,” Professional Sports Authenticator (PSA). ↩

Topps would win the trading card battle with its rival, Bowman Gum Company, and monopolize baseball card production for two decades by coercing young players into signing contracts guaranteeing exclusive rights to reproduce their likenesses. Though the FTC would file an antitrust lawsuit against Topps in the early ’60s, it would lose in appellate court. It is yet another angle to the exploitation and marketization submerged under the saccharine conjurings of baseball cards and bubble gum. ↩