Destroying All the Arguments Against Cancelling Student Debt

A new study exposes much of the misleading B.S. that is used to undermine the case for cancellation.

The Jain Family Institute and the Debt Collective have jointly put out an important new study1 that explains why cancelling large amounts of student debt is a good idea, destroying many of the bad arguments commonly made for putting various limitations on debt cancellation. The study is a devastating response to those (like the editorial boards of the New York Times and Washington Post) who have been making the case that “across-the-board debt forgiveness will not help” (to quote the Times) because “across-the-board student debt cancellation, which left-wing activists and politicians demand, would amount to a regressive subsidy for many high-income university graduates” (to quote the Post). Since Democratic presidents have a regrettable tendency to take the New York Times seriously, it is crucial that the study’s findings be widely disseminated and forcibly injected into the discourse.

Why Debt Cancellation Is Necessary In The First Place

Before looking at how the Jain Institute/Debt Collective study demolishes some common terrible talking points, let us recall what the problem is in the first place. There is a large amount of outstanding student debt (nearly $2 trillion in federal loans). People took these loans voluntarily, and, presumably, they are benefitting from their education with a higher income. I recently interviewed Josh Mitchell, Wall Street Journal reporter and author of The Debt Trap: How Student Loans Became A National Catastrophe. I asked Mitchell why the word “catastrophe” was appropriate to describe the situation. Why do so many of us talk about this as a crisis in need of a major public policy intervention? Mitchell’s reply is, I believe, persuasive:

Let’s go back to the end of 2019, right before the pandemic. The economy was actually pretty solid. And even back then, more than one in five students were at least three months behind on their student loans. That is a very high default rate. If you compare that to the peak of how much mortgage debt was three months behind at the height of the housing crisis, it’s more than twice that. So just comparing this to the housing crisis, there are far more people as a percentage of overall debt that are defaulting on their loans. They can’t repay them.

If you look at the effect that it’s having on people’s ability to buy houses, to start businesses, to save for retirement—these are things that are kind of hard to notice on a day-to-day basis—there’s a lot of research to show that student loans are really negatively impacting people’s ability to make these types of investments that over the long run will lead to wealth.

If you look at how much debt is non-performing, there are a lot of people who are not necessarily in default on their loans. But they are not making payments that are big enough to actually cover the interest on these loans. So the balance is rising. This is kind of like being upside down on your home loan, which was a big deal during the housing crisis. So a similar thing is going on right now. So while someone may not be in default, their balance is growing and growing and growing, and it stays with them for years and years. A student loan used to be a 10-year obligation. Now, it’s a 30-year obligation in a lot of cases. So if we can call the housing crisis a crisis, I don’t see how, by any metric, you can say that student loans are not a crisis.

So: we have a class of people who have a colossal amount of debt that they will never be able to pay. The human reality behind the numbers is bleak. Student debt lingers for decades; some people with student loans are now having their Social Security checks garnished. And, as Mitchell explains, living under debt for years upon years is a horrible experience:

People who are in debt have to worry about making that next payment. It’s a source of anxiety and stress. It changes your psychology. If you don’t make your payments on time, you’re penalized harshly. Your credit scores are trashed, and that limits your options in terms of being able to rent an apartment or secure a job. The stakes are enormously high. In some places, if you default on your student loans, your license can be taken away so you can’t even do your job.

My colleague Lily Sánchez elaborates on the human toll of crushing debt, which is so often left out of conversations about whether debt cancellation is “regressive” (it isn’t), whether the president has executive authority to cancel debt (he does), and how much should be canceled (all of it).

Mitchell’s The Debt Trap documents how this situation was created by a combination of poor public policy choices and insatiable Wall Street greed. Once upon a time, the federal government considered options for financing college through scholarships rather than student loan debt. However, the idea of giving students something for nothing was, then as now, seen as the road to authoritarian socialism, and instead we got an absurd system that sinks poor students deep into debt (rich students just have their parents pay) to fund both private and even public higher education. (To see just how absurd the system is, imagine if high school was funded by a “high school loan” program.)

Bad Arguments Demolished

As the idea of cancelling student debt has become popular, so has the idea of introducing strict limitations on cancellation in order ensure that only the “deserving” get relief. Mostly these alternatives propose to (1) only allow people below a certain income threshold to have their debts canceled and (2) only cancel a certain amount of debt (possibly as little as $10,000 per borrower). The Jain Institute/Debt Collective study shows why “means tests” and limitations on the amount are both unwise.

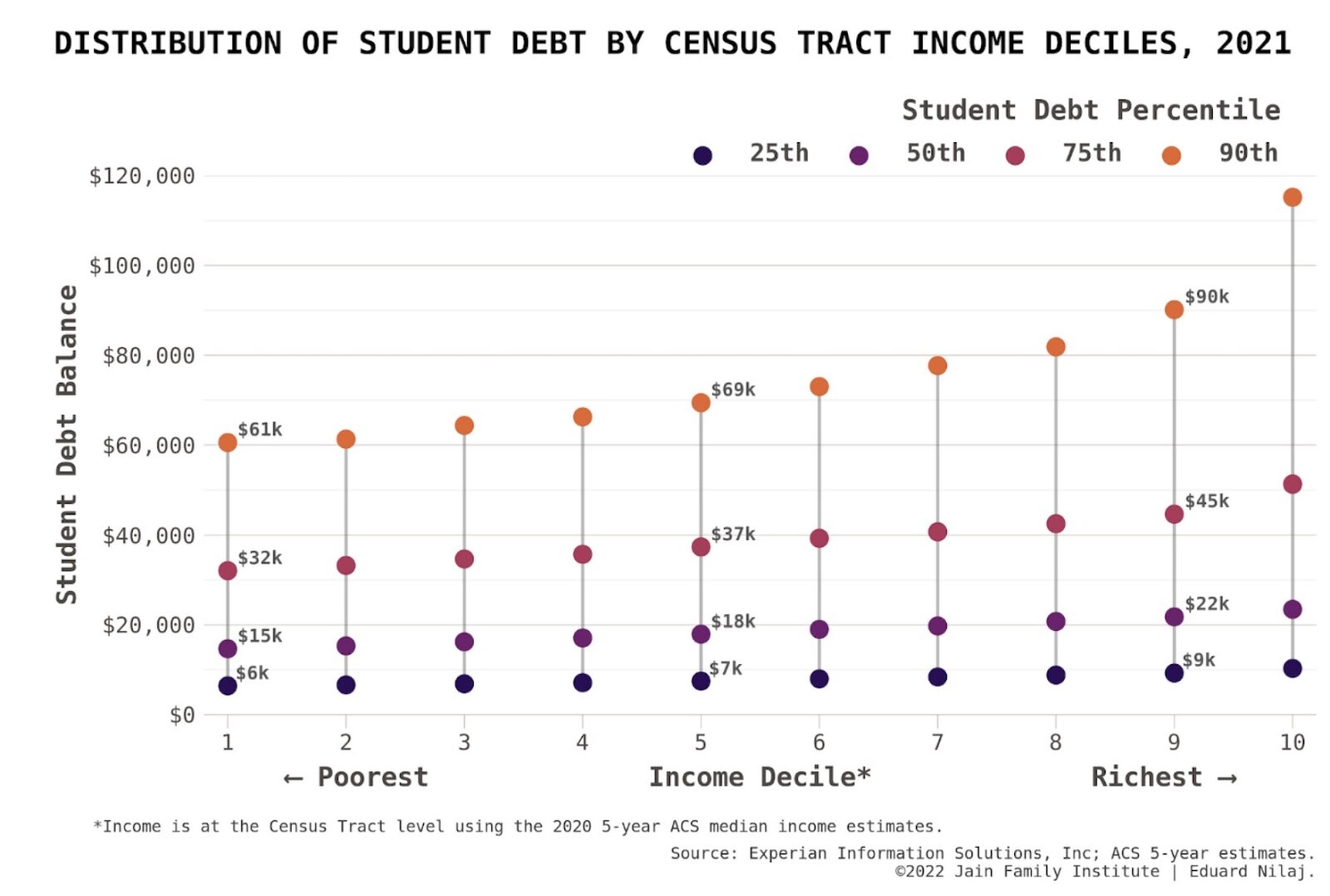

Limiting the amount to $10,000, the study points out, is based on the assumption that poor people have very little debt and wealthier people have a lot of debt (because they get expensive graduate degrees and such), and so only forgiving small amounts of debt will help lower-income people while avoiding subsidizing lawyers with $200,000 in debt. But the study shows that this picture of debtors is misleading:

As you can see, it’s true that the people with very high debts tend to have higher incomes. But it’s also true that while the biggest debtors among high-income people have higher debts than the biggest debtors among lower-income people, there are a lot of very low-income people with huge amounts of debt. Oftentimes, people who have large amounts of debt and low incomes are in public service professions. The study also notes that “not only are many borrowers drowning underneath high debt balances while working as teachers, social workers, or not able to work at all, but studies have shown that Black borrowers and female borrowers carry higher balances on average than their white male counterparts.” The report stresses that limitations on the dollar amount arbitrarily denies relief to many of the neediest people, but also

Limiting cancellation by dollar amount, particularly the low amounts currently being considered by the Biden administration, will not only miss huge numbers of borrowers in dire need, but it will also leave millions of borrowers with the exact same monthly payment they had before, thus negating the purpose of cancellation. Case in point: even if $10,000 of student debt was cancelled it would leave 83 percent of Black borrowers who have carried their loan balance for 12 years and now owe more than they originally borrowed (due to growing interest), still in some debt. Low levels of cancellation likely will leave already distressed Black borrowers still struggling with repayment. Dollar caps on cancellation will also leave many of these borrowers behind, will effectively punish those who pursued advanced degrees to work in jobs with lower pay but higher social value, and will leave many people in exactly the same financial situation they were in before cancellation.

This suggests that $10,000 in relief will simply not help the people who are suffering the most—namely, those whohave low incomes and high debt loads. This suggests that relief should be very generous, but leads naturally to the idea that, in order to avoid helping the lawyers, we should add a means test to the relief so that it only goes to people below a certain income threshold. But one factor the study draws attention to, which is often left out of the student debt conversation, is something known as reality. In the imaginary place we might call “Wonk World,” where policies are implemented by magic rather than by real-world bureaucratic processes, it might be perfectly feasible to do a “means test” on borrowers. Here in the real world, however, a means test is always incredibly complicated, involves a lot of paperwork, and inevitably leaves out people who are the most needy (since usually many of the most burdened are the least able to jump through time-consuming administrative hoops). As the study says, “income caps and other administrative hurdles ensure that many of the most vulnerable borrowers will be denied relief. Many will not be aware of the opportunity to apply, how to apply, or will be unable to prove their income (a significant number of low income people do not file tax returns).” They note that only a small percentage of borrowers make large amounts of money, and even “many of the borrowers above the $125,000 income cap are likely to have zero or negative wealth—especially borrowers of color.” It does not make sense, they argue, to introduce “a convoluted, slow, and error-prone system” merely “to exclude this small subset of borrowers.”

The report shows that universal, non-means-tested, generous relief is the most sensible way to implement forgiveness. It also demolishes the case for an alternative that is often put forward—“fixing” the existing “income-based repayment” program—which the study authors show to be irreparably broken. Currently, the income-based repayment program puts borrowers through an impossible series of recurring means tests in order to forgive their debt after 25 years of payments. Considering the psychological burden of living a quarter-century under a debt mountain, the seemingly benevolent income-based repayment program seems downright sadistic. We could simply forgive the debt now!

The Politics of Cancellation

The Jain Institute/Debt Collective report makes sensible policy arguments against means testing, caps to the cancellation amount, and fixes to the income-based repayment system. It does not, however, deal much with some of the arguments that cancelling student debt is “bad politics.” It is frequently claimed that Democrats will be giving a “handout to the rich” by cancelling student debt. This is, of course, nonsense on its face: if you are rich, you do not have to go into debt to finance your education. But there is a certain narrative that student loan forgiveness will “look bad” even if it helps an immense number of people. Here is a New York Times column by David Brooks, who has actually come around on forgiveness although he (naturally) wants strict means testing:

Debt forgiveness sends terrible cultural signals. This nation is already bitterly divided along educational lines. Today’s populists are rightly angry that college-educated Americans have built a society that’s pretty sweet for them and their kids, and pretty rough for everybody else. Student loan forgiveness would be seen as just another example of the educated class taking care of its own—and leaving everyone else to eat dust.

Here is another New York Times op-ed, this time by Jeff Maurer, a former senior writer for Last Week Tonight with John Oliver2

Conservatives will have a field day with this. Prepare to meet the Person Who Got the Stupidest Degree in America, because that person will be on Fox News more than pundits who exude an “angry cheerleading coach” vibe. The case study will be some tragic dweeb who took out $400,000 in loans to get a Ph.D. in intersectional puppet theory from Cosa Nostra Online College and who wrote his dissertation about how “Fraggle Rock” is an allegory for the Franco-Prussian War. I can picture Tucker Carlson putting on his confused cocker spaniel puppy face and asking the poor sap, “Why do Democrats want to forgive every last penny of your student loans?” Are we trying to foment populism? Are we trying to affirm the stereotype that Democrats serve the needs of educated elites and ignore everyone else? I am completely aware that no matter what, Republicans will portray us as fancy little Fauntleroys ensconced in our twee nursery of upper-middle-class desires, deaf to the needs of the struggling masses. But it’s very important to me that this caricature not be true. As someone who cares about the progressive project, I am begging Democrats to make means testing or a meaningful cap (or both) part of this policy.

Now, personally, I do not believe in making policy on the basis of what faces Tucker Carlson will make when he talks about it. I believe in making policies on the basis of justice, and resolutely telling conservatives to go fuck themselves if they oppose some necessary measurement for bettering the human condition. I also think that when New York Times columnists choose to use their platforms not to explain why a progressive policy is good but to fret about how it will be “perceived,” they themselves are the ones creating the problem. Half the reason this narrative about student debt cancellation as “regressive” and a “handout” has taken hold is that liberals at the New York Times and the Brookings Institution have used their platforms to fret about debt cancellation, doing the right’s work by spreading its talking points. Maurer, who clearly has done no research on the issue and understands nothing about the harms of debt (he should read Mitchell’s book), thinks the conservative stereotype about “fancy little Fauntleroys” (with clear homophobic undertones) is “true.” But debt forgiveness is an issue of gender and racial injustice, something a person who actually “cared about the progressive project” would explain rather than trying to convince Times readers that nasty right-wing stereotypes are actually true.

David Brooks does have one valuable point, though. He says that it would be a bad idea for the Biden administration to take care of the “educated class” while telling everyone else to “eat dust.” I agree, which is why it is essential that the policy of the Biden administration toward working people should not be “eat dust.” It is true that if Democrats only cancel student debt, and do nothing for anyone else, people who do not have degrees will rightly wonder why this is the only thing that has been done for anyone. That is why it is essential that student debt relief not be an isolated measure, but part of a comprehensive vision that helps everyone. One Twitter commenter, arguing against student debt cancellation, said: “The question I always come down to is why student loan debt must be cancelled and yet nobody’s talking about medical debt, credit card debt, mortgage debt, etc. The answer, of course, is this is pushed mostly by rich private school grads.” In fact, one reason people talk about student debt more than other kinds of debt is because the federal government has significant power to easily forgive it in ways that differ from privately-held debt. But it is important that people struggling with medical debt, or who cannot afford their rent, do not feel that only the “private school grads” are being taken care of. This is not an argument against cancelling debt, though. It is an argument for expanding the agenda beyond student debt relief.

Another argument against cancelling student debt is that it creates what is called “moral hazard.” The American Enterprise Institute has argued, mostly through unsubstantiated speculation, that student debt forgiveness would “backfire” because it “creates an implicit guarantee that future students won’t be on the hook to pay back what they borrow” and thus encourages further irresponsible borrowing. But again, this is actually an argument for doing more. It’s not an argument against forgiveness. The “backfire” argument actually reveals that debt forgiveness needs to be the first step in a comprehensive plan to create affordable higher education. Yes, it’s true that just forgiving the debt and letting the same situation arise again, at which point we will once again need to forgive the debt, is a poor solution. That is why nobody should want to stop at debt forgiveness.

We cannot discuss the politics of loan forgiveness, though, without discussing the political cost of not doing this. Joe Biden explicitly said he supported cancelling $10,000 in student debt. People who voted for him had a right to assume that if he had an opportunity, he would make good on that promise. I have noted before that it is a terrible idea for Democrats to campaign on a policy promise and then, once they are in office, make excuses for not doing the thing.. Young people who are even more burdened by debt at the end of Biden’s presidency than they were at the start will feel, quite correctly, that electing Democrats to office does not help them and that Democratic promises are worthless. Good luck getting them to the polls. (Biden’s support among young voters has been plummeting, for the obvious reason that he does the opposite of what they want—for example, expanding fossil fuel use and thereby destroying their future.)

Not cancelling the debt also opens up the possibility that if Donald Trump wins in 2024, he will use his executive authority to do what Joe Biden did not. Donald Trump is not a particularly ideologically consistent person, and may well delight in the opportunity to take a simple step that will win him immense (in many cases grudging) goodwill among millions of young people. This would be an absolute calamity for Democrats. If Biden promised relief and didn’t provide it, and then Trump provides it, it will make it even harder to pitch young voters on voting Democratic. This kind of unpredictable move that would get under the skin of liberals is precisely the sort of thing one can imagine Trump doing.

It is depressing that, well into Biden’s presidency, he has not already fulfilled a promise that would be extremely easy and help large numbers of people. This could have been done on day 1 and then we wouldn’t have had to suffer through all this hand-wringing and agonizing debate, and Biden’s approval rating among young people might now be less dismal. Instead, we have gotten endless Democratic dithering, as the Biden administration tries to figure out how they can do something that technically counts as doing something while loading up enough administrative burdens and means tests that hardly anybody will actually see the benefit. (If you want to understand how centrist Democrats think about policy, recall Kamala Harris’ much-mocked plan to “establish a student-loan forgiveness plan for Pell Grant recipients who start a business that operates for three years in disadvantaged communities.”) Instead of giving political enemies the opportunity to poke holes and suggest modifications, Biden should have just forgiven the debt and been done with it, then moved on to other pressing issues. (Hey, remember climate change? Is that still happening? Or do we just not talk about that anymore?)

The barrage of terrible anti-forgiveness talking points never seem to stop, but let us hope that the Jain Institute/Debt Collective study can successfully obliterate a few of the more egregious ones.

For more deconstruction of all the bad arguments against cancelling student debt, and explanations of how to reform higher education financing, see these previous Current Affairs articles:

- Is Student Debt Cancellation Regressive? NO.

- Cancelling Student Debt Reduces The Racial Wealth Gap

- If You Want To Enact Free College, Cancel Student Debt Immediately

- The Taxonomy of Student Debt Arguments

- Student Debt Forgiveness: Let’s Do Some Math

- How Student Debt Is Worsening Gender and Racial Injustice

- The Case for Free College

- What a Better Biden Would Say About Student Loan Debt