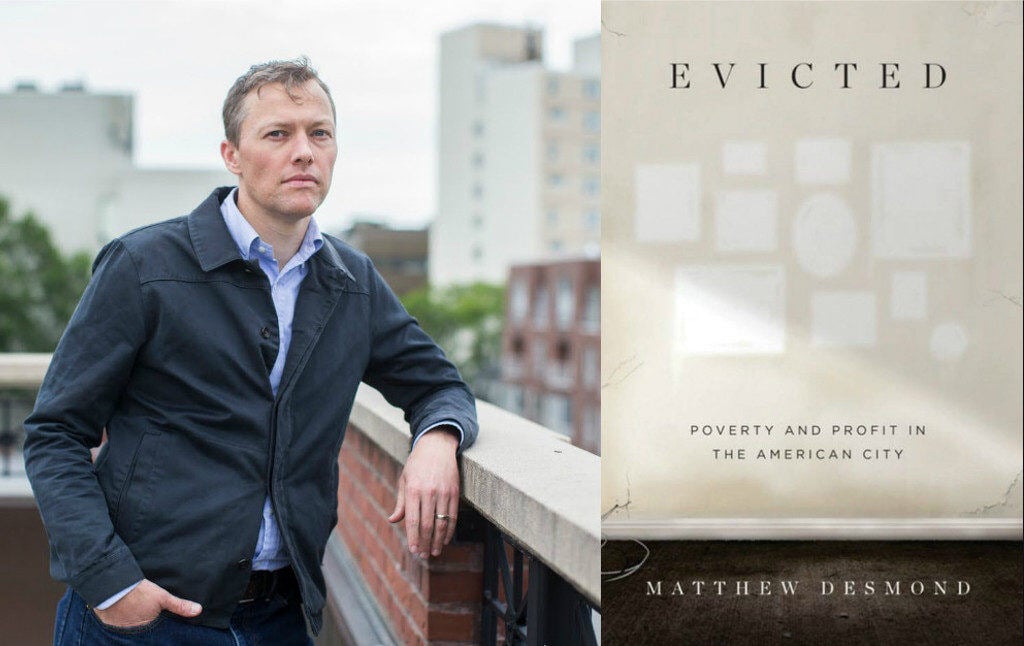

Praise for Matthew Desmond’s Evicted has been nearly universal. It has won a PEN Award, the National Book Critics Circle Award, and, now, the 2017 Nonfiction Pulitzer Prize. To quote the New York Times, it is “a comet book — the sort of thing that swings around only every so often, and is, for those who’ve experienced it, pretty much impossible to forget.”

For many readers, it is a first foray into the housing question. Desmond draws our attention not only to the power of evictions to reproduce poverty, but also to their prevalence: evictions are common in communities that are black and white, poor and not so poor. For many more readers, it is also a first foray into Midwestern poverty. As American liberals scramble to understand what went wrong in swing states like Wisconsin, Desmond illustrates how the daily desperation of Milwaukee’s low-income communities translates into “lost confidence in… political capacity.”

But while the book makes valuable contributions to public understanding of eviction, the overwhelming critical enthusiasm for Desmond’s book should perhaps give us pause. After all, most journalists and academics live in municipalities where housing inequality runs high. We might, in general, expect Desmond’s call for fairly apportioned housing to engender some resistance — or at least some uncomfortable reflection — from those readers who enjoy the fruits of housing market exclusion from brunch on the corner to dinner in the brownstone.

Instead, Evicted has met only eager approval. The reason for this, I believe, is that most readers feel that the Desmond’s evictions are distant from them — something they merely observe as sympathetic spectators, rather than something in which all of us actively participate. The deceptive simplicity of Desmond’s policy prescription—housing vouchers—implies that an inclusive housing system can be accomplished in one fell swoop, without any substantial sacrifices or lifestyle change on the part of the privileged.

As a moral portrait, Desmond’s book is Manichean, with clear delineations between good and evil. The protagonists confront injustice after injustice: Arleen and her children are evicted, and then they are robbed, and then evicted once more. Lamar, who lost both of his legs when he passed out in a freezing house, faces eviction with his two children, and is unable to collect his disability benefits. Villainous landlords, meanwhile, inflict injustice without much remorse. “You know, if you have money right now, you can profit from other people’s failures,” says Sherrena Tarver, a former schoolteacher and one of Desmond’s main landlord contacts. “I’m catching properties. I’m catching ’em.” Sherrena gambles, she travels, she evicts. At times, Desmond is careful to humanize Sherrena, who is making her way in a world that does not afford many opportunities to black women. Overall, however, Desmond portrays her as self-pitying (“If you ever thinking about become [sic] a landlord, don’t… Get the short end of the stick every time”), self-important (“these low-quality people,” she complains of her tenants), and self-satisfied (“The ’hood is good”). The other landlord who appears in Desmond’s account is Tobin Charney, who makes over $400,000 from 131 trailers. He is, according to his tenants, a “greedy Jew.” From chapter to chapter, we are led from heartbreak to righteous outrage.

But the moral universe in Evicted is small. This is the strength of Desmond’s ethnography. He digs deep into the lives of his subjects to give a portrait of poverty that is both honest and respectful. Yet Desmond begs us to consider the question of scope — both for his diagnosis of the eviction problem and his prescription for it. “It is ultimately up to future researchers to determine whether what I found in Milwaukee is true in other places,” he writes.

This sets forth two very different tasks. The first is basic and empirical: Are low-income renters in other cities around the world vulnerable to eviction and the suffering that flows from it? The second, however, requires us to go beyond eviction to assess the distributional justice of housing markets beyond the landlord-tenant relationship. Who profits from renters’ poverty? Who gains from tenure insecurity? And what would we need to sacrifice to guarantee inclusion in our cities? After all, our cities are not populated exclusively by grasping landlords and their impoverished tenants. All of us participate in the housing market, and many of us benefit from it in ways that hurt our neighbors.

In “Home and Hope,” the book’s epilogue, Desmond carefully lays out his policy prescription for America’s broken housing system. “The idea is simple,” Desmond writes. The government should guarantee rental subsidies to all low-income families struggling to pay rent. With vouchers in hand, families could choose where they wanted to live — “as long as their housing was neither too expensive, big, and luxurious nor too shabby and run-down” — without the fear of falling into debt and, inevitably, facing eviction. “A universal housing voucher program would carve a middle path between the landlord’s desire to make a living and the tenant’s desire, simply, to live.”

Desmond is fervent in his advocacy. The program would, he writes, “change the face of poverty”:

Evictions would plummet and become rare occurrences. Homelessness would almost disappear. Families would immediately feel the income gains and be able to buy enough food, invest in themselves and their children through schooling or job training, and start modest savings. They would find stability and have a sense of ownership over their home and community.

It is here, in the epilogue, that the limits of Desmond’s book come into view. He tucks a confession into a footnote. “A universal voucher program would not solve all our problems,” he writes — “especially in tight markets.” But where, we might ask, are Desmond’s loose markets? All across the United States, housing markets are tightening at an increasing clip — from Los Angeles to San Francisco, Austin to Houston, Washington to Boston. In those markets, while addressing some short-term problems, housing voucher programs create a host of new, long-term ones.

Consider Britain, where I have spent the last two years researching the ongoing housing crisis. Britain’s housing voucher system earns Desmond’s praise. “Great Britain’s Housing Benefit is available to so many households that a journalist recently reporting on the program asked, ‘Perhaps it is easier to say who does not get it?’ ‘Indeed,’ came the answer.” But Britain’s housing market remains one of the most exclusionary in Europe. Far from narrowing the gap between rich and poor in Britain, Housing Benefit has — in many ways — done the opposite.

First, Housing Benefit drives up demand in places like central London, where properties would otherwise be unaffordable to the vast majority of people. Vouchers in hand, renters can pursue high-rent properties — so long as they are not, to use Desmond’s phrase, “too big, expensive and luxurious.” With this rising demand, landlords can then raise their rents, knowing that the state will foot the bill. Often, this inflationary pressure — rather than preventing evictions — incentivizes them. Evictions in Britain’s private rental sector have soared over the last five years, even as tenant arrears have been in steep decline. The reason for the rising rate of eviction is landlord opportunism. Because they are certain that their properties will fetch increasingly higher rents, landlords make use of evictions to free up their property.

By driving up the value of local housing stock, Housing Benefit can also behave like a regressive tax on low-income renters. Homeowners reap huge windfall gains from house price inflation — the average house in London rose by £40,000 in value in 2015 alone. For these homeowners, the gains of house price inflation far outweigh the tax burden of housing benefit expenditure. So it is low-income renters that ultimately bear the cost of their vouchers — funding homeowners’ retirement along the way.

Desmond’s housing voucher system may very well “change the face of poverty,” but it will do nothing to challenge housing market exclusion in America’s major cities. There, the face of poverty will become even more segregated. Low-income renters will be funneled toward low-income neighborhoods, where at least — if new regulations are introduced, as Desmond hopes they will be — evictions will fall. High-income renters will be funneled toward high-income neighborhoods where — repeating “white flight” — they can reproduce systems of privilege. We can further consider the link between gentrification and displacement. With security of tenure, homeowners gain from gentrification: house prices rise, local amenities multiply, and neighborhood services improve. Without security of tenure, renters face displacement: rents rise, landlords evict, and local shops price them out.

The most powerful insight of Desmond’s book is, to quote its title, that there is profit to be made from poverty. The implication of my argument here, though, is that it is not just landlords that reap this profit — all local homeowners and wealthy renters stand to gain from housing market exclusion. Who, after all, cries loudest in the name of not in my backyard? Not the landlords. Instead, it is those wealthy renters and homeowners who seek to maintain the status quo.

This is the piece that is missing from Desmond’s Evicted: housing markets are broadly zero-sum. Accumulation for some is immiseration for others. We are all tied together — landlords and tenants, homeowners and homeless.

In Evicted, though, there is no confrontation between these groups. They do not confront each other in the street — unwinding gentrification or redressing school segregation. Nor do they confront each other in city hall — crafting policy for a fairer housing market.

And this raises the question: If we make solutions to social problems appear simple, noncontroversial, and non-zero-sum in the abstract — or, in this case, in the ‘loose market’ of Milwaukee — when the implementation of these solutions will, in fact, threaten the resources and status of those in power, are we charting a course for a better world or soothing the conscience of elites?

Let’s imagine an inclusive housing market — a place where, Desmond hopes, the “basic right of all Americans” to affordable housing is balanced against “the right to make as much money as possible.” What would it look like? More importantly, what changes in our cities would be necessary to get there?

At the most basic level, inclusion would require that cash not rule everything around us. Wealthy residents would not have priority in the choice of apartments based on their economic advantage. They would, like the thousands and thousands on public housing lists across American cities, have to wait their turn. Gentrification would move at a snail’s pace. Pop-up shops could not descend on low-income communities, replacing affordable with luxury amenities. Public school districts would no longer segregate the privileged from the poor.

In a word, inclusion would require de-commodification — the transformation of our cities from sites of speculative investment to sites of rights-based community organization and development.

This is a sacrifice, however, that most wealthy (and white) urban residents are unwilling to make. Nikole Hannah-Jones, in her excellent work on public schools in Brooklyn, shows just how tightly her middle-class neighbors cling to the system of segregation that keeps low-income students on a separate campus. If applied in cities like New York, Desmond’s voucher program would have rippling effects for institutions like public schools, but Hannah-Jones’s work suggests that these would come with considerable resistance. Residents of large American cities are simply too attached to the distributive justice of the dollar. What do you mean, the banker will ask, that I cannot outbid my rivals for this house, this apartment, this bagel?

Desmond predicts some level of resistance to housing reform. “Those who profit from the current situation,” he writes, “will say that the housing market should be left alone to regulate itself.” But in reality, it’s not only free-market conservatives who will resist housing reform. Most likely, the American liberal will support regulation until it shows up in his backyard.

Evicted is indeed a masterpiece of “relational ethnography.” Desmond is thorough in his data collection, unearthing minute details that bring us deep into the lives of his subjects. He is careful in his depiction — never too sentimental — of the complex social and economic relations that produce and are products of eviction. And he is measured in his suggestion of a common-sense housing reform that would raise the welfare of millions of Americans.

If, however, we want to solve the problem of urban inequality on our doorstep, we need a whole new set of solutions. A housing voucher system will not suffice. We must think instead about what we are willing to give up on behalf of inclusion. We might start with tolerating the noisy construction next door, which will build the new units that are necessary to house our cities’ low-income residents. Or we might raise our property taxes, funding new housing developments with the balance. Or we might send our children to the local public school, finally following through on our constitutional promise of integration. But it will be hard, and it will be painful. There can be no true social reform, after all, without sacrifice.