The Day Wells Fargo Closed

Welcome to the year 2040, when a bank once deemed “too big to fail” is shut down for the benefit of the public.

Wells Fargo closed its doors today for good, ending the megabank’s centuries-long reign of power in the global economy.

I had just submitted my final grades for the semester and was finishing my morning tea when the alert popped up on my phone. I swiveled around in my chair and threw my hands into the air. Yes! I had been anticipating this day for months, and it had finally arrived. I heard a few cheers erupt from the bustling sidewalk outside my office window. I grabbed my bag and slid out, from behind my bookshelf, the decorated poster board with bold lettering that I’d prepared for just this occasion. I walked quickly out of the building to join a small crowd that had gathered spontaneously in the university quad and whose chorus, “Hey, hey, ho, ho, Wells Fargo has got to go!” was growing louder by the minute.

Eighteen years ago, a bank closure wouldn’t have gotten this kind of attention. Fortunately, things changed. People were radicalized by an onslaught of environmental and economic catastrophes, bank scandals (especially scandals involving Wells Fargo), and a creative use of financial education that, collectively, brought banks’ power into sharp focus. Banks spent millions of dollars each year telling people to take responsibility for their finances and budget their way out of poverty. Organizers and academic researchers like myself started to leverage the financial education that banks had financed. We didn’t just teach people how to contest their overdraft fees or fix errors on their credit reports. We taught popular education and built political power. We explained how private banks make money off of dubious account fees and how proprietary credit scoring algorithms surveil and discriminate. So, many people were ready to celebrate the closure of a bank that had once been deemed “too big to fail.”

No one knows exactly what set off the chain of events that caused regulators to finally close the bank. As a researcher studying the power and politics of banks, I had watched for decades as the pressure against Wells Fargo mounted and more people called for change. Native organizers identified Wells Fargo as a primary target for boycotts and divestment campaigns, given the bank’s routine violations of Indigenous rights. The Action Center on Race & the Economy, a hub for organizations working to bring racial justice and accountability to Wall Street, ran a campaign called “Forgo Wells.” Even some progressive policymakers like Sen. Elizabeth Warren started calling on regulators to break up the bank. I couldn’t be sure of the final straw that caused regulatory action. But, I have a few guesses.

Maybe regulators were taking climate change seriously as a systemic risk to the financial system. After all, this year, 2040, is the year that scientists predicted global warming would reach 1.5 degrees Celsius. The year is still symbolic even though we passed the temperature threshold a while ago.

Wells Fargo was always financing harmful projects like coal mines and oil pipelines.1 Wells Fargo was one of the “Dirty Thirty,” a list of banks compiled by environmental justice groups and ranked based on their investments in fossil fuels, which scientists warned were causing the planet to warm to unsafe levels. Even after countries signed the Paris Agreement in 2015 (what ended up being a normative approach to preventing climate atrocity), Wells Fargo amped up its investments in fossil fuels and poured more than $223 billion into coal and oil industries. And these projects wrought renewed public ire when climate reports again foretold impending planetary and human catastrophes unless we stopped using fossil fuels. Some environmental activists even set themselves on fire to raise awareness about the dire situation and compel meaningful action.

Or, maybe it was because of new scandals such as problems with the bank’s blockchain and cryptocurrency that finally bubbled up to the surface or fresh accusations of discriminatory lending. During the pandemic years, when homeowners were refinancing their mortgages and locking in their wealth alongside low interest rates, investigative reports uncovered evidence that the bank engaged in discriminatory lending. Wells Fargo approved fewer than half of Black borrowers’ loan applications while approving nearly three quarters of white borrowers’ applications. After claims of discrimination, major cities vowed to prohibit the bank from receiving public contracts. Policymakers held hearings to publicly chastise the bank, and regulators tried to force some degree of accountability through sanctions.

Or, maybe because regulators had discovered an old scandal was greater in scope than originally reported. What began as an investigation into the bank’s retail banking unit—the “fake accounts” scandal that surfaced in 2013—quickly spread to wealth management and other units. What happened was that Wells Fargo employees had opened bank accounts and lines of credit without customers’ permission. Then the bank charged customers fees on accounts they didn’t know they owned! And, of course, they targeted Black, Latino, and Native customers. The Justice Department, Securities and Exchange Commission, and Federal Bureau of Investigation kept widening the scope of their investigations because they kept discovering new leads. For a while, it seemed like regulators were issuing new monetary sanctions against the bank every few months for this decade-old scandal.

These scandals were actually just the most recent ones in the company’s much longer history.

In an embezzlement scheme uncovered in the 1980s, Wells Fargo employees stole around $21 million from the bank by taking advantage of a delay in the computerized system that processed transactions from its branches.2 Harold Smith, a boxing promoter and chair of a sports enterprise named after Muhammad Ali, helped to embezzle the funds. Bankers allegedly used the money to secure lucrative oil deals in African countries by leveraging the famous boxer’s name. The scheme ran undetected for two years until a lawyer for Muhammad Ali3 became concerned with the sports enterprise’s extravagant spending. The lawyer tipped off an employee at the branch where the funds were being embezzled, and the employee noticed irregularities. A lot of people were caught up once the scandal was revealed, including Smith and at least four bank executives along with the chairman of Wells Fargo’s board.

Investigations revealed an embezzlement scandal that had all the trappings of a Hollywood action movie—a setting not too far away from the Beverly Hills branch where most of the money disappeared. In interviews with investigators, Smith described going into hiding once the fraud surfaced, his sons being kidnapped by a Wells Fargo representative, and being chased by armed pursuers through the snowy mountains of Colorado. So many of the retellings cast Smith as the protagonist in this saga. But it probably didn’t take much effort for Wells Fargo to leverage the perceived overachievement of a successful Black man and make him the public face of a scandal in order to downplay its own responsibility. White America always has a stage set for a Black man to play a part in their script.

For years after the “fake accounts” scandal surfaced, Wells Fargo executives paraded in front of regulators and congressional committees with empty apologies and feigned deference to oversight. Policymakers held special congressional hearings where Wells Fargo executives were required to testify. Wells Fargo paid over $4 billion in fines and penalties to regulators; this had become part of the bank’s routine cost of doing business.

Wells Fargo never really recuperated whatever was left of its flimsy public image. And it seemed like everyone knew the latest “fake accounts” scandal wasn’t an exception. It was just part of how the bank and the wider financial industry operated. Every moment is a sales opportunity, every customer a potential mark, every minute a chance to make a profit.4 It was well known that other banks had aspired to Wells Fargo’s corrosive sales culture. Other banks just didn’t get caught.

Wells Fargo employees were vocal about the bank’s sales culture when it came time for them to tell their stories. In interviews with reporters, employees talked as if they were deployed as soldiers during wartime or worked in sweatshops of the 1930s, saying that working in the bank’s sales offices was worse than anyone could have imagined. One employee revealed, “I was in the 1991 Gulf War. … This is sad and hard for me to say, but I had less stress in the 1991 Gulf War than working for Wells Fargo.” Employees were ridiculed and threatened by supervisors. Some were forced to walk outside on the hot concrete under blistering sun as punishment. Just imagine how climate change made that punishment so much worse! It wasn’t safe to be outside even in those days, when the surface temperature of sidewalks and parking lots rose to 150 degrees Fahrenheit. One employee was threatened with being “transferred to a store where someone had been shot and killed” if they failed to meet their sales goals.

Wells Fargo got its start in the Gold Rush of California.

In the late 1840s, masses of people migrated westward hoping to strike it rich after gold was discovered in California. The mostly white settlers who began occupying the California foothills needed loans to buy mining equipment and other supplies. The lucky ones needed to exchange their gold dust for paper money. And that’s when Henry Wells and William Fargo, executives of the stagecoach mail delivery company American Express, devised a plan to secure their own fortunes. Wells and Fargo founded their bank to capitalize on the colonial occupation and gold speculation of the West.

The settlers streaming into the foothills didn’t have it easy. Mining for gold was worse than hard. The work was dangerous. Food and supplies were expensive. In today’s dollars, a dozen eggs cost upwards of $90 and the price of a full breakfast was $1,200. The terrain was rugged and living conditions were rustic. Since they feared missing any chance to strike it rich, miners worked nonstop and rarely took breaks. They dug through mud and waded through freezing rivers, sometimes losing fingers and limbs in the process. Competition and jealousy between miners often led to murder.

What happened next is what always happens. Big corporations swooped in, made working conditions worse by subjugating the labor of individual prospectors, destroyed the local environment with industrialized mining, and took off with the profits. White settlers, the people who were the original perpetrators, became the victims of corporate speculation.

Native peoples were attacked, subjugated, and killed during this time, too. Tribes were forced off their ancestral lands and many were confined to military reservations. The California state legislature gave white settlers legal permission to enslave Native peoples and their children. Thousands of Native peoples died from disease and malnutrition. White America killed them in the name of a shiny, precious manifest destiny—another script in the playbook of a country eager to put nonwhite peoples in their place. In a recent interview, a descendant of a Native group that was attacked during the Gold Rush recalled these events: “These … were massacres. We didn’t have weapons to fight back,” said the Yuki tribeswoman. “We were their hunt. And what we lost was more than lives.” A history professor indicted California’s legislators, saying they had “established a state-sponsored killing machine.”

It’s an eerie coincidence that Native customers in California were among the first targeted by Wells Fargo’s ‘fake accounts’ scandal. Two hundred years doesn’t make much of a difference when history rhymes.

Regulators’ decision to close down Wells Fargo was prudent, confidential. We do know that the Federal Deposit Insurance Corporation (FDIC) listed fraud on the paperwork as a reason for the bank’s failure. And whatever the reasons, things ran pretty smoothly once regulators set into motion the process for dismantling the bank.

It turns out that regulators have standard operating procedures for closing down a bank. Regulations even require banks to have plans in place for how their private company should be resolved through bankruptcy, if it were to fail. So it was really just a matter of dusting off several large, three-ring binders that had been anchoring down bookshelves in a dimly-lit basement of some government building. Or, more likely, opening computer files of the digitized standard operating procedures and scrolling through the pages. Regulators and bank employees had step-by-step instructions and well-organized checklists to guide the process.

Organizers, policymakers, and academic researchers like myself learned that dismantling a bank isn’t nearly as impossible as banks and their allies make it out to be. Actually, we learned how easy it is to dismantle a megabank.

Since Wells Fargo was a federally chartered bank, The Office of the Comptroller of the Currency (OCC) was able to step in and terminate the bank’s charter. The OCC put the FDIC in charge of resolving the bank. And once the FDIC was in charge, it took about seven years to close the bank.

The average time to close a failing bank is five years. But Wells Fargo was big and complex, and there was some disagreement at the beginning about how the bank’s assets should be resolved. The President of the United States got involved. She suggested that the FDIC manage the bank to prevent it from failing. The FDIC was leaning toward this option, and it was rumored that the U.S. Secretary of the Treasury and Board of Governors of the Federal Reserve System were ready to approve this approach that would have kept the bank’s assets in the private sector. However, a series of news reports claimed that many high-ranking politicians were private shareholders with a stake in Wells Fargo’s assets. And private shareholders would have ended up benefiting financially from the FDIC’s management. The reports didn’t reveal any names. But, given these concerns, the FDIC chose a public and more transparent method of resolving the bank.

The FDIC decided to settle Wells Fargo’s accounts by paying all of the bank’s depositors. In other words, the FDIC gave people their money back. This included retail and corporate or business accounts. At the time, commercial bankers were serving nearly 480,000 customers and wealth advisors were managing the investments of 2.8 million customers. And these numbers are probably low estimates since Wells Fargo had nearly $2 trillion in assets.

There were several benefits to this method of deposit payoffs. The FDIC did not have to decide whether other banks were healthy enough themselves to purchase a failing bank’s assets and liabilities. Some of Wells Fargo’s more recent problems actually stemmed from agreeing to purchase the assets and liabilities of banks that failed during the Great Recession. Wells Fargo had agreed to these purchases at a time when the federal government was trying to restore stability to the financial system and stepping in to resolve failing institutions. Wells Fargo’s problems clearly started before the Great Recession in 2008. But taking on other banks’ problems certainly didn’t help.

Wells Fargo also had over 250,000 employees that needed to find jobs elsewhere. Many Wells Fargo employees sought jobs at other banks. Since the financial industry was one of the fastest growing sectors, there were plenty of jobs for everyone. Employees at several big banks had also formed unions by that time. Bank employees had taken advantage of the momentum built by labor organizing victories at Amazon, Kellogg, and Starbucks. Former Wells Fargo employees got to move to banks where they were paid better wages and received benefits. They also got to join unions that could advocate on their behalf. No more war-or Gold Rush-like working conditions.

Congress passed legislation guaranteeing a $25 minimum wage and paid sick leave a few years ago, so sometimes people don’t realize that a lot of Wells Fargo employees had been low wage workers without much of a safety net. In the past, banks like Wells Fargo hadn’t paid workers enough to put food on the table. Most tellers and customer service representatives earned less than $15 per hour and one third received welfare. When bank employees first started to talk about unionizing, a few other researchers and I went around the country asking people about their working conditions and experiences with labor organizing. So I know for sure that many former Wells Fargo employees had better working conditions after leaving the bank.

Of course, not all Wells Fargo employees were low paid and not all continued working in the financial industry. Some of the higher paid executives retired. Others worked as executives in different industries. And some became consultants, lobbyists, and politicians.

Organizers pushing for the bank’s shut down were prepared and made sure that voters knew about the bank’s record. Some Wells Fargo employees had taken their insider knowledge of the banking system into the growing number of jobs at grassroots organizations to fight against capitalism, discrimination, and fossil fuel investment, so that helped inform voters, too. Ultimately, voters didn’t believe that vice presidents (mostly wealthy white men) of a scandalous megabank could represent their interests in state or federal government, especially once they realized how much harm the bank had done to their communities by investing in fossil fuels and financing discrimination. As a result, most of the political campaigns by former Wells Fargo executives failed.

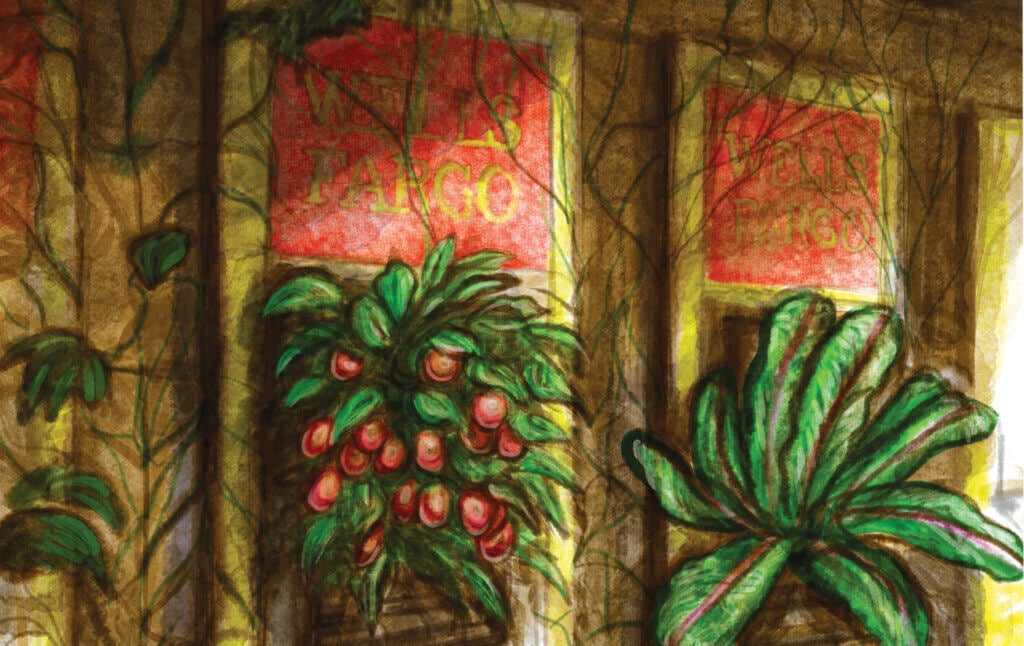

Organizers also made sure that the failed bank’s real estate was repurposed for the public good. When regulators stepped in, the bank was operating 8,050 locations with branches in 31 states and more than 13,000 automated teller machines (ATMs). The bank took up a lot of real estate! And regulators had to figure out what should happen with everything.

Since the FDIC chose a public method to resolve the bank, it was bound by regulation to close the bank in the least costly way. This usually meant selling off a bank’s real estate to the highest bidders. But people didn’t want the status quo: another megabank buying up real estate, privatizing property, and continuing the same harms. And really, communities were owed repair. So, the FDIC worked with Congress to pass a onetime exception to this least-cost resolution requirement.

This exception came about because of organizers’ strategic portrayals of Wells Fargo in their direct actions.

The police had always stood guard at Wells Fargo’s branch entrances around the country. The police essentially functioned as publicly financed bodyguards to Wells Fargo while the private bank bolstered white customers’ wealth and underwrote racism and climate destruction. Branch managers regularly called on the police to remove people they thought were suspicious: in other words, Black, brown, or poor white people. And the police remained stationed outside of branches even after regulators announced their plans to close the bank.

Tensions were running high once the closure process got underway. What happened is what always happens whenever police are on the scene: violence. Organizers released dozens of videos showing police violently arresting unhoused people outside Wells Fargo branches, harassing women as they walked by on the sidewalk, and intimidating Black customers entering and exiting the branches. In every video, image, and social media post they shared, organizers reminded people that police violence was a part of the bank’s routine operations.

The videos went viral. People organized a day of action and thousands demanded change by camping outside the FDIC headquarters in Arlington, Virginia. They promised to stay 1 minute for each of Wells Fargo’s 8,050 bank locations. That was 5 days, 14 hours, 9 minutes, and 59 seconds. The employees at the FDIC headquarters weren’t accustomed to being the focus of this type of direct action. And the Washington, D.C. suburb’s white and wealthy residents weren’t happy about the protests, either. Residents flooded city council meetings with petty grievances and called the police to complain about noise and parking violations. Some local restaurants and grocery stores refused to serve protestors. So, to repair harm, rebuild trust, and appease both protestors and Arlington residents, the FDIC agreed to work with Congress on the least-cost resolution exemption. Then, the FDIC agreed to establish the advisory panel for transferring ownership of branch properties to local communities.

As part of the FDIC’s public resolution process, communities could petition to take over local Wells Fargo bank branches. A community advisory panel reviewed the petitions, after which the FDIC transferred properties to local communities for free. Branches around the country became community centers, day cares, shelters, farmers markets, and art studios. Some branches became public banks under the fiscal authority of local governments. These banks were committed to local community investment and public accountability.

A lot of people believe that public banks will help address the climate crisis and stop discriminatory lending—things Wells Fargo and the rest of the financial system have failed to do. Organizers have been working for years to move nearly $12 trillion in public money from taxes and pension funds out of private banks like Wells Fargo, where interest-bearing profits got siphoned off to shareholders instead of reinvested locally. Some cities like Los Angeles and Philadelphia already have public banks. Now, many cities around the country are following their example. People are even beginning to identify other aspects of life that can be turned over to public control, like housing, healthcare, and safety. It’s encouraging to see glimmers of hope for reversing the power of private corporations, which have suffocated the country for so long.

The remaining branches were turned over to communities earlier today. Wells Fargo is officially closed. The bank no longer exists.

This day was a long time coming and getting here wasn’t always easy. Organizers with Native-led divestment campaigns had been working to close Wells Fargo for decades. There’s already talk of how to keep changing the financial system into one that is publicly accountable and aligned with principles of justice, peace, and sustainability. After all, there are still 5,999 more private banks in the United States and 29 left on the “Dirty Thirty” list.

I’m grateful to have played a small part among a much bigger chorus of people calling for something that many said was impossible. Academics like myself, sometimes preferring to proselytize from comfy armchairs and cushioned retirement accounts without involving ourselves directly in everyday struggles, aren’t known for having radical research agendas or revolutionary politics. But in today’s world, we need “transformational demands,” as activist Mariame Kaba says. We should demand the impossible and not settle for anything less. The last 18 years have taught me this for sure.

The crowd gathered in the quad this morning is just a glimpse of the upcoming festivities. I hope you’ll come to the big celebration tonight. We will honor the people who were harmed by the bank and those who fought for its dismantling. It will be good to cry and laugh and dance and celebrate. And to remember where we’ve been so we can dream about where to go next.

Terri Friedline is an associate professor of social work at the University of Michigan and a faculty affiliate with U-M’s Poverty Solutions initiative. She is the author of the book, Banking on a Revolution: Why Financial Technology Won’t Save a Broken System. She can be followed on Twitter @TerriFriedline. This piece was inspired by the works and writings of Barbara Ransby, Octavia Butler, Mariame Kaba, and Tamara Nopper. The author thanks Jeremy Kress for his input regarding legal authority in the bank resolution process.

Rainforest Action Network et al. (2018). Banking on climate change: Fossil fuel finance report card 2018. San Francisco, CA: Rainforest Action Network, BankTrack, Sierra Club, OilChange International, Indigenous Environmental Network, and Honor the Earth. ↩

Henderson, B., & Allison, D. (2014). Ring of Deceit: Inside the Biggest Sports and Banking Scandal in History. New York, NY: Bruce Henderson Books. ↩

According to Mr. Ali’s statements reported in coverage by the New York Times, he was not involved in any management aspects at Muhammad Ali Professional Sports Inc., which was known as Maps and where Harold Smith served as the chairman. Mr. Ali received a fee for his name being used in the sports enterprise. ↩

This is adapted from a famous quote by civil rights activist, women’s advocate, and labor organizer Dolores Huerta, who said, “Every moment is an organizing opportunity, every person a potential activist, every minute a chance to change the world.” ↩